Audio By Carbonatix

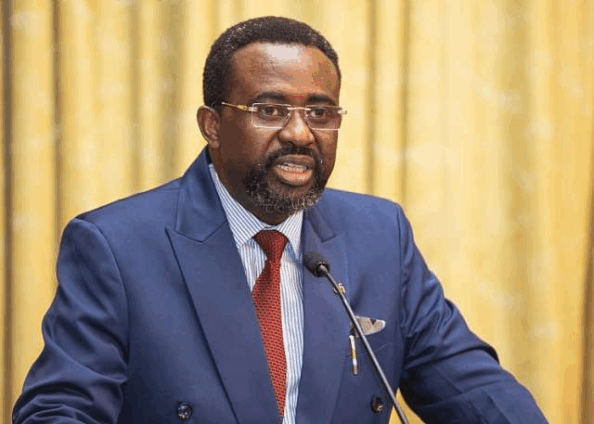

Governor of the Bank of Ghana, Dr Johnson Asiama, says the hallmark of his tenure will be to make the local currency cedi, the currency of choice and to build a central bank that is agile and future-ready.

Speaking in Washington DC during the ongoing IMF/World Bank Spring Meetings, he said his clear mandate is to achieve price and financial stability, and that after eight months in office, he believes the country is on course.

He said one of the biggest challenges confronting the economy is dollarisation, a problem he has observed throughout his 30-year career in central banking.

According to him, the widespread use of foreign currency undermines the effectiveness of monetary policy and weakens confidence in the cedi.

“I’ve seen this for many years. I started central banking some 30 years ago. The phenomenon has been there, and so we are tackling it to make the local currency the sole legal tender,” he said.

Dr Pandit disclosed that on October 28, the Bank of Ghana will mark the 60th anniversary of the cedi in an event dubbed “The Cedi at 60.”

He said the celebration will symbolise a new beginning for Ghana’s currency regime.

“We want that to mark a new beginning, because when we use the local currency in all transactions, that enhances the efficiency of monetary policy,” he said.

“It’s one of the things I would want to be remembered for, that I came, I solved that problem, I made the local currency the currency of choice.”

Beyond currency stability, Dr Asiama said his vision is to modernise the central bank to effectively manage emerging risks in the financial ecosystem.

He noted that the banking landscape has changed dramatically from when he began his career three decades ago.

He cited fintechs and cryptocurrencies as new realities that must be managed carefully to preserve financial stability.

“We do not have fintechs those days, but I believe that if not handled properly, fintechs, for example, that area could be an area where a risk could emerge going forward. And so we are, you know, looking at that industry well. We are mending the legislation there as well,” he said.

On digital assets, Dr Asiama acknowledged that cryptocurrencies pose another challenge for modern central banks.

He emphasised the need for a forward-looking institution that can adapt to any emerging threat or innovation.

“What I want to see is a central bank that is ready and able to adapt. It is critical today. It could be something else tomorrow. It could be anything. Who knows, but we should have the manpower, we should have that agility, we should have the balance sheet to be able to contend with any of these risks as they emerge in the future,” he said.

For Dr Asiama, his defining legacy will not only be about achieving monetary stability but also about creating a resilient, adaptive, and innovative central bank prepared to meet the demands of a rapidly changing financial world.

Latest Stories

-

Willie Colón, trombonist who pioneered salsa music, dies aged 75

31 minutes -

Guardiola tells team to chill with cocktails as Man City pile pressure on Arsenal

33 minutes -

Majority blasts Minority over Burkinabe border bloodbath claims

2 hours -

Analyst says Burkina Faso killings were a calculated signal to Ghana

3 hours -

Veep extends Ramadan greetings, donates to Cape Coast Central Mosque

3 hours -

UBIDS secures $6.6m prefabricated classroom complex to end space deficit

5 hours -

Gold Fields Ghana Foundation deepens childhood cancer awareness drive; invests $4.8m in community health

5 hours -

Iran students stage first large anti-government protests since deadly crackdown

5 hours -

Fire guts Saboba Hospital’s Children Ward

6 hours -

Interior Ministry extends aptitude test dates for WASSCE applicants in 2025/26 security services recruitment

7 hours -

National Investment Bank donates GH₵1m to support GAF barracks redevelopment project

8 hours -

Gomoa-East demolition: 14 suspects remanded by Kasoa Ofaakor Court

8 hours -

Divers recover bodies of seven Chinese tourists from bottom of Lake Baikal

10 hours -

From windstorm to resilience: How Wa school is growing climate protection

10 hours -

Reclaiming the Garden City: Dr. Kwame Adinkrah urges Kumasi to rein in billboard proliferation

10 hours