Audio By Carbonatix

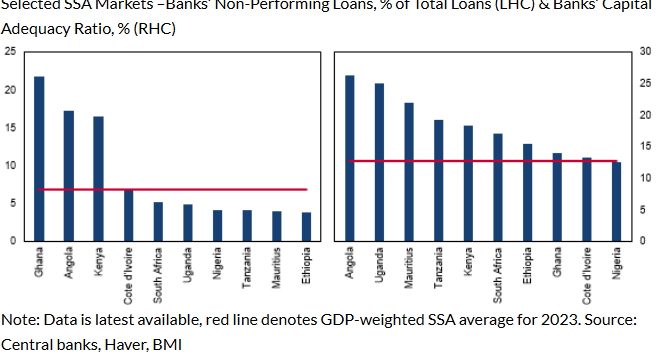

Ghana’s banking sector is particularly vulnerable, with a high non-performing loan (NPL) ratio of 21.8% and a Capital Adequacy Ratio (CAR) of 14.0%.

According to Fitch Solutions, this is a result of the domestic debt exchange programme (DDEP) and high interest rates.

In its paper titled “US Tariffs Increase Risks for SSA Banks”, Ghana has the highest NPLs among the 10 top Sub-Saharan Africa countries, whilst its CAR is the third weakest.

Despite upcoming challenges, it however said SSA banks are generally well-positioned, supported by robust capital adequacy ratios (CAR) and decent loan quality.

“We anticipate improvements in most sectors’ capital, driven by regulatory enhancements in markets such as Nigeria and Kenya, alongside improving economic conditions in most markets.”

“Our core view remains that interest rates will fall in 2025 for most markets, which will help improve loan quality. Very high profits following steep interest rate hikes in recent years will also provide banks a sufficient reserve for 2025”, it mentioned.

Monetary Policy Expectations to Impact Banks’ Profits

It continued that US tariffs will impact SSA banks in relation to monetary policy, and thus expect banks to face increased uncertainty as policy expectations shift.

“If interest rates remain elevated for longer than we currently expect, this could adversely impact loan quality and growth, potentially deterring credit extension if consumers and businesses remain uncertain about interest rates”. While higher interest margins – which currently exceed 50% in all the largest SSA banking sectors aside from Nigeria– could bolster profits, this effect, it said, may be offset by weaker loan growth and increased provisioning for higher NPLs.

Conversely, a quicker-than-expected decline in interest rates, following economic growth concerns, would reverse these effects.

Fitch Solutions added that his uncertainty complicates strategic planning for banks in the region, affecting loan quality risks, lending activity, income from interest and fees and commissions.

Latest Stories

-

NPP presidential primaries tougher than 2024 polls – Hassan Tampuli

47 seconds -

Ghana’s petroleum revenue dips to $399.6m in second half of 2025 – BoG

14 minutes -

World Bank loan to boost food security and transform agriculture – Ato Forson

19 minutes -

Telecel Group and King’s Trust International partner to support digital skills for young people in Ghana

21 minutes -

NPP primaries a victory for entire party, says Hassan Tampuli

24 minutes -

Drivers arrested for carrying suspected narcotic drugs

28 minutes -

I’m going to be very open-minded to everyone, including those who insulted me – Bawumia

30 minutes -

Oti Region’s healthcare challenges persist, says Health Minister

35 minutes -

TMPC cracks down on unlicensed herbal operators in Madina, Ashaiman

43 minutes -

Bawumia’s primary victory shows nationwide appeal – Tampuli

48 minutes -

No 95% landslide ensures humility, no arrogance – Oppong Nkrumah defends competitive leadership

53 minutes -

Police gun down suspected highway robber

53 minutes -

Police arrest suspect over inciteful commentary

57 minutes -

Parliament reconvenes today

1 hour -

NPP grassroots ready to unite, but leaders divided – Pollster Mussa Dankwa

1 hour