Audio By Carbonatix

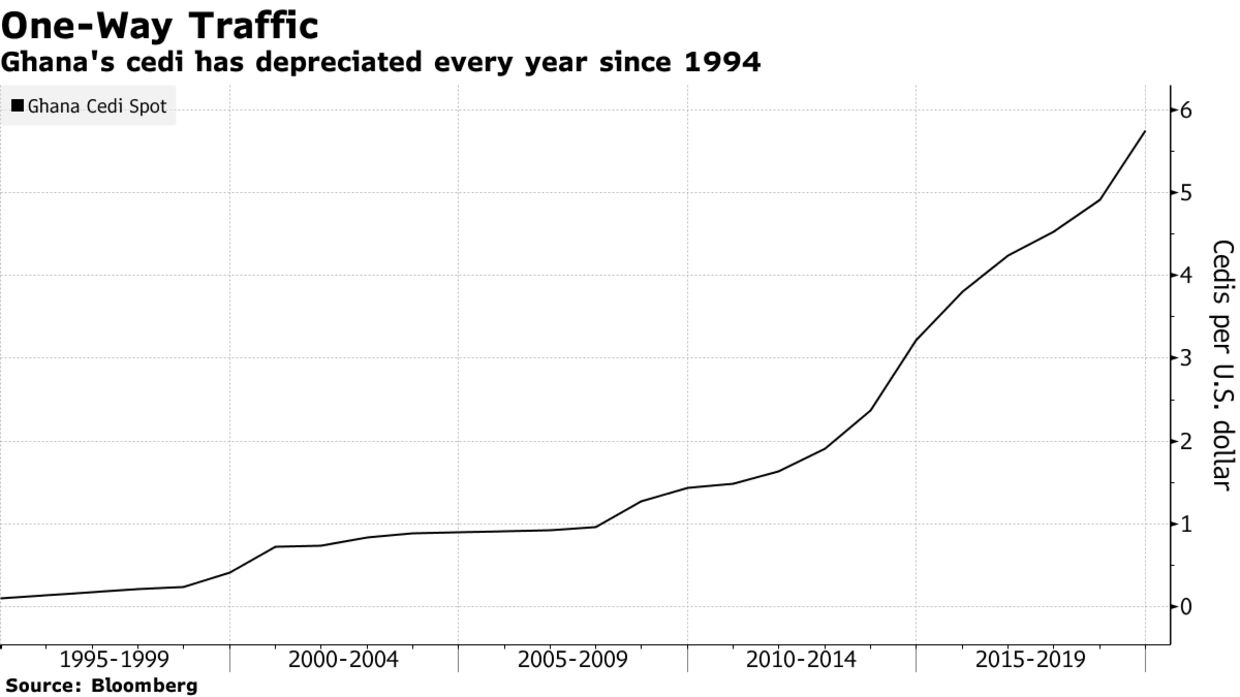

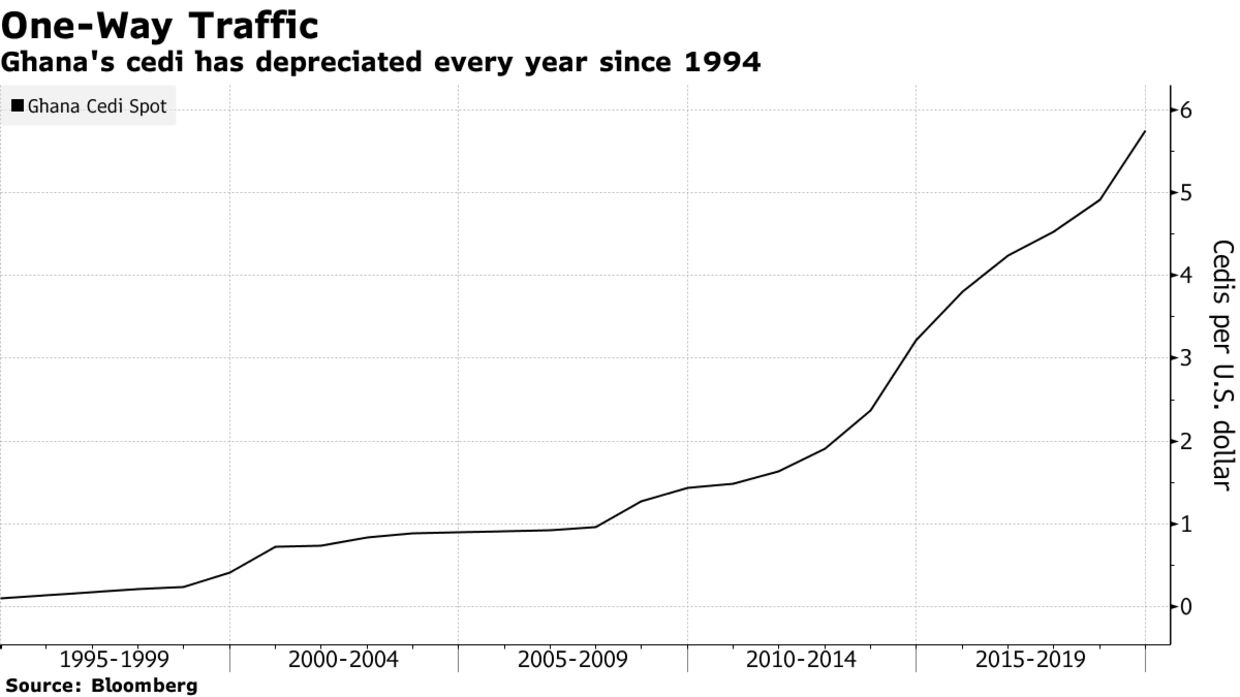

The cedi is headed for its 25th straight year of depreciation against the dollar as government’s fiscal challenges erode investor confidence in the currency of the world’s second-biggest cocoa producer.

The cedi is down 13% so far in 2019, according to data compiled by Bloomberg, poised for the worst decline since 2015, when it slumped 18%. It has declined every year since Bloomberg started keeping records in 1994.

Investors are concerned the government won’t stick to spending targets as it gets closer to an election next year, according to Cobus de Hart, chief economist for the west, central and north Africa at NKC African Economics in Paarl, South Africa.

The cedi slipped 0.1% on Thursday to 5.67 per dollar, bringing its decline this quarter to 5%.

“The overshooting fiscal deficit and debt from arrears is putting pressure on the cedi,” De Hart said by phone. “We have an election coming up next year and portfolio investors are concerned that the plan outlined in the 2020 budget will not be met because revenue continues to underperform.”

Ghana’s budget deficit is forecast to widen to 4.9% of gross domestic product this year, from 4.1% in 2018, according to the median estimate in a Bloomberg survey of economists. The shortfall is rising as the government increases spending to pay for financial-sector bailouts and liabilities in the energy sector.

The central bank’s inability to quickly build foreign reserves due to a deficit in the current account is another source of cedi weakness, De Hart said.

“Even though the trade account is in surplus, the current account is in deficit, impeding the accumulation of foreign reserves,” he said. “Gross reserves have hovered around $8 billion for some time now, which suggests that the central bank has not aggressively intervened to support the currency.”

Ghana adopted the cedi in 1965 to replace the Ghanaian pound, which was equal in value to the British pound and its currency since independence in 1957.

The “new cedi,” worth 1.2 original cedis and about half a British pound, was introduced in 1967. Decades of high inflation led to a redenomination in 2007, when the new cedi was phased out and replaced by the current currency at a ratio of one to 10,000. It has since lost about 80% of its value.

“The overshooting fiscal deficit and debt from arrears is putting pressure on the cedi,” De Hart said by phone. “We have an election coming up next year and portfolio investors are concerned that the plan outlined in the 2020 budget will not be met because revenue continues to underperform.”

Ghana’s budget deficit is forecast to widen to 4.9% of gross domestic product this year, from 4.1% in 2018, according to the median estimate in a Bloomberg survey of economists. The shortfall is rising as the government increases spending to pay for financial-sector bailouts and liabilities in the energy sector.

The central bank’s inability to quickly build foreign reserves due to a deficit in the current account is another source of cedi weakness, De Hart said.

“Even though the trade account is in surplus, the current account is in deficit, impeding the accumulation of foreign reserves,” he said. “Gross reserves have hovered around $8 billion for some time now, which suggests that the central bank has not aggressively intervened to support the currency.”

Ghana adopted the cedi in 1965 to replace the Ghanaian pound, which was equal in value to the British pound and its currency since independence in 1957.

The “new cedi,” worth 1.2 original cedis and about half a British pound, was introduced in 1967. Decades of high inflation led to a redenomination in 2007, when the new cedi was phased out and replaced by the current currency at a ratio of one to 10,000. It has since lost about 80% of its value.

“The overshooting fiscal deficit and debt from arrears is putting pressure on the cedi,” De Hart said by phone. “We have an election coming up next year and portfolio investors are concerned that the plan outlined in the 2020 budget will not be met because revenue continues to underperform.”

Ghana’s budget deficit is forecast to widen to 4.9% of gross domestic product this year, from 4.1% in 2018, according to the median estimate in a Bloomberg survey of economists. The shortfall is rising as the government increases spending to pay for financial-sector bailouts and liabilities in the energy sector.

The central bank’s inability to quickly build foreign reserves due to a deficit in the current account is another source of cedi weakness, De Hart said.

“Even though the trade account is in surplus, the current account is in deficit, impeding the accumulation of foreign reserves,” he said. “Gross reserves have hovered around $8 billion for some time now, which suggests that the central bank has not aggressively intervened to support the currency.”

Ghana adopted the cedi in 1965 to replace the Ghanaian pound, which was equal in value to the British pound and its currency since independence in 1957.

The “new cedi,” worth 1.2 original cedis and about half a British pound, was introduced in 1967. Decades of high inflation led to a redenomination in 2007, when the new cedi was phased out and replaced by the current currency at a ratio of one to 10,000. It has since lost about 80% of its value.

“The overshooting fiscal deficit and debt from arrears is putting pressure on the cedi,” De Hart said by phone. “We have an election coming up next year and portfolio investors are concerned that the plan outlined in the 2020 budget will not be met because revenue continues to underperform.”

Ghana’s budget deficit is forecast to widen to 4.9% of gross domestic product this year, from 4.1% in 2018, according to the median estimate in a Bloomberg survey of economists. The shortfall is rising as the government increases spending to pay for financial-sector bailouts and liabilities in the energy sector.

The central bank’s inability to quickly build foreign reserves due to a deficit in the current account is another source of cedi weakness, De Hart said.

“Even though the trade account is in surplus, the current account is in deficit, impeding the accumulation of foreign reserves,” he said. “Gross reserves have hovered around $8 billion for some time now, which suggests that the central bank has not aggressively intervened to support the currency.”

Ghana adopted the cedi in 1965 to replace the Ghanaian pound, which was equal in value to the British pound and its currency since independence in 1957.

The “new cedi,” worth 1.2 original cedis and about half a British pound, was introduced in 1967. Decades of high inflation led to a redenomination in 2007, when the new cedi was phased out and replaced by the current currency at a ratio of one to 10,000. It has since lost about 80% of its value.DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Latest Stories

-

AU adopts Ghana-led resolution by consensus, Mahama outlines global diplomatic push

13 minutes -

New PESCO Old Students’ leadership promises to reposition association

23 minutes -

Every African object unjustly held abroad must be returned – Mahama demands restitution

32 minutes -

AU Summit: President Mahama advocates for continental resolution on enslavement

35 minutes -

Amin Adam slams NDC’s economic management

51 minutes -

President Mahama urges global support on reparatory justice at AU Summit

52 minutes -

Mankessim-Accra lorry station’s choked gutters

56 minutes -

The politics of envelopes: Why bad roads in Ghana may be a voter problem too

1 hour -

Dagbani Wikimedians, sister language communities hold annual capacity building retreat in Wa

1 hour -

Interior Ministry confirms attack on Ghanaian traders in Burkina Faso

1 hour -

New Oboase traditional leaders praise Asiedu Nketia for returning to express gratitude

1 hour -

Ministry of Health reaffirms commitment to tackling sickle cell disease

2 hours -

Livestream: The Law discusses Legal Education Reform Bill

2 hours -

Seven remanded over open defecation

2 hours -

Karaga MP Amin Adam donates funds, 1,000 bags of cement for Northern Regional NPP headquarters

3 hours