Audio By Carbonatix

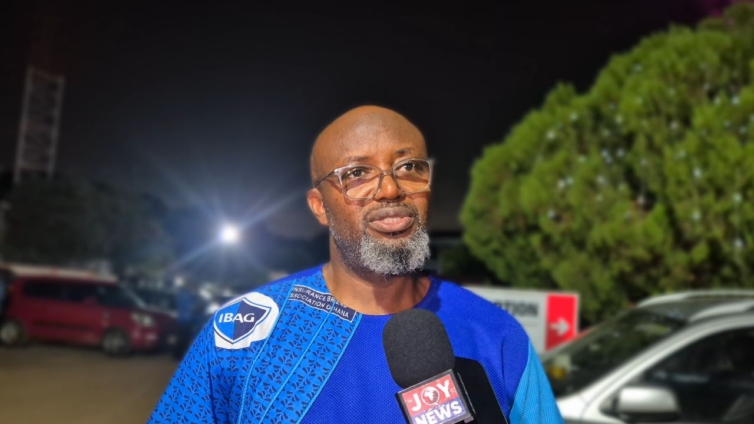

The outgoing President of the Insurance Brokers Association of Ghana (IBAG), Shaibu Ali, says the introduction of Value Added Tax (VAT) on non-life insurance premiums significantly slowed policy uptake in 2025, dealing a major blow to brokers and the wider insurance industry.

“With the introduction of the VAT on insurance, it affected the policies that people took. It slowed things down significantly. For most brokers, the numbers show a real impact,” he said.

Speaking during IBAG’s 12th Annual General Meeting (AGM), Mr. Ali described the past year as “topsy-turvy,” noting that the 15% VAT which effectively pushed insurance costs to about 22% came at a time when many businesses and individuals had already finalized their budgets.

The VAT on non-life insurance premiums took effect on July 1, 2025, under the Value Added Tax (Amendment) Act, 2023 (Act 1107), as part of government efforts to expand the tax base and raise domestic revenue.

According to Mr. Ali, while the policy may have fiscal benefits for the state, its timing posed challenges for the industry.

“It came at a time when people had already done their budgets. That made the increase feel even heavier. We are hopeful that by 2026, things will begin to pick up,” he added.

Trust Still a Major Hurdle

Beyond taxation, Mr. Ali identified lingering public mistrust as one of the insurance sector’s biggest challenges, even though he insists the industry has made significant progress over the years.

He rejected the long-held perception that insurance companies deliberately refuse to pay valid claims, describing it as a narrative rooted more in the past than current realities.

“People are still living in the past. The era when insurers could simply bluff and refuse to pay claims is largely gone,” he said.

Mr. Ali pointed to stronger regulation by the National Insurance Commission (NIC), the existence of complaints mechanisms, and the role of insurance brokers as safeguards for policyholders.

“If an insurance company refuses to pay a valid claim today and the case is right, the NIC will compel them to pay. Even the Ghana Insurance Association has a complaints bureau that investigates such cases,” he explained.

He stressed that insurance brokers serve as a critical layer of protection for customers, arguing that brokers possess the same technical knowledge as insurance company staff and are better positioned to protect clients’ interests.

“Everything an insurance company employee knows, a broker knows. We went to the same classrooms, wrote the same exams. The difference is that brokers checkmate insurers to ensure policies are right and claims are honoured,” he said.

Industry Gains Despite Headwinds

Despite the challenges, Mr. Ali said IBAG recorded notable gains during his tenure. Membership of the association grew from 84 in 2022 to 114 in 2025, while youth participation increased through mentorship programmes, media engagement, and professional development initiatives.

IBAG also expanded its international footprint through participation in major conferences, including the African Insurance Organization (AIO) Conference in Ethiopia and the British Insurance Brokers’ Association (BIBA) Conference in the United Kingdom.

Financially, the association recorded improved performance, with revenue rising from GH¢6.1 million in 2023 to GH¢6.8 million in 2024, while total assets increased to over GH¢12 million.

New Leadership Elected

At the AGM held on December 12, IBAG also conducted elections to usher in a new executive council.

Stephen Kwarteng Yeboah was elected President with unanimous support, polling all 58 valid votes cast. Bianca Noshie was elected Vice President, while Philip Atinga secured the Treasurer position.

Other elected officers include Kofi Akoto as General Secretary, Shiela Wristberg as Assistant Secretary, and Leticia Baidoo as Assistant Treasurer.

As he hands over leadership, Mr. Ali expressed optimism about the future of the insurance broking industry, urging the public to move beyond outdated perceptions and engage insurance through licensed brokers.

“We are making headway as an industry. The challenge now is changing mindsets and helping people understand that insurance done right works,” he said.

Latest Stories

-

NAIMOS has failed in galamsey fight; it’s time for a state of emergency – DYMOG to President Mahama

25 minutes -

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

30 minutes -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

45 minutes -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

1 hour -

Police conduct show of force exercise ahead of Ayawaso East by-election

3 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

3 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

3 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

3 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

4 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

4 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

4 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

4 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

5 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

5 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

5 hours