Audio By Carbonatix

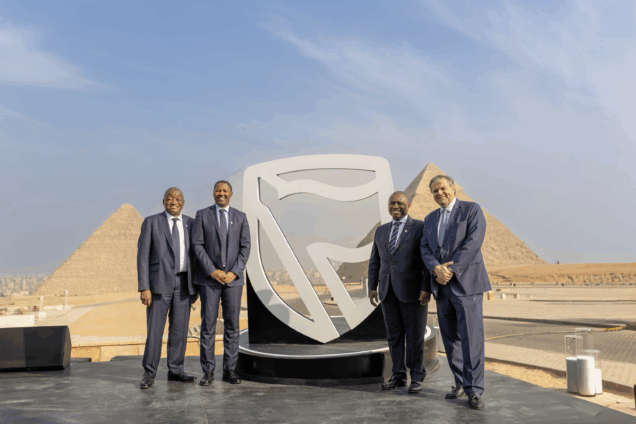

Standard Bank Group, the parent company of Stanbic Bank Ghana has announced the official launch of its Representative Office in Egypt during an event held at the Pyramids of Giza in Cairo.

The Group’s Representative Office will strengthen trade and investment flows between Egypt, Sub-Saharan Africa, and the Middle East, recognising Egypt’s role as a vital gateway in Africa's north-south trade corridor.

Sim Tshabalala, Chief Executive of Standard Bank Group, said: “This expansion reflects Standard Bank’s belief in Egypt’s growing role as an investment and logistics hub, aligned with the country’s Vision 2030 and Africa’s broader development agenda.

"Our new Representative Office will act as a vital conduit to connect Egyptian corporates, investors, and multinationals with opportunities across Standard Bank’s footprint spanning 21 countries in Africa.”

Through its Egypt office, Standard Bank aims to deepen its purpose of driving Africa’s growth by supporting Egyptian businesses expanding across the continent and enabling global multinationals to invest in Egypt’s dynamic economy.

Speaking at the launch event, Luvuyo Masinda, Chief Executive of Corporate and Investment Banking (CIB) at Standard Bank Group, said: “Through our presence in Egypt, we aim to foster stronger financial cooperation, provide on-the-ground market intelligence, and support clients seeking to expand their operations between Egypt and Sub-Saharan Africa, as well as the Group’s international offices in Dubai, Beijing, New York and London.

"This is a pivotal milestone in accelerating regional integration and unlocking continental growth through sustainable investment and expanded trade.”

Dr Rassem Zok, Chief Executive MENA and Chief Representative Officer Egypt Office, adds that: “With over 163 years of connecting Africa to global markets, Standard Bank brings a unique combination of local insight and pan-African expertise, empowering clients in Egypt to seize new opportunities while navigating the evolving regional landscape.

Standard Bank continues to play a key role in facilitating trade and investment across Africa’s fastest-growing economies, other select emerging markets, as well as pools of capital in developed markets, and our balanced portfolio of businesses provides significant opportunities for growth.

Standard Bank’s Egypt office complements its Middle East and North Africa (MENA) strategy, which began in the UAE in 1997, and has since been spearheaded by a 20-year Dubai International Finance Centre (DIFC) presence and operation.

This reinforces the Group’s position as a leading enabler in the Gulf-sub-Saharan Africa trade and investment corridor.

Latest Stories

-

Eight out of 10 cardiac hospitalisations in Ghana caused by heart failure

5 minutes -

Fisheries Commission to roll out insurance; Navy training for fishermen after sea attack

34 minutes -

Failure to appoint Defence Minister has made Ghana vulnerable to external threats – Ntim Fordjour

38 minutes -

Sanction fishermen who go beyond the demarcated fishing zones – Dr Doke

40 minutes -

Gov’t seizes 500 excavators, impounds 490 at Tema Port

46 minutes -

No ready market, no licence: Gov’t sets strict entry rules for cannabis business

1 hour -

Minority MPs demand solutions on issues confronting Ghanaians ahead of SONA

1 hour -

6,530 Delegates endorse APN’s 12-Point compact, push for visa-free Africa

1 hour -

MahamaCare to embrace natural health solutions backed by science

1 hour -

Gov’t approves payment plan for nurses and midwives’ salary arrears

1 hour -

No arrangement to send DVLA staff abroad – Foreign Affairs Ministry contradicts DVLA boss

2 hours -

US and Iran hold talks seen as crucial to prevent conflict

2 hours -

Spain to check Gibraltar arrivals under post-Brexit deal

2 hours -

Insurance cover crucial for canoe fishermen – Prof Benjamin Campion

2 hours -

Communications Minister engages GIFEC staff, pledges support for welfare and institutional growth

2 hours