Audio By Carbonatix

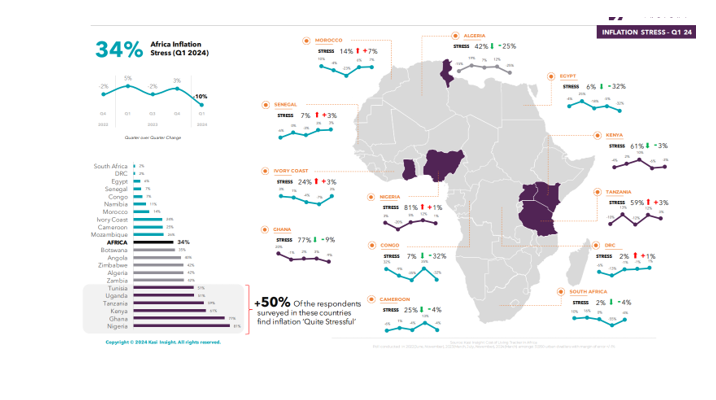

Seventy seven percent of Ghanaians are reporting a significant stress on their livelihood due to the rising costs of living, the impact on their daily life and consumer behavior.

This is according to a recent data from Maverick Research and Kasi Insights which revealed a troubling picture for consumers and the Fast-Moving Consumer Goods (FMCG) industry.

This statistic underscores the severe strain that inflation is placing on households, eroding purchasing power and compelling difficult choices in spending.

“The new data indicate that Ghana and Nigeria are at the forefront of this economic stress. With a staggering 81% of respondents in Nigeria and 77% in Ghana reporting significant stress due to rising costs of living, the impact on daily life and consumer behavior is profound. This statistic underscores the severe strain that inflation is placing on households, eroding purchasing power and compelling difficult choices in spending”.

Economic Strain and Consumer Behavior

The report revealed that the consumer feedback collected since the beginning of the year highlights a palpable anxiety among retail owners and clients, now quantified by this recent research.

“The financial squeeze is not merely anecdotal but a widespread reality affecting a vast majority of the population. In Ghana and Nigeria, where inflation rates are particularly high, the stress manifests in reduced disposable income and altered consumption patterns. Consumers are forced to prioritize essentials, often cutting back on non-essential goods and services”, it mentioned.

“This shift in consumer behavior has significant implications for the FMCG industry. Companies operating within this sector are finding it increasingly challenging to maintain sales volumes and profitability”, it added.

The report continued that the strain on household budgets means that brands must innovate to remain relevant and accessible to their customers, adding, pricing strategies, product sizes, and promotional tactics are all under scrutiny as businesses seek to align with the new economic realities faced by their consumers.

The Regional Perspective

Beyond Ghana and Nigeria, the stress of inflation is felt to varying degrees across other African nations.

In Kenya, the report said 61% of respondents report high stress levels, while in Tanzania, the figure stands at 59%. These numbers, though slightly lower, still reflect a significant portion of the population grappling with economic pressures.

Countries like Tunisia and Uganda show similar trends, with over half of their populations reporting substantial stress.

Interestingly, the data revealed that regions less impacted by extreme inflationary pressures, such as South Africa and Egypt, report relatively lower stress levels at 2% and 7%, respectively. This disparity highlights the uneven economic landscape of the continent, where some nations are more resilient or perhaps have better mechanisms to manage inflation and its impacts.

Latest Stories

-

Paediatric Society of Ghana pens open letter to President Mahama on galamsey effects on Children

16 minutes -

Minimie Atsomo launches “Laugh It Off” creator challenge to celebrate Ghanaian humour and creativity

28 minutes -

Middle East crisis: Ablakwa assures all Ghanaians will be supported

33 minutes -

Voting underway in Ayawaso East as over 49,000 voters head to polls across 113 centres

43 minutes -

Bond market: Turnover rose by 43% to GH¢2.98bn

43 minutes -

Banks wrote off GH¢1.64 billion in 2025, NPL stock hits GH¢21.0 billion – BoG

48 minutes -

Let’s brace ourselves for Middle East war fallout—President Mahama to African leaders

48 minutes -

China removes three retired generals from national advisory body

50 minutes -

Andre Ayew’s 2026 World Cup inclusion won’t surprise me – Kofi Adams

51 minutes -

World Sustainability Organization launches Friend of the Earth sustainable packaging certification in Ghana

1 hour -

14-year-old boy seriously injured following alleged abuse in Ashanti Region

1 hour -

Nana Agradaa walks free from prison after release

1 hour -

Man arrested for alleged assault after accident at Maamobi

1 hour -

Government urged to review compensation fund to support vulnerable accident victims

1 hour -

Photos: Hasaacas Ladies beat Army Ladies to go top of WPL table

1 hour