Government bagged ¢51.58 billion in revenue in the nine months of this year, missing the target narrowly by 0.89%.

The target for 2022 is ¢52.04 billion.

However, the performance represents a nominal growth of 29% over the same period in 2021.

In a tweet, the Ghana Revenue Authority (GRA) said domestic revenue grew by 28.6%.

At the same time, customs revenue grew nominally by 29.8%.

It is expected that government will accrue more revenue in the third quarter of 2022 because historically revenue mobilisation goes up in the last quarter of every year.

Government targeted ¢96.842 billion from total revenue and grant in 2022, but about ¢88 billion from revenue

E-Levy rakes in 328m since implementation in May

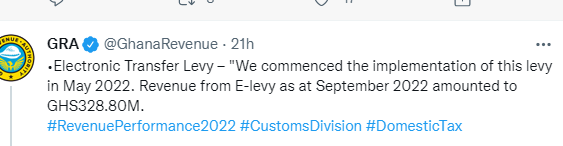

Meanwhile, government earned ¢328 million from the Electronic Transaction Levy (E-Levy) at the end of the third quarter of this year.

According to the GRA, it recorded 20% month-on-month improvement in the collection of the levy since its implementation in May 2022.

“We commenced the implementation of this levy in May 2022. Revenue from E-levy as at September 2022 amounted to ¢328.80m”, it said in a tweet.

“It is worth mentioning that on month-on-month basis we continue to see a 20% improvement in collection of the levy. It is therefore our expectation that this will continue and improve domestic revenue generation to support government expenditure”, the Commissioner-General, Dr. Amishaddai Owusu-Amoah disclosed.

The government had initially projected ¢6.9 billion from E-Levy collections for 2022, but revised it to ¢4.9 billion and later to ¢611 million.

GRA automates process of obtaining Tax Clearing Certificates

Meanwhile, the GRA says it has automated the process of obtaining Tax Clearing Certificates (TCCs), and therefore tax payers can now apply for TCCS electronically via the Taxpayers portal.

Again, it has also acquired a USS code that will allow every Ghanaian to check on their tax compliance status. This tax code the GRA said will be made public soon.

Latest Stories

-

Sons shouldn’t be mothers’ emotional support system – Ethel Adjololo

2 mins -

Family threatens to take on Trinity Hospital over missing corpse

8 mins -

Kofi Kinaata unfazed by death prophecies

13 mins -

Jospong Group partners Komptech to train over 600 stakeholders on integrated solid waste management

20 mins -

Two East Africans charged in UK migrant deaths investigation

26 mins -

DR Congo legal warning to Apple is ‘first move’ – lawyer

36 mins -

Question Time: Did policing minister confuse Rwanda and Congo?

39 mins -

We need better sets for theatre productions – Omar Sherrif Captan

45 mins -

KPMG report on SML must be published and laid in Parliament – Isaac Adongo to Akufo-Addo

48 mins -

Rainstorm causes havoc in Anloga District

50 mins -

Akufo-Addo nominates new MCE for Krachi East Municipal Assembly

52 mins -

Sunyani Technical University refutes sex-for-grades claim, describes allegation as baseless

1 hour -

I’ll win TGMA Artiste of the Year at the right time – Kofi Kinaata

1 hour -

Meet Fred Amugi’s 100-year-old mother

2 hours -

Nkomor Ghana pilots Medicine Delivery Service at the Ghana Autism Conference

2 hours