Audio By Carbonatix

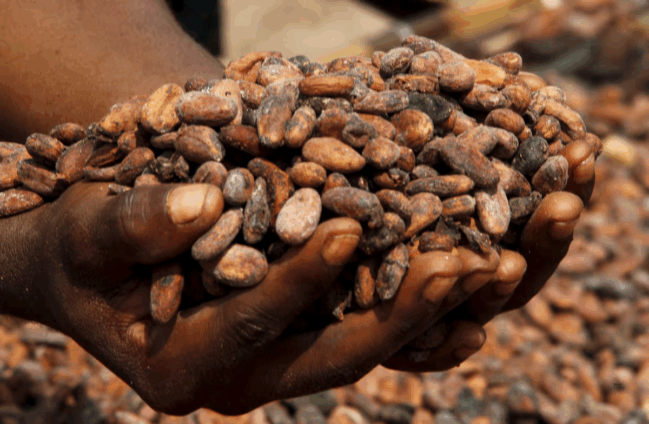

Some international buyers of Ghana’s cocoa have started advancing part of more than $4 billion to COCOBOD for cocoa bean purchases for the 2025/2026 crop season.

JoyBusiness has learned that the full amount will not be released at once but spread over a period. However, sources say a significant portion is expected before the end of this year.

The move by global traders is to secure the necessary commitment from COCOBOD for bean supply.

COCOBOD’s New Financing Deal

In 2023, COCOBOD introduced a new funding model for cocoa purchases, requiring global traders to deposit at least 60% of the value of their forward contracts at the start of the season.

This system replaced the three-decade-old pre-export syndicated loan from international banks.

Part of the traders’ deposits will be used to finance purchases from farmers through existing partnerships with licensed cocoa buying companies (LBCs). In this arrangement, traders fund LBCs to buy cocoa while COCOBOD acts as an intermediary.

Impact on the Cedi

Analysts argue that apart from cocoa farmers, the cedi will be one of the biggest beneficiaries of these inflows, as they could significantly boost the Bank of Ghana’s international reserves.

The Bank’s Economic and Financial Data released in July put Ghana’s reserves at $11.1 billion.

Bank of Ghana Governor, Dr. Johnson Asiama, in an exclusive interview with JoyBusiness’s George Wiafe, said the inflows should signal to the market that the central bank is well-positioned to intervene when needed to meet the demands of businesses and commercial banks.

Dr. Asiama maintained that the development shows a favourable outlook for the cedi despite recent pressures. “As regulator, we have taken the needed actions to ensure that things do not get out of hand,” he assured.

He added that Ghana’s macroeconomic situation remains solid and should give businesses confidence in the cedi’s outlook as well as in ongoing measures to improve market liquidity.

JoyBusiness has also learned that the country could receive additional inflows from development partners, which should further strengthen international reserves.

Latest Stories

-

24-Hour Economy not just talk — Edudzi Tamakloe confirms sector-level implementation

15 minutes -

Four arrested over robbery attack on okada rider at Fomena

17 minutes -

NDC gov’t refusing to take responsibility for anything that affects Ghanaians – Miracles Aboagye

42 minutes -

Parental Presence, Not Just Provision: Why active involvement in children’s education matters

1 hour -

24-Hour economy policy fails to create promised jobs – Dennis Miracles Aboagye

1 hour -

Ghana Embassy in Doha urges nationals to take shelter after missile attack

1 hour -

Government’s macroeconomic stability commendable, but we need focus on SME growth – Victoria Bright

2 hours -

Macro stability won’t matter without food self-sufficiency- Prof. Agyeman-Duah

2 hours -

How Virtual Security Africa is strengthening safety at Mamprobi Polyclinic

2 hours -

Ghana on right track macroeconomically, but structural gaps remain – Fred Dzanku

2 hours -

ADB MD honoured for impactful leadership at PMI Ghana engagement

2 hours -

Bringing Ofori-Atta’s photo to Parliament and displaying it was unfair – Afenyo-Markin

3 hours -

Minority leader calls 24-Hour economy policy more PR than practical solution

3 hours -

Afenyo-Markin accuses government of using anti-corruption drive to target opponents

3 hours -

GPL: Kotoko announce new board of directors

3 hours