Introduction

By the end of the 3rd Quarter of 2021, Ghana’s fiscal vulnerability had been evident to the market, resulting in a loss of market access largely consistent with the country’s struggle to manage its public debt since independence. In all of Ghana's programme engagements with the International Monetary Fund (IMF), debt unsustainability has been recurring reflecting a weak fiscal regime of expenditure rigidities and low domestic revenue mobilization.

The latest IMF Supported Programme is unique given the number of prior actions the country had to undertake in order to qualify for help from the IMF, including taking a comprehensive approach to restructuring the country’s public debt with domestic debt restructuring being a condition precedent to getting IMF Board approval.

Unlike the case of Zambia, which excluded the domestic debt from its debt restructuring to protect the domestic financial system, Ghana applied the most aggressive debt restructuring which was first announced on December 5, 2022. Arguably the first of its kind in the country's history.

Government instruments (excluding only treasury bills) held across households (including pensioners), financial institutions, body corporates, and resident and non-resident investors were considered to be in the universe of eligible bonds.

The country’s economic fundamentals had deteriorated to the extent that the traditional fiscal consolidation measures embodying expenditure restraint and revenue enhancement measures were considered to be inadequate and therefore restructuring had become fundamental to restoring fiscal sustainability.

Ghana’s economy entered a full-blown macroeconomic crisis in 2022 on the back of pre-existing imbalances and external shocks. Large financing needs and tightening financing conditions exacerbated debt sustainability concerns, shutting-off Ghana from the international market.

Large capital outflows combined with monetary policy tightening in advanced economies put significant pressure on the exchange rate, together with monetary financing of the budget deficit, resulting in high inflation. These developments interrupted the post COVID-19 recovery of the economy as GDP growth declined from 5.1% in 2021 to 3.1% in 2022. The 2022 fiscal deficit was well above target at 11.8%. Public debt rose from 79.6% in 2021 to over 90% of GDP in 2022, as debt service-to-revenue reached 117.6% (World Bank., 2022).

The monetisation of fiscal deficits and Bank of Ghana lending to government through ways and means advances has risen to GHS50 billion in 2022, exceeding the threshold set by Bank of Ghana Act 2002 Act 612 as amended Act 2016 Act 918 Section (30:2) the total loans, advances, purchases of treasury bills shall not at any time exceeds 5% of the total revenue of the previous fiscal year.

These ways and means advances are temporary overdraft facilities provided to the Government of Ghana (GoG) to help with financial difficulties caused by a cash flow mismatch by bridging the gap between expenditure and revenue receipts. This level of borrowing from the Bank of Ghana to finance fiscal deficit was clearly unsustainable, fuelled inflation and endangering growth.

In Ghana, deficit financing has led to borrowings from the multinational finance institutions, such as the International Monetary Fund (IMF), the World Bank, African Development Bank (ADB) and Euro-markets.

Unfortunately, the rising national debt in Ghana began to outweigh the country’s revenue generation capacity and drawing down on foreign reserves, hence stifling the much-needed public capital investments and economic productivity. Also, it has been reported that these borrowed funds are often mismanaged and misapplied, hence, were not used for economically productive activities, leading to debt burden, capital flight and economic instability in the long-run.

Ghana was in a critical situation with regard to its public debt as the country’s debt to GDP has exceeded the dreadful limit of 100% recently after the joint Debt Sustainability Analysis by the Government/IMF and World Bank. It is the world’s second- most severely indebted developing countries after Sri Lanka. Ghana has become the latest among a number of smaller emerging markets from Sri Lanka to Zambia to buckle under its debt burden as the economic fallout from the Covid-19 pandemic and Russia and Ukraine war fuelled by high inflation and rising borrowing costs around the globe. Ghana is a severely indebted middle-income nation.

The total public debt burden stood at approximately US$58 billion or 105 percent of GDP at the end of 2022. High debt – and debt service – levels coupled with limited access to external finance has meant the government has had little fiscal space with which to increase expenditures in public investment and poverty reduction programmes. The joint Debt Sustainability Analysis by Ghana Government/International Monetary Fund (IMF) demonstrated that Ghana’s debt servicing absorbs more than 50% of total government revenues and almost 70% of the tax revenues. Additionally, the total public debt stock, including that of state-owned enterprises among others exceeded 100% of the Gross Domestic Product (GDP).

At the beginning of December 2022, the Ministry of Finance announced that the country’s public debt-to-GDP ratio had reached 100 percent, a figure projected to climb to 107 percent by the end of 2022 (World Bank, 2022). Ghana entered the world economic downturn in the beginning of April 2022 from a position of growth rate of 3.4% of GDP with high, increasing debt levels and inflation at 50.3% in November, 2022, the highest in 21 years. As a result, Ghana’s fiscal situation quickly became unsustainable after the Covid-19 pandemic and Russia and Ukraine war.

The Original Domestic Debt Exchange Programme

Starting in December, 2022, the government made important efforts to bring high debt levels to sustainable, by announcing domestic debt exchange, to bring its debt trajectory on a sustainable path. Under Ghana’s debt exchange arrangement, the Government of Ghana proposed to exchange existing domestic bonds as of 5th December, 2022 for 12 new bonds maturing in 2027, 2028, 2029,2030, 2031, 2032, 2033, 2034, 2035, 2036, 2037 and 2038.

According the Ministry of Finance these new bonds will pay 0% in 2023, 5% in 2024, and subsequently 9.1% interest per annum until final maturity in 2038. The predetermined allocation ratios are 17% for the short- term bonds, 17% for intermediate bonds, 25% for medium term bonds and 41% for long term bonds. If the debt exchange is completed successfully it is expected to afford the government some fiscal space to reduce the domestic interest costs starting from 2023 to the end of 2037.

The Ministry of Finance invited on 5th December, 2022, holders of old domestic debt to voluntarily exchange GHS137.3 (US$14.3) billion domestic bonds and notes including E.S.L.A and Daakye Bonds, for a package of four new domestic bonds. Under the debt swap or exchange announced on 5th December, 2022, local holders including domestic banks, Bank of Ghana, Firms and Institutions, insurance companies, foreign investors, Rural and Community Banks and SSNIT have until 15th January, 2023 to exchange GHC 137.3 billion (US$14.3) worth over 60 domestic bonds for 12 new bonds, one maturing each year starting January 2027 and ending January 2038.

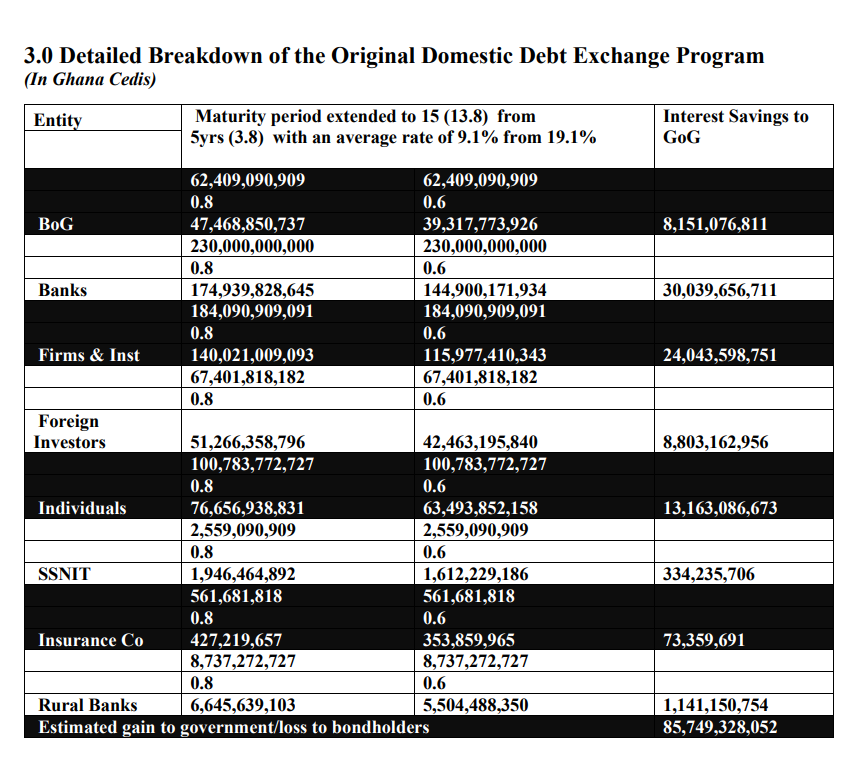

Losses are traditionally measured in terms of their net present value. From our data analysis of the original debt exchange of the total NPV of Bond value of Domestic banks, Bank of Ghana, Firms and Institutions, Foreign investors, Retail and Individuals, Insurance companies, SSNIT and Rural banks of GHC 428,133,044, showed the estimated losses of GHS87,549,328,052 in (NPV) to local bondholders, with maturity extension from 5 (3.8) years to 15 (13.8) years with average coupon rate declining from 19.1% to an average of (8.3%) 10% for new bonds.

Given the significant losses to bondholders which we estimated at GHS87,549,328,052 in NPV. With an overall NPV loss of 20 percent, banking sector losses amounted to GHS87.5 billion, a major factor for determining the capital needs of the banks.

3.0 Detailed Breakdown of the Original Domestic Debt Exchange Programme (In Ghana Cedis)

Detailed Breakdown of Revised Domestic Debt Exchange

The breakdown of the GHS203bn restructured domestic debt is as follows:

- GHS 87bn restructured from Treasury bonds, ESLA and Daakye bonds excluding pension funds. The average coupon rate and maturity period of the restructured bonds currently stands at 9.1 (previously 19.1%) and 8.3 years (previously 13.8 years)

- GHS 29.6bn restructured Pension Fund holdings in Treasury bonds, ESLA and Daakye bonds excluding pension funds. The coupon rate and average maturity period remains the same at 20% and 4 years respectively

- US$742m restructured from dollar-denominated local bonds with average coupon rate and maturity period being 3% (previously 5.3%) and 1.5 years (4.5 years).

- GHS 7.7bn restructured from Cocoa bills with the coupon rate and maturity period being 13% (previously above 30%) and 4.4 years (previously 0.7 month)

- GHS 70.9bn principal haircut on the non-marketable debt instrument of the Bank of Ghana with the current coupon rate and maturity period 10% and 15 years respectively.

The government offered most bondholders a set of new bonds at fixed exchange proportions with a combined average maturity of 8.3 years instead of the original 13.8 years and coupons of up to 10 percent (with part of the coupons capitalized rather than paid in cash in 2023 and 2024). It started by launching a voluntary Domestic Debt Exchange Program (DDEP), which is intended to increase average debt maturity from 3.8 years to 8.3 years instead of the original13.8 years and reduce average coupon payments from 19.1% to 9.1%, with only 5% paid in cash in 2023 and 2024.

Crucially, the completed DDEP has also produced very large cash debt relief for the government of almost GHS61.7 billion in 2023, relieving pressure on the domestic financing market. The average haircut on Ghana of Ghana and Bank of Ghana bonds of GHS203 billion has resulted in government savings of GHS61.7 billion or 30% which at same time represented a significant loss to all bondholders especially Bank of Ghana that has taken massive hit to its balance sheet.

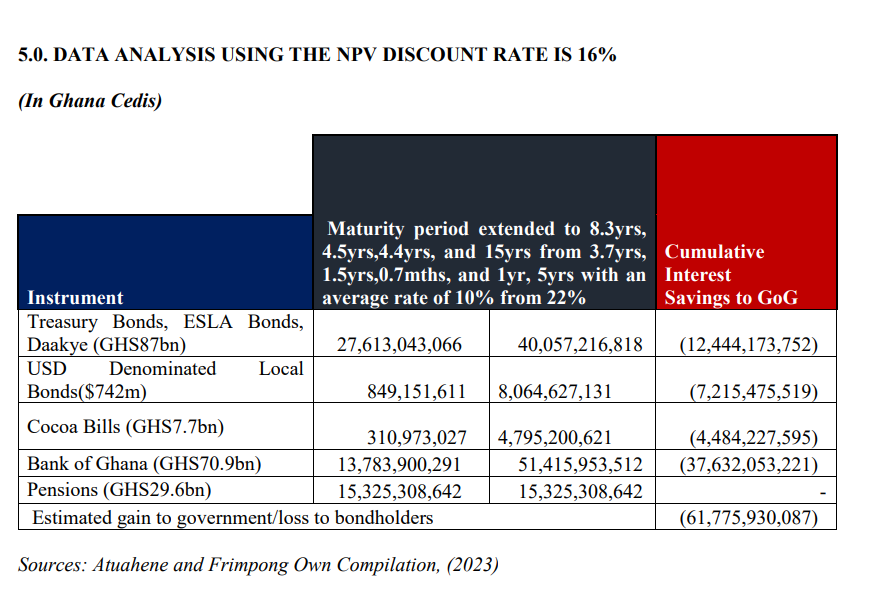

Data Analysis Using the NPV Discount Rate IS 16% (In Ghana Cedis)

Detailed Fiscal Space of GHS61.7 billion on Government Bonds valued GHS203 billion on the DDEP implementation.

The Government issuer of Treasury bonds (Daakye and ESLA) valued GHS 87 billion would saving approximately GHS12.4 billion (14%) after the DDEP while making savings of GHS7.2 billion on US $ Dominated local bonds valued US$742 million. The Government would be saving GHS 4.5 billion (58.4%) on the Cocoa bills valued GHS7.7 billion while the government made savings of GHS37.6 billion (53%) on the Bank of Ghana’s marketable and non-marketable bonds valued GHS70.9 billion.

On the Pension fund bonds valued GHS29.6 billion the government made no savings (0%) on the DDEP as a result of complete exemption from the program. The government made total savings of GHS61.7 billion on the Government bonds valued GHS203 billion. The revised DDEP marginally impacted on the banking sector, while NPV losses of the Bank of Ghana impacted significantly and negatively, and the Cocoa bills suffered negatively likewise US$ dominated local bonds with the pension suffered no hair cut at all.

The largest holders of domestic debt in the country included domestic banks, the Bank of Ghana, non-bank financial institutions, private individuals, pension funds, insurance companies, rural and community banks and foreign investors. Investor losses ranged from 14% to 58.4%, with average haircut of 30% based on comparing the market value of the new debt with the net present value of the old debt evaluated at the sovereign yield immediately following the debt exchange.

The NPV haircuts—defined by comparing the present value of new instruments received with that of old instruments tendered, both evaluated at yields prevailing immediately after the debt exchange—varied substantially across the debt restructurings studied. The DDEP has offered important lesson for other countries in similar situations. With hindsight, it is clear that the DDEP led to a stronger reduction in debt in NPV terms. The “toughest” restructuring was Argentina’s 2005 exchange with an average haircut of almost 75%, followed by the Russian GKO exchange (50-70%), with Ghana’s milder haircut of 30% while the mildest was Uruguay’s international bond exchange, with a haircut close to 10%.

The revised DDEP has shifted the losses burden from the banking sector to the Bank of Ghana which took hit of DDEP loss of GHS37.6 billion and followed by the Cocoa bills which also took a hit of DDEP loss of GHS5.4 billion.

Lessons from other countries’ that have implemented DDEP

Learning from other countries that have gone through a sovereign debt exchange program, like Greece and Jamaica, adoption of the DDEP is likely to trigger financial challenges that may threaten the stability of various sectors of the economy markets, making government support necessary, especially for banks identified as systemically important. To its credit, there are plans by the government to extend support in the form of a stabilization fund. As seen from the swift action of the US and Swiss regulators to resolve banks considered systemic, the fund would be key to stabilizing the financial services sector and instilling confidence in the system to ward off threats of an accelerated economic crisis

If we take Greece as an example, their debt restructuring achieved a reduction in the debt, but led to a contraction in consumption, driven by the effects of the austerity measures put in place e.g., cuts in public spending and a decrease in social welfare benefits. This resulted in a decrease in living standards for many individuals, as well as increased poverty and unemployment.

Looking further to the Caribbean, Jamaica underwent a similar debt exchange program. Initially there was a decrease in disposable income by households as the Jamaican dollar was devalued resulting in inflation. This effect was felt more by low income earners. However, the fiscal space created by reducing the debt repayment burden allowed the government to redirect freed funds to infrastructure development and spend more on social intervention programs in the longer term

Lessons from the revised DDEP on the overall economy

i. One lesson from the restructuring of the country’s domestic debt had marginally impacted on individual households, whether through direct ownership of debt or through investments in mutual and insurance companies as the tenor has been reduced from 13.8 years to 8.3 years with coupon rate from 19.1% to 9.1% where the pension funds suffered no nominal NPV losses. The revised DDEP has affected the access to bank credit and the cost of borrowing for Ghanaian businesses and households, which could have further distributional consequences. Ghana’s debt restructuring achieved a reduction in the debt, but led to a contraction in consumption, driven by the effects of the austerity measures put in place e.g. cuts in public spending and a decrease in social welfare benefits like Leap. This resulted in a decrease in living standards for many individuals, as well as increased poverty and unemployment. It also affected the ability of domestic banks and businesses to grow, resulting in a decrease in overall economic output. Additionally, restructuring including a “haircut”, has led to a further loss of confidence in the government’s ability to repay its debts and in the country’s economy as a whole

ii. Another lesson from the debt exchange caused the Ghanaian financial sector to deleverage in doing so, banks cut off credit to the non-financial sector — the now infamous “credit crunch.” Because credit is a fundamental ingredient in the smooth operation of asset markets, the crunch adversely affected the value of all types of tangible business capital.

The steep drops in the value of assets owned by the bank and non-bank financial sector also lowered the sector’s net worth and raised the frequency of business failures. Ghana’s bigger debt servicing burdens have reduced available fiscal space for development and stabilization and growing sovereign debt financing also needs have crowded out domestic investment. For the first time in 30 years of international syndicated loan facilities, Ghana’s credit rating is so broken that the global banks don’t want to participate in international syndicated loan facility.

The presence of collateral damage on Ghana post DDEP has affected the country’s international trade finance and payment system. Domestic debt exchange has caused reputational spill over that has depressed Foreign Direct Investment and other foreign capital inflows into the country including international cocoa syndicated loans for 2023. The domestic debt exchange has negatively impacted on 2023 international syndicated loan of US$800 million as result of reputational spillover with international financiers (The Thomson Reuters; 07/11/2023). Ghana’s credibility and financial standing is now being questioned by international financiers.

iii. Another lesson from the domestic debt exchange has hampered economic growth through the debt overhang effect and the crowding out effect. Heavy public debt service obligations resulted in a large risk premium on interest rates, periodic bouts of financial market instability, and a crowding out of bank credit to the private sector, all of which had contributed to a very low potential growth rate. One negative effect of domestic debt restructuring is that it has caused investors to lose confidence in the country's ability to repay its debt on time. This has led to a decrease in domestic investment and an increase in the cost of borrowing for the government and local businesses.

The decreased domestic investment has a ripple effect on the local economy. As businesses including SMEs have struggled to access the funds they need to grow and hire workers, the unemployment rate in Ghana has dramatically increased. This lack of investment has also led to an increase in the cost of borrowing for the government and local businesses, making it more difficult for them to finance their operations and invest in growth. In terms of the effects on the domestic bond market and local financial institutions (banks, insurance, asset management companies & specialized deposit taking institutions), domestic debt exchange had both direct and indirect effects.

The direct effect was that the restructuring has resulted in a loss of value for domestic bondholders. This has led to a decrease in demand for Ghana government bonds and a decreased in the overall value of the bond market. The indirect effect was that the restructured domestic debt has affected the stability of local financial institutions especially in the area of liquidity and solvency. If the government was unable to manage its domestic debt exchange process properly, the economy has suffered as a result, Cocoa Board had face increased risks and potentially experienced financial difficulties.

This has led to a decrease in the availability of credit for local businesses as well as higher cost of credit and households, thus hindered economic recovery and growth. Ghana’s balance of payments is expected to continue to deteriorate further in 2024, on the back of continued capital outflows, and the continued Cedi depreciation as a result of decline inward remittances, low returns on extractive industries like gold and poor cocoa syndication loan of US $ 800 million lowest recorded over the past two decades.

iv. One major lesson from the domestic debt exchange that it has negatively impacted through debt overhang which has caused investors to lose confidence in the country's ability to repay its debt on time. This has led to a decrease in foreign investment and an increase in the cost of borrowing for the government and local businesses with yearly Treasury bill rates had increased from 22% to 33.7% post DDEP era. The higher interest rates on treasury bills also affect the country’s banking institutions thus creating an adverse selection problem.

As interest rates rise more conservative, risk-averse borrowers shy away from the credit market. A larger proportion of the persons applying for loans are thus those who are willing to take risky bets. The likelihood of default increases and so therefore does the banks’ proportion of non- performing loans. The domestic debt exchange has resulted the government regularly mopping liquidity from the banking sector through purchasing considerable volumes of Treasury bills at increasing high interest rates.

The domestic debt exchange has also weakened financial sector through impaired financial intermediation that led to a hesitance of financial institutions to provide funds to individuals and businesses. Credit to the private sector has contracted in the third quarter of 2023 as Banks continued to deploy their resources towards treasury bills as opposed to extension of credit facilities in response to the increased risks associated with lending due to the deteriorating macroeconomic conditions and the impact of the domestic debt exchange program thus confirming the crowding out hypothesis. This has threatened future economic growth and development.

Indeed, the present economic challenges that has compromised the ability of individuals and businesses to pay their loans which impacted negatively on the non-performing assets of the banking sector.

v. Another key lesson from the revised DDEP revealed that recent Bank of Ghana’s report on the increases in the non-performing asset ratio from 15% to 20% confirmed the debt overhang hypothesis. The weakened financial sector has impaired financial intermediation that has led to a hesitance of financial institutions to provide funds to individuals and businesses. This has threatened future economic growth and development. Indeed, the present economic challenges that has compromised the ability of individuals and businesses to pay their loans which impacted negatively on the non-performing assets of the banking sector. Weaker economic activity has translated into higher non‐performing loans by both firms and households which could increase bank distress through higher non-performing assets in the banking sector. The 2022 currency depreciation has exacerbated non‐performing loan volumes through currency mismatches.

vi. Another lesson from the domestic debt exchange is that it has caused debt overhang which has also led to stagnant growth and a degradation of living standards from reduced funds to spending in critical areas such as healthcare, education, and social care like Leap. The debt overhang had resulted in non-payment of some road contractors as well as food suppliers to the National Food Buffer Stock Company that have resulted in higher non-performing assets of the banking sector.

Because of the way they affected balance sheets and bottom lines, debt overhangs have distressed entities including banking institutions in different ways. The decreased domestic investment has a rippling effect on the local economy. As businesses including SMEs have struggled to access the cheaper funding to grow and expand their businesses and also impeded the hiring workers, and thus unemployment rate in Ghana has dramatically increased. This lack of investment has also led to an increased in the cost of borrowing for the government and local businesses, making it more difficult for them to finance their operations and invest in growth. The domestic debt exchange has caused debt overhang arose when debt stock exceeded government’s ability to repay. This has led to an increase in various taxes towards generating adequate revenue to settle both foreign and domestic creditors, thus discouraged investments due to a sudden increase in taxes.

As part of the country’s debt overhang, the government introduced myriad of taxes in 2023 including Income Tax Amendments Act, 2023 (Act 1094). Minimum chargeable income system; Tax is imposed on a minimum chargeable income of five percent of turnover where a person has been declaring tax losses for the previous five years of assessment. This excludes persons: within the first five years of commencement of operations; and engaged in farming, ii) Unification of the provision on carry-forward of tax losses; All taxpayers are allowed to carry forward tax losses from business for a period of five years.

Restriction of foreign exchange loss deduction; The deductibility of foreign exchange loss in respect of debt claim, debt obligation or foreign currency holdings is limited to realized losses incurred in the production of income. Exchange losses on transactions with resident persons are also not deductible. Taxpayers are allowed to capitalize foreign exchange losses of a capital nature and claim capital allowance accordingly. iii)Realization of assets and liabilities; A person who realizes an asset or liability is required to file a return, in the form prescribed by the Commissioner-General of the Ghana Revenue Authority, within 30 days after the realization.

Qualifying consideration payments for the realization of assets and liabilities will attract a withholding tax of three and ten percent for resident and non-resident persons respectively, iv) Broader definition of controlled relationship; The scope of association of persons in a controlled relationship has been broadened by reducing the minimum control threshold to 25% direct or indirect control. This means that a person is an associate of an entity and deemed to be in a controlled relationship where the person has directly or indirectly at least 25% of the voting right of the entity, v) Increase in the income tax rate for persons entitled to temporary concessions.

The income tax rate for persons entitled to concessions such as those engaged in the business of farming, agro-processing, cocoa by product, rural banking, waste processing, low cost housing, unit trust, mutual fund and venture capital financing has been increased to 5%. Taxation of lottery operations and winnings from lottery. The gross gaming revenue from lottery operations, including betting, gaming and any game of chance is taxed at an income tax rate of 20%.

Payments in respect of winnings from lottery are subject to a final withholding tax rate of 10%. vi) Increase in the upper limits of quantifiable motor vehicle benefits. The upper limit of motor vehicle benefits to be included in the employment tax computation has been increased as follows: Driver and vehicle with fuel - GHS1,500; Vehicle with fuel - GHS1,250; Vehicle only - GHS625; and Fuel only - GHS625. vii) Revision of the personal income tax bands and rates: The personal income tax bands and rates for individuals have been revised to align with the 2023 minimum daily wage.

There is an introduction of an additional tax rate of 35% on income exceeding GHS600,000 per year. Growth and Sustainability Levy, 2023 (Act 1095) Act 1095 repeals the National Fiscal Stabilization Levy, 2013 (Act 862) and introduces the Growth and Sustainability Levy (GSL or levy). The GSL is payable by entities categorized into three groups as follows: Category A- Existing National Fiscal Stabilization Levy entities plus six additional sectors: 5% of profit before tax; Category B- Mining companies and upstream oil and gas companies: 1% of gross production); and Category C- All other entities not falling within Category A or Category B: 2.5% of profit before tax.

The levy is applicable for the 2023, 2024 and 2025 years of assessment. It is payable quarterly and due on 31 March, 30 June, 30 September and 31 December of the year. The above new taxes introduced by the government has affirmed the debt overhang hypothesis. Excessively high rates of tax exact a high cost in terms of lower private investment and growth. They reduce the incentive to invest because the after tax returns to investors are lower. In addition, the cost of compliance with the administration of taxes can be high. The literature shows that lower rates of tax can increase investment and growth. Higher rates of tax can decrease business entry and the growth of established firms, with the medium sized firms hit hardest, as the small can trade informally, and the large avoid taxes. As well as reducing tax rates, policies that broaden the tax base, simplify the tax structure, improve administration and give greater autonomy to tax agencies help to reduce this constraint.

vii. Another lesson from the DDEP, it has affected and discouraged private investments depend on how government has raised fiscal revenue necessary to finance local debt-service obligations (an inflation tax and excessive government expenditure that has contributed increased the domestic inflation that also discouraged private investment). These combined effects had discouraged private investment and thus have a negative impact on national output growth.

As part of domestic debt restructuring the country has experienced debt overhang which has led to recent increase in taxes towards generating adequate revenue to settle domestic creditors, thus discouraged investments due to a sudden increase in recent taxes. Thus, the indebted country like Ghana retained only a fraction or nothing from domestic output and export revenue. This implied that accumulation of debt has hampered economic prosperity through tax disincentive. Tax disincentive denoted debt overhang has impaired investments as potential investors foresee a possible tax increase on future income in a bid to repay the borrowed funds.

Excessive taxes on production are hampering the growth and competitiveness of domestic businesses. Taxing production excessively has already affected local industries and worsening the already high unemployment situation in the country. As such, the debt overhang theory posited that borrowed funds be well invested in productive sectors capable of generating adequate revenue for repaying the debt and financing domestic investments but that is not the case of Ghana because of higher unplanned government expenditures.

In those developing economies such as Ghana with heavy indebtedness “debt overhang” was considered to have led to cause of distortion and slowing down of economic growth. Ghana’s economic growth has slowed down because it lost their pull on private investors. Additionally, servicing of debts has exhausted up so much of the Ghana’s revenue to the extent that the potential of returning to growth paths is abridged. The theory asserts that if there is a probability that Ghana’s future debt will be more than its repayment ability, then the anticipated cost of debt-servicing can depress the investment. However, the extent to which investment is discouraged by debt overhang depends on how government generates resources to finance debt service obligations.

viii. One important lesson from the post- DDEP experience has resulted in the Crowding out that seemed to be occurring as the government has been borrowing from money market rate surge from 22% per annum in 2022 to 33.7% per annum in 2023 which have affected the private sector to source funds to expand as well as grow their businesses to expand the economy. As the government continued to borrow from domestic market at higher prevailing rates between pre-DDEP era of 22% per annum and 33.7% per-annum post-DDEP period could cause a serious crowding out of the private sector which is said to be the engine of growth.

This postulated that Ghana’s economic stability could be undermined by debt burden if debt service cost weighs down excessive public expenditures. This implied that public investments are crowded-out as rising national debt obligations consume a large proportion of government revenue. The current situation where the government is currently borrowing from the short term end of money market through treasury bill rate has pushed from 22% last year to 33.7% in October,2023 thus crowded out the private sector to slow down the expansion and growth of Ghana’s economy.

As government continued to waste resources through loose public expenditures such as the government flagship program as ‘one district, one factory’, as the entire economy has faced a resource shortage, thus preventing sufficient private-sector investment. As the crowding-out mechanism has triggered, private-sector capital accumulation had been consequently become insufficient, which led to economic stagnation. A crowding-out have caused a rise in real interest rates in the post DDEP era. By the crowding-out effect, a decreased in public investments had transmitted to a reduction in private investments due to the complementarily of some private and public investments.

In as much as extreme national debt can result in liquidity constrain by crowding-out domestic investments in the debtor country; reliance on debt is a necessity for unindustrialized economies at their early stage of development since available financial resources at that phase could be inadequate to enhance the needed growth and development. The crowding out could also impact negatively on economic growth as it slowed down because Ghana has lost their pull on private investors while servicing of debts exhausts up so much of the indebted country’s revenue to the extent that the potential of returning to growth paths is abridged.

The most severe negative effects of domestic debt are, however, also channelled through the financial sector. The crowding out effect of domestic debt on private investment is a serious concern. Bank credit to the private sector has been empirically proven to be a contributor to economic growth. However, when governments borrow domestically they use up domestic private savings that would otherwise have been available for private sector lending. As increasing public financing needs push up government debt yields, this has further caused a net flow of funds out of the private sector into the public sector and this has pushed up private interest rates. In shallow financial markets, especially where domestic firms have limited access to international finance, domestic debt issuance of treasury bills could lead to both swift and severe crowding out of private lending.

In most developing countries like Ghana, only large, well established firms have access to international finance, suggesting that the burden of crowding out fell heavily on small and medium-sized enterprises and rural borrowers. The higher interest rates on treasury bills have also affected banking institutions in Ghana thus created an adverse selection problem. As interest rates rise more conservative, risk-averse borrowers shy away from the credit market. A larger proportion of the persons applying for loans are thus those who are willing to take risky bets. The likelihood of default increased and so therefore does the banks’ proportion of non-performing loans.

Philosophy behind the crowding out effects concept assumes that government debts expend a greater part of the national savings meant for investment due to increase in demand for savings while supply remains constant, the cost of money therefore increases to make it difficult for the private sector to source funds for production which is expected to be engine of growth. The long-term evidence showed that economic stability has collectively undermined by indicators of debt burden. In the short run, shortages of foreign exchange reserve, revenue inadequacy and unstable exchange rate had adverse and significant impact on real GDP growth rate. Thus, it was concluded that excessive borrowing on the money-market by the government has deprived Ghana of the revenue and reserves required to fund domestic investments and enhance economic stability

ix. One of the lessons learnt from the design of the domestic debt exchange did rely some analysis of critical issues, such as: (i) stress testing of the debt exchange to secure the integrity of the financial system but not detailed and comprehensive; (ii) bond holders’ balance sheet needs to maximize the demand for the new instruments; (iii) legal implications of the exchange, including constitutional issues matters that was addressed by Ministry of Justice and Attorney General, to minimize potential sources of contention; and (iv) potential reaction of rating agencies to minimize the international fallout from the operation.

x. Another lessons learnt from the DDEP was the burden sharing was not explicit as the government didn’t review its expenditure including some of the flagship program: There was a perception that the burden of the exchange was being shared across the society to achieve a better outcome for the country as a whole but this was not comprehensive done. This was critical for making the accompanying fiscal consolidation plan acceptable to those directly affected, including tax payers and public sector employees.

xi. One important lesson from DDEP was poor communication strategy as the participation rate was lower than envisaged (100% vs. 85%), resulting in significantly larger fiscal saving: The debt exchange was not presented as a critical component of a broad macroeconomic program (including comprehensive structural reforms) instead of a stand-alone operation. During the launching of the exchange, it was made clear that holdouts would not be allowed to gain any competitive advantage.

xii. The final lesson from the revised DDEP has revealed that the banking sector from had been the needed huge recapitalization and shifted losses to the central bank. The ability for Bank of Ghana to operate with negative equity does not imply fiscal risks are reduced when crisis interventions were undertaken on the Bank of Ghana’s balance sheet.

As the losses from the Bank of Ghana’s non-core operations were large enough that generated an overall net operating loss, they may be financed through equity buffers (where sufficient) or with government transfers, both of which imply fiscal costs. Alternatively, Bank of Ghana may operate with negative equity but finance itself through issuance of additional Bank of Ghana debt. However, this outcome could also lead to fiscal costs - for example, if it jeopardizes the central bank’s ability to achieve its core policy mandates (so-called policy insolvency).

As part of the revised DDEP policy intervention conducted on the Bank of Ghana’s balance sheet, there were strong arguments for the fiscal authority, Ministry of Finance to directly bear any associated financial risks. Governments faced incentives to let the Bank of Ghana bear the risks and costs from its domestic debt exchange policy interventions, partly due to the NPV losses in the original DDEP impact on the banking sector from GHS41.3 billion to the revised NPV losses of GHS7.3 billion where the differences were passed onto the Bank of Ghana. But when associated losses were eventuated, these impacted Bank of Ghana’s profitability and balance sheets, and in turn could jeopardize the conduct of monetary policy and undermine macro and fiscal stability.

The NPV losses of GHS 37.6 billion of revised domestic debt exchange on Bank of Ghana could impact negatively on the functioning of the central bank. Bank of Ghana may be able to continue its monetary policy and regulatory functions in spite of the debt restructuring. But Bank of Ghana’s ability to be in a position to continue its other functions, such as operating payments systems, providing emergency liquidity support for the banking system or conducting it corresponding banking operations could be compromised. Depending on its ex- ante equity position, any losses on the central bank balance sheet that may result from the DDEP would have to be addressed, including through recapitalization (Liu, Y; Savastano, M & Zettelmeyer, J. 2021).

Another finding revealed the negative effect of the revised DDEP has shifted the massive previous NPV losses (GHS41.3 billion) of the banking sector to Bank of Ghana’s NPV losses of GHS 37.6 billion, in the revised-DDEP which has thus reduced the central bank’s ability to (i) manage liquidity in the banking system through open market operations and emergency liquidity support ; (ii) define and implement collateral policy given the decline in the stock of available government securities; and (iii) hold government securities as counterpart to central bank liabilities, such as currency in circulation and commercial bank deposits with the central bank.

In the case of Bank of Ghana, a recapitalization of the central bank by the government (to compensate for the losses from haircuts on its holdings of government securities) may be unavoidable. Bank of Ghana’s liquidity facilities was designed to provide emergency support to banking institutions affected by DDEP have been key elements of the financial safety net in the recent episode.

A liquidity backstop served as a lifeline for banking institutions which might lose access to market or deposit funding. It could be especially useful for a banking system with a high degree of interconnectedness and for financial institutions which otherwise do not have access to Bank of Ghana window for liquidity support. Collateral eligibility requirements for ‘Repos’ (Repurchase Agreement) might need to be reviewed, especially as banks faced marginal haircuts on government bonds typically used as collateral for central bank operations. In countries such as Ghana where financial market is not well developed, however, the size and scope of liquidity backstop facilities would be limited.

Conclusion

Economic recovery from domestic debt exchange could be slowed down, through the debt overhang and crowding out problems accompanied a financial crisis lower country’s net worth. if the country has been carrying debt, the loss of net worth brought Ghana closer to default which has impacted negatively on country’s reputation and credibility. Domestic debt exchange has caused debt overhang which occurred as there was a significant probability that a Ghana could go bankrupt in the near future.

The debt overhang has reduced the incentives of new domestic investors to invest in business capital because, in the event of default, part of the return on new investment accrues to existing creditors. Debt overhang has also led deterioration of the fiscal outlook which has resulted to fiscal measures such as tax increases and without government spending cut which has reduced economic activity, thus lowered household and firm incomes. This has led to a deeper reduction in tax revenues and further undermined the fiscal position. Debt overhang also has decreased country’s incentives to invest their current revenue in financial assets because these assets are easier to liquidate when business conditions deteriorate and bankruptcy becomes more likely.

On both counts, the rate of investment in social infrastructure is adversely affected. Thus, debt overhang has been one of potential explanations for why domestic firms have been reluctant to expand capacity in this recovery. The macroeconomic consequence of this reluctance to invest is a slow recovery. Post- DDEP experience showed that crowding out has led to higher interest rates on banking credit facilities that has slowed down economic growth.

As the government has aggressively borrowed funds from money market (Treasury Bills market) to finance its spending, it has been competing with private borrowers for available funds. According to reports, the government has cumulatively as at 20 November, 2023, issued GHS 128.93 billion on the money market, surpassing the GHS 119.77 billion target (GCB Capital, 11/20/2023). This competition between government, banking institutions and private sectors have driven up interest rates (i.e. higher treasury bill rates), which has made it more expensive for businesses to borrow money for both working capital and expansion. Crowding-out has occurred when increased government borrowing reduces investment spending. Higher interest rates also reduced consumer spending, as people chose to save their money instead of spending it.

In the medium term, crowding out could also reduce private investment. When interest rates rise, businesses may choose to delay or cancel their investment plans. This could lead to lower levels of economic growth and fewer job opportunities. Crowding out has led to higher inflation. As the government spent more money, it increased the demand for goods and services. As the supply of goods and services did not increase to meet this demand, prices rose, leading to higher inflation over the past two years. Crowding out could also reduce long-term economic growth rate to 1.5% of GDP in 2023. According to the World Bank Ghana’s economic growth will remain depressed in 2024 at 2.8% of GDP but the economy is expected to recover to its potential growth by 2025. Bretton Wood institution posited that the economic growth rate would be held back by high and persistent inflation, lower credit as a result of elevated interest rates and weakness in the energy sector. According to the World Bank, these drivers would operate through a slowdown in the growth of household consumption and investment. As the government spent money on projects that do not generate a return on investment, such as social welfare programs, it may divert resources away from more productive uses.

This could lead to lower levels of economic growth over the long term. As the government issues more treasury bills to finance its deficit, banks shift their portfolio away from risky private loans and opt for lazy behaviour characterized by a shrinking overall credit tilted more and more toward government debt-instruments. To the extent that a slow recovery engenders pessimism, it exacerbates the crowding out and debt overhang problems in post DDEP period. It could be inferred from this study that domestic debt exchange has a negative impact on economic stability in consonance with the debt overhang, and crowding-out effects.

Thus, policymakers should ensure that public debt is used to finance high income generating investments capable of attracting adequate revenue required to amortize the debt and also create future streams of revenue that would help reduce national debt and enhance future economic growth.

The Ghana’s domestic debt restructuring was both unavoidable and partially successful in the sense of being a bit orderly, reasonably quick, and in providing significant government savings of GHC 61.7 billion at the expense of bondholders. At the same time, it has been subjected to a battery of criticisms such as lack of transparency and openness, bad faith efforts for a collaborative process to restore debt sustainability; partiality and unfair treatment across various creditors. Ghana’s domestic debt restructuring was bedeviled with poorly and untimely flow of information, lack of transparency, bad faith actions and unfair treatment of some domestic creditors. Most importantly, it was too little, too late, or both; hence failing to clearly restore Ghana’s debt sustainability. The question is whether this reflected avoidable policy mistakes or unavoidable trade-offs – in the sense that Ghana and its domestic creditors faced difficult choices, and did their best given what was feasible.

Recommendation

i. The domestic debt exchange, must be underpinned by strong fiscal consolidation, to be necessary to reverse the adverse fiscal dynamics and reduce the debt overhang and crowding out that had plagued Ghana for the past decade. These significant efforts to reduce fiscal dominance were to be aimed at encouraging private sector investment in order to catalyze the underlying conditions for robust economic growth. The experiences of many of the countries that have undertaken some form of debt restructuring suggests that the transformation to virtuous cycle of sustained macroeconomic improvement hinged strongly on a substantially improved external environment which facilitated an export‐led recovery.

Russia (1999, 2000) and Ecuador (2000), for example, benefited from the dramatic rise in oil prices following their restructuring. Similarly, Uruguay (2003) and Argentina (2001) had significant positive terms of trade windfalls arising from commodity prices with average growth rates of about 8.0 per cent between 2004 and 2008. Ukraine’s post‐crisis recovery was primarily driven by a rapid expansion in exports to Russia The x‐axes in the graphs depict quarters, where quarter 2 coincides with the debt exchanges and China as well as buoyant international liquidity conditions in 1999.

However, the global conditions to reinforce a meaningful post‐restructuring recovery did not exist at the end of both debt transactions for Ghana especially given its very narrow export base. Notwithstanding the absence of a favourable external economic climate, a depreciated but stable real exchange rate is a critical component of Ghana’s economic program which will increase profitability of the tradable sector. This boost in competitiveness is expected to catalyse strong GDP growth, reduce unemployment and strengthen the current account which should result in a more sustainable reduction in Ghana’s debt‐to‐GDP.

ii Despite its achievements, DDEP arguably did not directly address the debt overhang problem. The stock of debt and its structure continue to pose risks for fiscal sustainability and policy slippages could put Ghana right where it started before the DDEP. Ghana’s debt outlook remains vulnerable to a wide range of issues including fiscal and structural, as well as to the external factors (such as the path of the global recovery after Covid-19). DDEP did not trigger any meaningful fiscal consolidation beyond the reduction of the interest bill especially the recent rises in the Treasury Bill rates.

Instead, the sense of additional fiscal space created by lower interest bill gave way for more pressures on the public wage front in the recent 23% wage increases for the public sector, building permanent pressures into the fiscal outlook and weakening the overall/net impact of the exchange in the medium term. Another critical aspect that may have gotten worse around the timing of DDEP (having been exacerbated by the global commodity prices and its implications on the domestic economy) that could jeopardize its achievement and debt sustainability in general is the contingent liabilities. All in all, there is an urgent need to implement policies that would help restore debt sustainability and investor confidence, as well as safeguard the stability of the financial sector.

A multi-year credible fiscal adjustment framework would be required to put the debt ratio on a downward trajectory. In contrast to consolidation attempts in the past, this effort would have to be underpinned by efforts that would aim to substantially strengthen expenditure management including reduction of the government size and expand the scope of public liability management to include state owned enterprises, which have in the past had a significant drain on public resources, mostly taking place off budget. Ghana’s debt overhang is likely to be a key factor behind the weak economic growth and financial market volatility and until/unless addressed would remain a drag on economic progress for years to come.

Latest Stories

-

Today’s front pages: Friday, May 3, 2024

22 mins -

CAFCC: USM Alger file appeal at CAS to contest CAF’s decisions on RS Berkane jersey

1 hour -

Africa’s Outstanding Professional, Engr. Ebenezer Kwadjo Dankyi

1 hour -

Deloitte Ghana wins Africa ESG Company of the Year 2024

3 hours -

Medical Laboratory Professionals threaten to strike over conditions of service

5 hours -

Residents of Anloga, Keta express frustration over ECG billing

5 hours -

I don’t believe in praying in tongues – Strongman

5 hours -

‘After The floods’: VRA and GMet clash over cause of Akosombo Dam spillage disaster

5 hours -

‘After The Floods’: Victims suffer harsh conditions 6 months after Akosombo dam disaster

6 hours -

Akufo-Addo to unveil Otumfuo commemorative stamp

6 hours -

EduSpots distributes over 100 tablets and laptops to 30 community-led education spaces

6 hours -

Taxation is driving away investors – FABAG General Secretary

7 hours -

Effutu MP commissions office for Hepatitis B; absorbs cost of testing, vaccination and management

7 hours -

Bawumia pushes for land digitisation to tackle land guard menace

7 hours -

Faith-based institutions are instrumental in national development – Bawumia

7 hours