Audio By Carbonatix

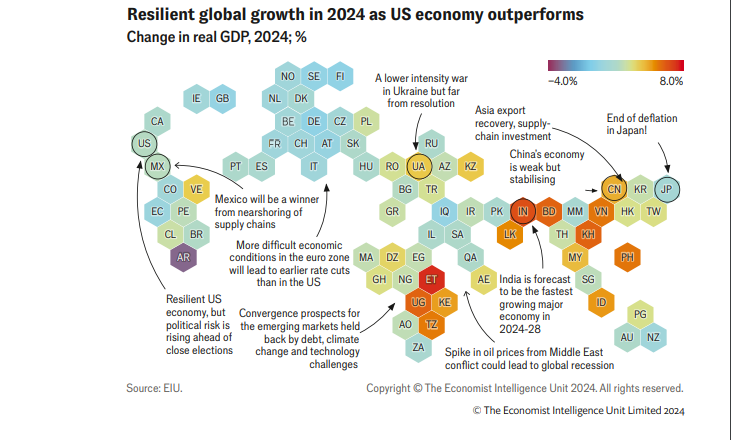

The Economist Intelligence Unit (EIU) has revised its global real Gross Domestic Product (GDP) growth in 2024 to 2.5% from 2.4%.

This means growth will be unchanged rather than slowing from 2023.

“Growth is proving surprisingly resilient in the face of high interest rates and geopolitical risks”, the London-based firm said in its global outlook.

The change in global growth it said reflects another upward revision for US growth in 2024 to 2.2% from 2% previously, upward revisions for several European economies that have pushed euro area growth to 1% from 0.8% and an upward revision for Brazil to 2.1% from 1.8%.

“We have reduced our expectations for future monetary policy loosening, removing one 25-basis point cut from the loosening cycles of both the Federal Reserve (the US central bank) and the European Central Bank in 2024-25. In contrast, we now expect the Bank of England (the UK central bank) to cut quicker than previously forecast, lowering its rate to 3.5% by end-2025 (compared with 4.25% previously)”.

Geopolitics will lead to reconfigurations in global economy

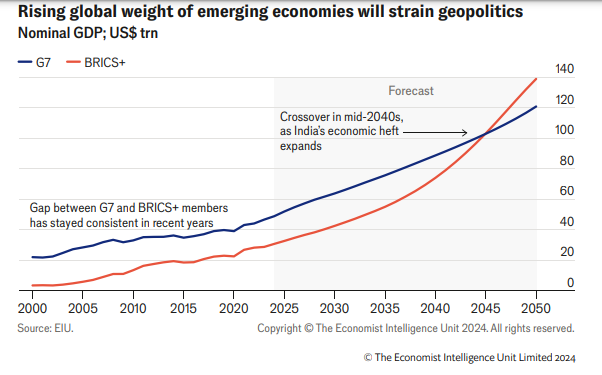

The EIU forecasts more fragmentation and regionalisation in the world economy in 2024-28 as alliances tighten and competing blocs form.

The return of industrial policy, including sanctions and the provision of new incentives, will push firms to adopt more inefficient supply chains, stoke trade tensions in strategic sectors and make it difficult to compete across the global marketplace.

These developments, it said, will drag on growth potential.

“We expect that global real GDP will expand by 2.8% a year on average over the next five years—below the 3% of the 2010s, which was hardly a stellar decade for the global economy.

Immediate growth outlook is fairly rosy

In the near term, however, the EIU, said global economy is showing resilience in the face of international conflict and higher interest rates.

This mainly reflects the remarkable strength of the US economy, which is driven by strong household finances, a rising trend in manufacturing investment and a booming technology sector.

Elsewhere, it said the picture is less dynamic but short of a downturn.

Momentum in Europe will build gradually in 2024. Modest government stimulus in China is helping the economy to emerge from a property-related slump.

Emerging markets will benefit from a rebound in global trade and firm commodities demand, even though they will face challenges from a strong US dollar and high debt-servicing costs.

Latest Stories

-

Keta MP lays mother to rest

23 minutes -

We must put an end to cocoa politics – Victoria Bright

47 minutes -

There is a cabal in electricity sector determined to rip off Ghanaians – Prof Agyemang-Duah

59 minutes -

NSA pays January 2026 allowance to National Service Personnel

1 hour -

24-Hour Economy not just talk — Edudzi Tamakloe confirms sector-level implementation

2 hours -

Four arrested over robbery attack on okada rider at Fomena

2 hours -

NDC gov’t refusing to take responsibility for anything that affects Ghanaians – Miracles Aboagye

2 hours -

Parental Presence, Not Just Provision: Why active involvement in children’s education matters

2 hours -

24-Hour economy policy fails to create promised jobs – Dennis Miracles Aboagye

3 hours -

Ghana Embassy in Doha urges nationals to take shelter after missile attack

3 hours -

Government’s macroeconomic stability commendable, but we need focus on SME growth – Victoria Bright

3 hours -

Macro stability won’t matter without food self-sufficiency- Prof. Agyeman-Duah

3 hours -

How Virtual Security Africa is strengthening safety at Mamprobi Polyclinic

3 hours -

Ghana on right track macroeconomically, but structural gaps remain – Fred Dzanku

4 hours -

ADB MD honoured for impactful leadership at PMI Ghana engagement

4 hours