Audio By Carbonatix

Playwright and Chief Executive of Globe Productions, Latif Abubakar, has urged the Ghana Revenue Authority (GRA) and the creative industry to work together to expand the country’s tax net, highlighting the enormous potential of the creative economy to boost Ghana’s Gross Domestic Product (GDP).

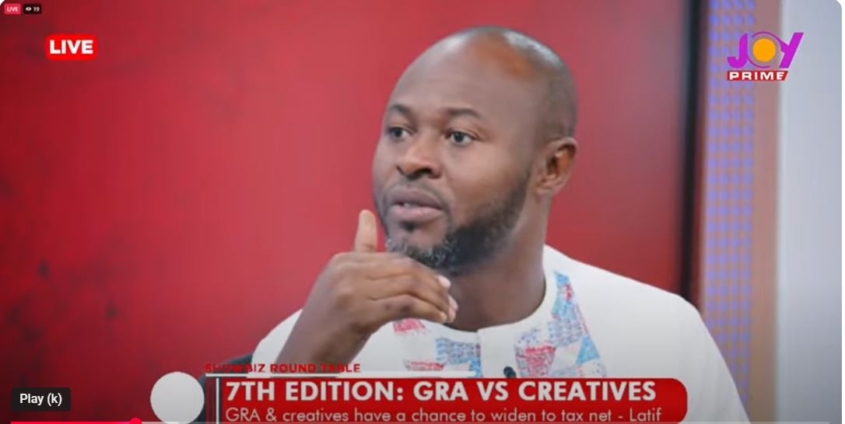

Speaking at the 7th edition of the Showbiz Roundtable on the theme “Taxation and the Future of Ghana’s Creative and Digital Economy” on Saturday, September 6, Mr. Abubakar stressed that the creative industry remains a largely untapped sector capable of contributing significantly to national revenue.

“I think one of the major things the GRA wants to do is to widen the tax net. Both the GRA and the creatives have an opportunity to widen the tax net. Globally, the creative economy contributes close to $4.1 trillion. In Sub-Saharan Africa, it is about 4% of GDP, roughly $58 billion. For Ghana, projections show the creative economy could contribute between $20 to $30 billion annually if we do things right,” he said.

However, he lamented the absence of reliable data on Ghana’s creative economy, which makes it difficult to determine its actual contribution to GDP. “We started processes to gather data some years ago, but without proper data, we cannot measure the true value of the industry,” he explained.

Mr. Abubakar also cautioned against taxation policies that cripple rather than support creatives. He narrated a case where a young playwright lost his company after being taxed on complimentary tickets issued during his debut production.

“For every production, you give out complimentary tickets so people can experience the arts. Unfortunately, after giving out tickets and losing money, GRA still demanded tax on them. The young man was slapped with nearly GH¢10,000 in taxes, on top of a GH¢30,000 loss. That was the end of his company,” he recounted.

He emphasized that while GRA has a mandate to mobilise revenue, the creative industry must be nurtured to grow and contribute sustainably.

“There’s an industry that can help widen the tax net. Stakeholders need to sit together and design policies that support both revenue generation and the growth of the creative sector,” he added.

Latest Stories

-

Government advances domestic processing, financial reforms in cocoa sector

20 minutes -

GHS enforces uniform, name tag policy after Mambrobi baby theft incident

25 minutes -

Cedi gains not enough to reduce prices as manufacturers still recovering losses – Dr Nsiah-Poku

1 hour -

Strong currency, but expensive power – AGI president explains why prices stay high

1 hour -

Tems, Burna Boy become African artistes with most Billboard Hot 100 entries

2 hours -

Lawyer fires back at Davido over social media harassment after custody case

2 hours -

Rapists should be castrated, burnt alive – Simi

3 hours -

Air Algérie Group and Africa Prosperity Network sign deal to advance ‘Make Africa Borderless Now!’ agenda

4 hours -

Africa Prosperity Network, Ethiopian Airlines explore partnership to advance ‘Make Africa Borderless Now!’ agenda

4 hours -

Trump’s Board of Peace members pledge $7bn in Gaza relief

5 hours -

Police retrieve five weapons, kill suspect in a shootout

5 hours -

Court fines driver over careless driving

5 hours -

Pharmacist arrested for alleged assault on medical officer over drugs

5 hours -

Not all women in leaked footage had intimate encounters with Russian suspect – Sam George

5 hours -

Ghana to prosecute Russian national in absentia over leaked footage – Sam George

6 hours