Audio By Carbonatix

Ghana investigated 2,283 forgery cases from 2019 to 2023, with 115 charged for Money Laundering (ML), the 2025 Anti-Money Laundering Report has revealed.

According to the report, there were 147 prosecutions and 25 successful convictions.

However, it said the COVID-19 pandemic disrupted court processes in Ghana, causing delays in hearings and trials due to lockdowns and social distancing measures.

Subsequently, convictions for ML related to forgery increased, indicating a renewed efforts to clear backlog.

The report continued that Ghana has implemented measures to strengthen enforcement and investigative capabilities within the Ghana Police Service and the Economic and Organised Crime Office (EOCO).

This includes digitalisation efforts such as the introduction of the biometric National Identification Card (Ghana Card), electronic verification systems for IDs, licences and digital addresses. Further, public awareness campaigns on “Police TV” have deepened awareness among the general public on forgery and other predicate offences. Training in forensic document analysis and digital forensics has been improved, and the financial sector has enhanced document security and verification processes.

Tax Offences

The Ghana Revenue Authority (GRA) was tasked with investigating and enforcing compliance with all the tax laws to ensure that individuals and businesses meet their tax obligations.

Tax offences in Ghana encompass a range of activities that violate the country’s tax laws, as outlined in Revenue Administration Act, 2016 (Act 915).

These offences include failing to file tax returns and making tax payments, providing false or misleading information, evading taxes, obstructing tax officers, failing to pay taxes on time and not maintaining proper records. Offences also cover unauthorised access to taxpayer information, failure to register for taxes and non-compliance with GRA notices.

The report added that the GRA recovers taxes through methods like garnishing bank accounts, seizing assets and placing liens on properties.

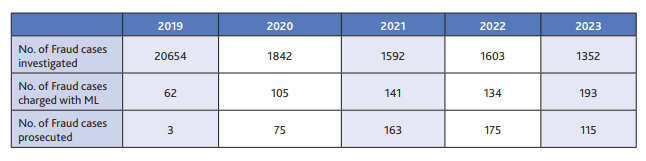

Data gathered showed that investigations into tax offences peaked in 2020 and rebounded in 2023. The yearly distribution is below.

Also, the data provided by FIC through the dissemination of Intelligence Reports (IRs) to GRA resulted in various tax assessments and collections from 2019 to 2023 as indicated in the table below.

According to the FIC, the data above highlights positive trends with respect to IRs disseminated by the FIC reflecting effective use of Intelligence Reports.

Latest Stories

-

World Sustainability Organization launches Friend of the Earth sustainable packaging certification in Ghana

13 minutes -

14-year-old boy seriously injured following alleged abuse in Ashanti Region

19 minutes -

Nana Agradaa walks free from prison after release

22 minutes -

Man arrested for alleged assault after accident at Maamobi

31 minutes -

Government urged to review compensation fund to support vulnerable accident victims

34 minutes -

Photos: Hasaacas Ladies beat Army Ladies to go top of WPL table

34 minutes -

Let’s fix flaws in our democratic governance to preserve the 4th Republic – Boakye Agyarko

35 minutes -

Market ready for bond issuance after fiscal shock therapy — Prof Bokpin

41 minutes -

Woman jailed for stealing from Church at Teshie barracks

53 minutes -

Man arrested for alleged assault after motor accident at Maamobi

53 minutes -

Warrant issued for arrest of Kenyasehene, Odikro of Buobai over the alleged sale of public land

55 minutes -

Bokpin warns Ghana faces major oil price shock from US–Israel strikes on Iran

1 hour -

Ayawaso East by-election: NPP vows not to participate in vote-buying

1 hour -

Gideon Boako to sponsor eye surgery for 35 Tano North constituents

1 hour -

Ayawaso East by-election: ‘Certified International Election Observer’ Koku Anyidoho applauds voting arrangements

2 hours