Audio By Carbonatix

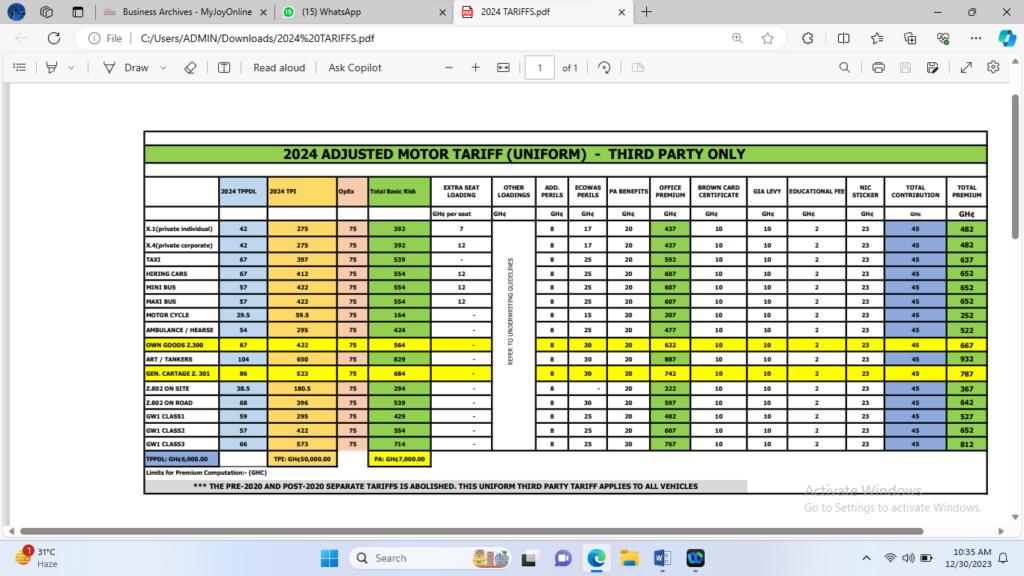

Third party insurance premiums are set to go up from January 1, 2024.

This was after the insurance companies secured approval from the National Insurance Commission to carry out these adjustments.

Private vehicles are therefore expected to pay ¢482 for third-party insurance, whilst commercial taxis will pay ¢437.

On the other hand, private corporate will be charged ¢482, while hiring vehicles will pay ¢652. Motor cycles are also expected to pay ¢252.

Complying with new tariffs and possible sanctions

A letter to the insurance companies from the Ghana Insurers Association sighted by Joy Business, advised members to strictly comply with the approved rates, as failure will attract the needed sanctions from the NIC.

The NIC also told Joy Business it is closely monitoring the new tariffs to see whether it’s in line with what have been approved.

It added it will not hesitate to sanction companies that fail to apply the approved tariffs.

The Ghana Insurers Association also advised its members there will no longer be accepting the pre and post 2020 tariffs.

Joy Business further understands that the capacity implication of ¢3000 and ¢5000 have been removed and will not make an impact on the premium collections.

Reasons behind increment

The Ghana Insurers Association in a letter to the insurance companies said the increment would help improve the financial position of the insurance companies to promote payment of legitimate claims.

Third-party insurance premium increase and VAT impact on non-life insurance products

Joy Business understands that the third party insurance premium increase did not factor in the Value Added Tax (VAT) Amendment Bill passed by Parliament last week, which may impose 21.9% VAT on all non-life insurance products. This will have resulted in insurance premiums going by more than 30%.

The Ghana Revenue Authority has yet to communicate to the public the date for implementing the five tax bills. However, the insurance companies have gone ahead to carry out these adjustments, minus the 21.9% application of the VAT on the non-life insurance products and business.

This could mean that when the GRA starts with the implementation of the VAT Amendment Bill , insurance premiums could go up again .

Latest Stories

-

Waiting in the Ring: life inside Bukom’s halted boxing scene

14 minutes -

Ofori-Atta saga: Red Notice ends after arrest – OSP official clarifies

59 minutes -

Health Minister to chair probe into ‘No Bed Syndrome’ death; promises system overhaul

2 hours -

Prime Insight to tackle ‘galamsey tax’ debate, cocoa reforms and Ayawaso East fallout this Saturday

2 hours -

Cocoa crisis, galamsey complicity and election credibility to dominate this Saturday’s Newsfile

3 hours -

INTERPOL deletes Red Notice for Ofori-Atta as extradition process continues — OSP confirms

3 hours -

MasterMinds resources positions itself as key player in skills development and workforce training

5 hours -

INTERPOL has deleted Ofori-Atta’s Red Notice – Lawyers

5 hours -

Steven Spielberg donates $25,000 to James Van Der Beek’s $2m GoFundMe

5 hours -

Six possible effects of Trump’s climate policy change

6 hours -

Booming Indicators, Dying Rivers: Ghana under Chronic Environmental Poisoning

6 hours -

World’s rules-based order ‘no longer exists’, Germany’s Merz warns

6 hours -

The Accra Mandate: Securing Africa’s AI Future through Local Data and Ethical Governance

6 hours -

Aquafresh donates to National Chief Imam ahead of Ramadan

7 hours -

Adopt a mix of bond and short-term finance to address financing challenges in cocoa industry – Professor Peprah to government

7 hours