Sale of Treasury bills post the December 7th elections was oversubscribed by 21.6%, according to auctioning results by the Bank of Ghana.

The oversubscription signifies investor interest in the domestic economy.

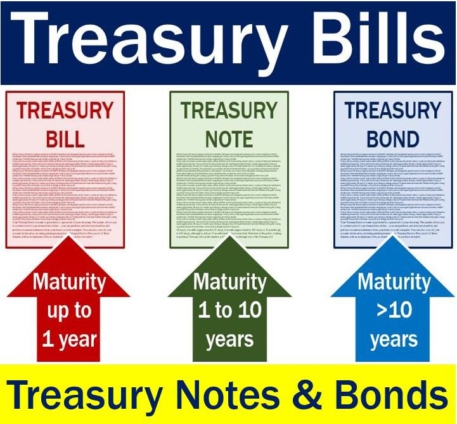

Total bids submitted for both the 91-day and 182-day Treasury bills was estimated at GH¢1.17 billion. This is against a target of GH¢925 million.

The government however accepted all the bids of GH¢1.17 billion cedis from the investors.

But, the yield on the financial instrument is still hovering around 14.07 percent though analysts had anticipated a fall in interest rates in the coming weeks because of a decline in inflation.

Demand has also exceeded supply in the almost three months auctioning of Treasury bills.

Any fall in inflation will ease cost of credit albeit marginally.

Importantly, activities in the economy are growing as aggregate demand picks up but slightly. This could reflect in the third and fourth quarter Gross Domestic Product figures to be released by the Ghana Statistical Service.

Some analysts have attributed improved economic activities to payment of locked-up funds of customers of defunct fund management firms and further easing in covid-19 restrictions.

Interest rate ease on short-end of market

Interest rate trends on the money market reflected mixed developments as yields on the short to medium term instruments eased, but broadly tightened at the longer end, the Bank of Ghana said in its Monetary Policy Report.

On a year-on-year basis, the 91-day Treasury bill rate declined to about 14.1% in October 2020 from 14.7% a year ago.

Similarly, the interest rate on the 182-day instrument declined to 14.1% from 15.1%.

With the exception of the 6-year bond, yields on the 7-year, 10-year, 15- year, and 20-year bonds all increased.

Latest Stories

-

Sons shouldn’t be mothers’ emotional support system – Ethel Adjololo

13 mins -

Family threatens to take on Trinity Hospital over missing corpse

19 mins -

Kofi Kinaata unfazed by death prophecies

24 mins -

Jospong Group partners Komptech to train over 600 stakeholders on integrated solid waste management

31 mins -

Two East Africans charged in UK migrant deaths investigation

37 mins -

DR Congo legal warning to Apple is ‘first move’ – lawyer

47 mins -

Question Time: Did policing minister confuse Rwanda and Congo?

50 mins -

We need better sets for theatre productions – Omar Sherrif Captan

56 mins -

KPMG report on SML must be published and laid in Parliament – Isaac Adongo to Akufo-Addo

59 mins -

Rainstorm causes havoc in Anloga District

1 hour -

Akufo-Addo nominates new MCE for Krachi East Municipal Assembly

1 hour -

Sunyani Technical University refutes sex-for-grades claim, describes allegation as baseless

1 hour -

I’ll win TGMA Artiste of the Year at the right time – Kofi Kinaata

2 hours -

Meet Fred Amugi’s 100-year-old mother

2 hours -

Nkomor Ghana pilots Medicine Delivery Service at the Ghana Autism Conference

2 hours