Audio By Carbonatix

The Ghana Reference Rate (GRR), a key benchmark used by commercial banks to price loans, has dropped significantly for December 2025.

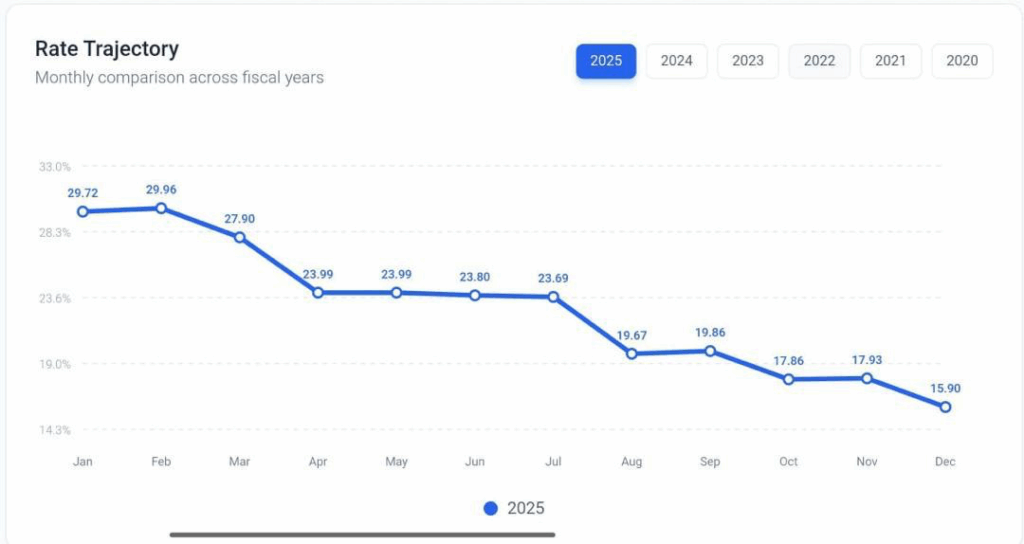

Data from the Ghana Association of Banks shows the rate has fallen from 17.93% in November to 15.9% in December.

This represents a 200 basis-point decline from the previous month.

The dip was driven by improvements in major indicators used in calculating the GRR. Key factors include the Monetary Policy Rate, Treasury rates, and interbank market rates.

Some commercial banks told JoyBusiness that the 350-basis-point reduction in the Monetary Policy Rate to 18% played a major role, alongside a slight fall in Treasury bill rates.

Background

In November 2025, the GRR increased marginally to 17.96% from 17.86%, influenced by slight rises in Treasury bill rates—from 10.50% to 10.67%—and interbank rates, which edged up from 20.93% to 21%.

In October, the GRR fell by 2%, dropping from 19.86% in September, continuing a downward trend observed throughout the year.

The rate, which stood at 29.72% in January 2025, rose slightly to 29.96% in February before declining steadily to 19.67% in August 2025.

Impact

The significant fall in the Ghana Reference Rate is expected to reduce the cost of borrowing and push commercial banks to adjust their lending rates downward in December.

Loans contracted in December 2025 are likely to be benchmarked on the new GRR. This means interest payments on new loans should be lower compared to November.

Borrowers with fixed-rate loans will not be affected, but those on variable-rate agreements may see small adjustments depending on their bank’s pricing model.

The decline comes at a time when many businesses are struggling to access credit due to a liquidity squeeze driven by measures to curb inflation and stabilise the economy.

According to the latest Monetary Policy Report, average lending rates have dropped from 26.6% to 24.2%, reflecting an easing credit environment.

The Bank of Ghana also notes a decline in money market yields, with the 91-day Treasury bill rate falling from 13.4% in July to 10.3% in August 2025.

Ghana Reference Rate

The Ghana Reference Rate was introduced in 2017 by the Bank of Ghana and the Ghana Association of Banks as a transparent benchmark for determining lending rates.

The maiden GRR, set in April 2017, was 16.82%.

Developed after extensive consultations, the GRR replaced the old base rate model to create a more consistent and open framework for loan pricing. It remains a central guide for interest rate decisions across the financial sector.

Latest Stories

-

Ghana’s Cybele Energy Limited launches oil exploration in Guyana

7 seconds -

There has been significant reconciliation among Kussasis, Mamprusis in other towns – Asantehene

13 minutes -

BoG Governor urges banks to support real sector after policy rate cut

16 minutes -

FIFA introduces $60 Supporter Entry Tier tickets for World Cup 2026

20 minutes -

Gov’t pledges definitive position on Bawku Mediation Report within 24 hours

21 minutes -

Bawku mediation report should bind on all parties – Asantehene

23 minutes -

Asantehene demands enforcement of law recognising Naba Azoka II as Bawku Chief

23 minutes -

Prudential Bank trains merchant partners on POS usage in Accra and Kumasi

31 minutes -

MGL, poultry farmers roll out X’mas Egg Market to tackle egg glut

40 minutes -

ORIGIN8A: Decoding the hidden meaning and intentionality behind Samini’s new album title

42 minutes -

Both sides willingly presented themselves for Bawku mediation process – Asantehene

46 minutes -

I’m not here to say who was right or wrong – Asantehene on Bawku peace process

52 minutes -

Asantehene presents Bawku Peace Mediation Report to Mahama

1 hour -

Analysis: Ghana’s oil exports drop by over $1bn in the first 10 months of 2025

1 hour -

Supreme Court slams EC officials for absenteeism in critical Kpandai re-run case

1 hour