Audio By Carbonatix

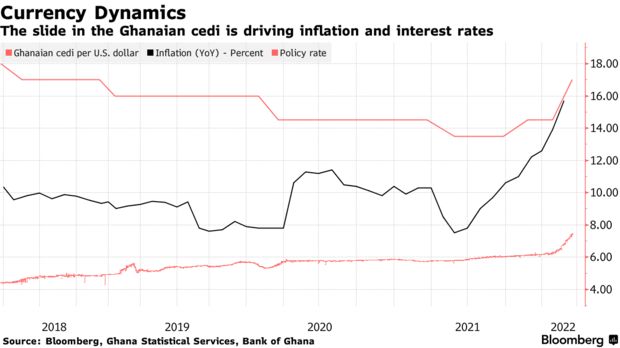

Ghana’s central bank will need to raise interest rates further this year unless a decline in the cedi is arrested, Goldman Sachs Group Inc. and Absa Group Ltd. said.

The West African nation increased borrowing costs by the biggest margin in two decades on Monday to arrest inflation that accelerated at the fastest pace in almost six years in February and stem a depreciation in the cedi. The currency has weakened more than 17% against the dollar this year, making it the worst performer on the continent.

Finance Minister Ken Ofori-Atta is preparing to unveil measures this week aimed at supporting the cedi, ensuring expenditure discipline and providing relief to the economy, the Information Ministry said. It didn’t provide further details.

“If these measures fail in turning the economy around or fall short of its ultimate objectives, including stabilizing the exchange rate or reversing the recent sharp depreciation, we believe a further policy rate hike” of 100 basis points is likely by the third quarter, Ridle Markus, a Johannesburg-based Africa strategist at Absa, said in a note to clients.

The cedi strengthened 0.1% to 7.36 per dollar by 10 a.m. in London.

Ghana’s currency has slumped this year amid concern the nation won’t achieve its revenue and debt targets, which has sparked a selloff of its foreign-currency debt. Inflation is surging in part because of the impact of the war in Ukraine on global energy and food prices. Ghana imports about a third of its grain needs and almost 40% of its fertilizer requirements from Russia, according to the central bank.

The government in January moved to reassure investors that it’s committed to fiscal targets, including expenditure cuts if revenue falls short of expectations. Ofori-Atta has yet to get parliament’s approval to introduce a so-called e-levy on financial transactions that’s aimed at helping boost tax revenue to 15.4% of gross domestic product this year from an estimated 12% last year.

“The fact that the government has so far failed to pass the budget that it proposed in November, including new revenue measures -- implying likely fiscal slippage -- adds to Ghana’s rising risk premium,” Goldman economists Bojosi Morule and Andrew Matheny said in an emailed note.

That combined with tightening financial conditions for emerging-market countries due to the war in Ukraine “add to the already meaningful depreciation pressures” on the cedi and increase the risk of further hikes, they said.

Ghana’s monetary policy committee is scheduled to announce its next rate decision on May 23.

Latest Stories

-

Ghana cautions nationals against non-essential travel to and from the Middle East as tensions escalate

2 hours -

NAIMOS has failed in galamsey fight; it’s time for a state of emergency – DYMOG to President Mahama

3 hours -

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

3 hours -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

4 hours -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

4 hours -

Police conduct show of force exercise ahead of Ayawaso East by-election

6 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

6 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

6 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

6 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

7 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

7 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

7 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

7 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

7 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

7 hours