Audio By Carbonatix

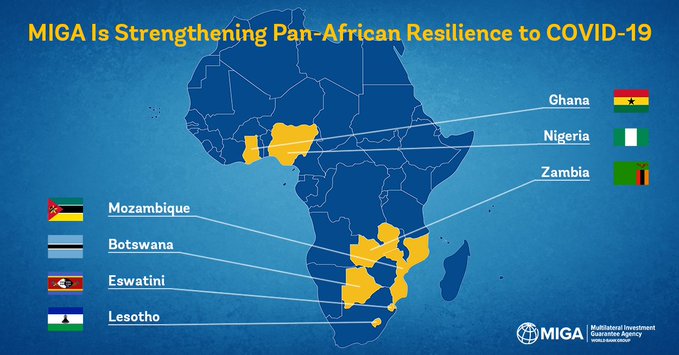

Ghana, together with six other African economies severely impacted by Covid-19 have been named beneficiaries of a World Bank Group capital relief project.

A member of the World Bank Group, Multilateral Investments Guarantee Agency (MIGA), issued the guarantees of up to $235 million to a wholly-owned subsidiary of South Africa’s FirstRand Group, for a period of up to 15 years.

It is the second capital relief project by MIGA meant to help strengthen the economies of beneficiary countries severely impacted by the coronavirus crisis.

MIGA is known for providing risk insurance and credit enhancement.

The guarantee covers the subsidiaries’ mandatory reserves held as per regulatory requirements in Ghana, Botswana, Eswatini, Lesotho, Mozambique, Nigeria, and Zambia.

This will help unlock funding and liquidity, and support the economies of the host countries, which are being severely impacted by the COVID-19 pandemic, particularly in the commodities markets.

Nearly 60 percent of the support provided by the MIGA guarantees will be directed to low-income IDA countries, and twelve percent will go to Mozambique, a country recently affected by conflict.

The global outlook remains weak due to the COVID-19 crisis.

Excluding Ghana and Mozambique, economic growth of the remaining five beneficiary economies are entering negative growth in 2020, though economic growth is projected to contract in all these countries.

Banks are facing increased pressure to optimize capital allocation and reduce risk exposures.

“Our support for a key regional bank that is helping weather the fallout from the global pandemic across seven countries in Sub-Saharan Africa is timely and essential,” said MIGA Executive Vice President, Hiroshi Matano.

He continued, “MIGA guarantees will help build resilience within the countries through the continued supply of credit. For the longer term, our support will help lay the foundations for credit growth and employment.”

MIGA’s capital optimisation product reduces the risk-weighting of the subsidiaries’ mandatory minimum reserves on FirstRand’s balance sheet.

FirstRand will use the freed-up capital to sustain the lending activities of its subsidiaries.

“MIGA’s capital optimisation product is particularly important now, given the stresses in many of the economies in which we operate on the African continent. In particular, it enables the availability of capital to support these economies through continued lending,” said Andries du Toit, FirstRand Group Treasurer.

MIGA’s support also entails providing assistance to the subsidiaries through the implementation of FirstRand’s updated Environmental and Social Management Systems (ESMS) and other policies related to MIGA’s Performance Standards.

This will improve the subsidiaries’ current environmental and social risk management practices.

Latest Stories

-

Leeds say boos during Ramadan pause ‘disappointing’

3 hours -

Premier League deletes Vicario social media post

3 hours -

Real Madrid beaten at home by Getafe for second successive loss

3 hours -

‘Clubs refused to look at me after my crash’ – Antonio on Qatar move

3 hours -

Mayweather to fight kickboxer before Pacquiao rematch

3 hours -

India and Canada reset ties with ‘landmark’ nuclear energy deal

4 hours -

Mahama should equally credit NPP for economic stability – Economist

4 hours -

Mbappe has knee sprain with no surgery planned

4 hours -

Interior Ministry releases funds to settle 2025 rent allowance arrears for security services

4 hours -

Ghana evacuates diplomatic staff from Iran; embassy shut indefinitely — Ablakwa

4 hours -

France to boost nuclear arsenal and extend deterrence to European allies

5 hours -

Chinese community in Ghana marks ‘Year of the Horse’ with grand new year festival

5 hours -

When regional instability becomes national risk: Ghanaian tomato traders killings

5 hours -

Photos: President Mahama meets Tanzania President Suluhu Hassan

5 hours -

Mahama calls for cessation of Iran-US-Israel conflict, urging return to dialogue

6 hours