Audio By Carbonatix

The owner of British Airways (BA) has joined rivals by announcing significant cuts to flight schedules, blaming a "levelling off" in passenger demand.

International Airlines Group (IAG), which counts Aer Lingus and Iberia among its brands, also confirmed progress in BA's union negotiations over changes to pay and conditions for cabin crew as the airline cuts thousands of jobs to save costs.

It said the UK airline had reached an agreement in principle with Unite, but revealed up to 13,000 people were on course to leave BA in total - with 8,236 having already departed "mostly as a result of voluntary redundancy".

Analysis by Sky News has aviation, as a sector, currently worst affected in the crisis for jobs - with BA's plans affecting the most people in a single company.

IAG said coronavirus travel restrictions and quarantine requirements had taken a toll on group bookings - dashing hopes of a steady recovery from the depths of the COVID-19 crisis.

The company previously stated that it hoped to operate 54% of its normal services between October and December.

But it revealed on Thursday that the figure was now tipped to be closer to 40% following an "overall levelling off of bookings" since July, when it restarted the majority of its services following a leap in lockdown-ending sales.

IAG said demand for short-haul travel had "fallen slightly" following the UK and other European countries reimposing quarantine requirements for travellers returning from specific countries.

The company's decision to scrap flights mirrors recent announcements by EasyJet and Ryanair, which have experienced similar falls in future booking volumes because of the uncertainty.

The sector has called for air passenger duty to be slashed and airport testing regimes to limit quarantine durations to help bolster confidence in flying.

IAG gave its progress report in an update for investors on its capital-raising plans - first revealed in July - aimed at shoring up its balance sheet during the current turbulence.

It said it was aiming to secure €2.7bn (£2.5bn) through the sale of new shares at a discounted rate.

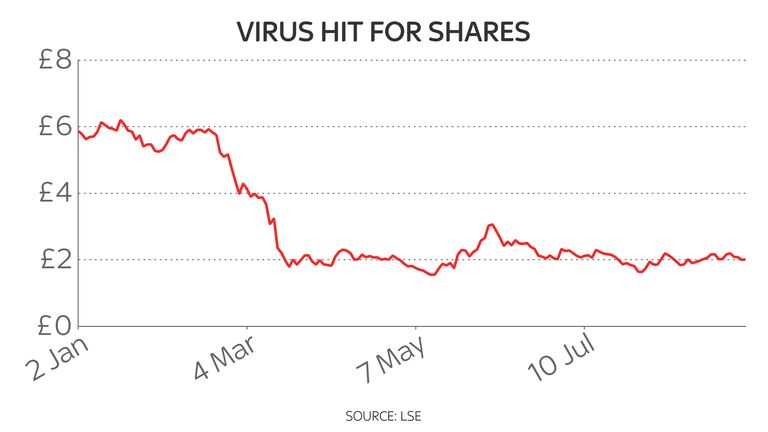

IAG's market value has taken a hit of almost 70% in the year to date.

Latest Stories

-

‘Why not cut COCOBOD staff salaries too?’ — Nana Aduna II questions fairness of cocoa price reduction

8 minutes -

Government to restructure COCOBOD’s GH¢5.8bn debt, tighten oversight

14 minutes -

JOY FM rolls out “Safari Experience” — a refreshing Ghana Month escape into nature, culture and connection

2 hours -

Ghana loses over GH¢4.5bn annually to traffic congestion, new study on urban mobility shows

2 hours -

ADB unveils new corporate cloth, determines to dominate industry

2 hours -

Peak Milk extends Ramadan support following courtesy visit to national Chief Imam

2 hours -

No solo bid for Ken Agyapong — Joojo Rocky Obeng dismisses ‘third force’ calls as politically ridiculous

2 hours -

Today’s Front pages: Friday, February 13, 2026

3 hours -

5 arrested for open defecation at Osu Cemetery

3 hours -

A Home that Travels: How the Diaspora carries Pan-Africanism across borders

3 hours -

Obituary: Hon. Stanley Basil Bade Carboo

3 hours -

Government to absorb COCOBOD’s $150m losses as Cabinet directs immediate cocoa purchases – Finance Ministry

4 hours -

Mpraeso MP demands immediate probe and arrest over alleged exploitation of young Ghanaian women

4 hours -

‘No bed syndrome,’ and how a hit-and-run victim was refused emergency care by Ridge, Police, Korle Bu hospitals for close to 3 hours before he died

4 hours -

Give Love a second chance on Valentine’s Day – Counsellor Perfect

4 hours