Audio By Carbonatix

The strengthening cedi alone cannot bring prices down, President of the Association of Ghana Industries (AGI), Dr Kofi Nsiah-Poku, has said.

He insists that businesses are still grappling with past losses, high utility costs and fragile economic confidence.

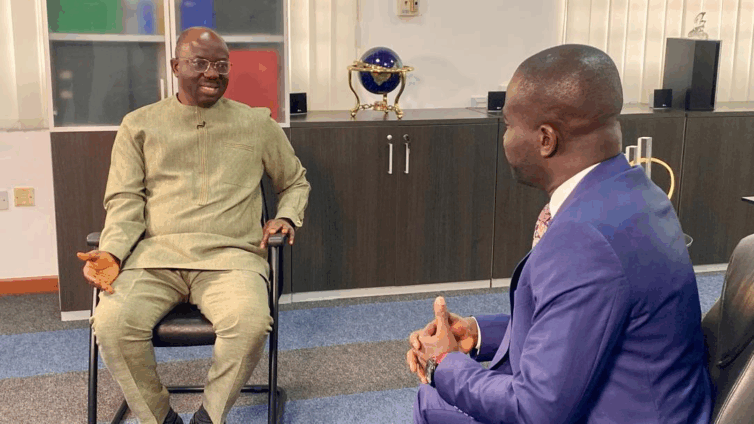

Speaking on Joy News’ PM Express Business Edition on Thursday, Dr Nsiah-Poku explained that manufacturers who suffered when the dollar surged are now trying to stabilise their books.

“At the time that the dollar was very high, I was making losses. Now that the dollar price is low, I have to recover the loss,” he said.

He noted that many consumers expect immediate price reductions because the exchange rate has improved, but the reality for industry is more complex.

“Some of the reasons why prices are not dropping as expected, even though the dollar has become very steep, is one of the reasons, but not the only reason,” he stated.

Beyond exchange rate movements, he pointed to concerns about sustainability. According to him, industry players are not fully convinced that the current economic gains are durable.

“Industry still does not think that the economy is so robust. And this is a credit economy,” he said.

Dr Nsiah-Poku explained that manufacturers often supply goods on credit and may not receive payment for months. That delay creates uncertainty.

“If I manufacture and give it to my customers on credit, and they pay me in two, three months, four months, and by that time, if the gain has reversed, what do I do?” he asked.

That risk, he said, forces businesses to act cautiously when adjusting prices.

“So we are very careful in trying to reduce the prices,” he added.

He also highlighted utility costs as a major factor keeping prices elevated. According to him, the cost of power and other services remains high, offsetting the gains from a stronger cedi.

“And also the cost of utilities is even high, even when the dollar is going down,” he said.

Dr Nsiah-Poku argued that if the exchange rate improves, utility costs should reflect that shift.

“If the dollar is going down, we expect that utility cost should also be down, because we now have a higher cost, which is balancing the gain in the exchange rate,” he explained.

His comments come at a time when many consumers are demanding price relief following the recent appreciation of the cedi.

But for industry, the equation is not straightforward. Past exchange rate losses, uncertainty about the durability of economic gains, and persistently high utility bills are combining to slow the pace of price reductions.

Latest Stories

-

Grey’s Anatomy star Eric Dane dies at 53 after ALS diagnosis

20 seconds -

Greater Accra Regional Hospital confirms assault on security officer; suspect arrested

13 minutes -

Fiifi Coleman to revive ‘I Told You So’ as stage play in March

34 minutes -

Ghana hosts high-level ministerial meeting on women and youth political participation

1 hour -

I was a top English and Fante student in secondary school – Kwaw Kese

1 hour -

UK Prisoner set to be deported to Ghana escapes police for second time in a week

1 hour -

PHDC, GNPC form new alliance to strengthen Ghana’s energy security

1 hour -

Bishops warn of deepening cocoa crisis and call for farmer relief

2 hours -

Gold Fields to hand over Damang Mine to Ghana in April 2026

2 hours -

Kweku Adu-Gyamfi Opoku’s ‘Adi Nhyia’ Book of Symbols launched in Accra

2 hours -

NLC orders striking university unions back to negotiation table

2 hours -

NPP China and Belgium branches boost Patriotic Institute with financial and training support

2 hours -

Ghana Catholic Bishops highlights moral duty to protect cocoa farmers

3 hours -

Catholic Bishops urge urgent action to rescue Ghana’s cocoa sector

3 hours -

President Mahama extends warm Ramadan wishes to Muslims

3 hours