Audio By Carbonatix

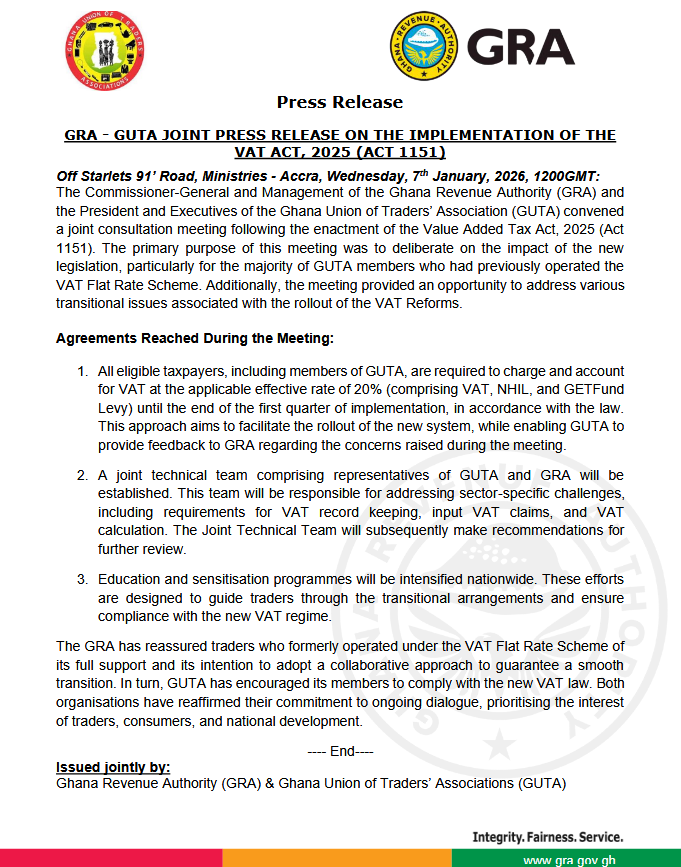

The Ghana Revenue Authority (GRA) and the Ghana Union of Traders’ Associations (GUTA) have reached key agreements to ensure a smooth transition to the newly enacted Value Added Tax Act, 2025 (Act 1151).

This follows a joint consultation meeting held on Wednesday, January 7, 2026, aimed at addressing the concerns of traders, particularly those previously operating under the VAT Flat Rate Scheme.

Under the new arrangements, all eligible taxpayers, including GUTA members, will charge and account for VAT at the applicable effective rate of 20%, comprising VAT, National Health Insurance Levy (NHIL), and GETFund Levy, until the end of the first quarter of implementation.

This interim measure is intended to facilitate the rollout of the new system while allowing GUTA to provide feedback to the GRA on practical challenges faced by traders.

To address sector-specific issues, a joint technical team comprising representatives from both GRA and GUTA will be established. This team will focus on challenges related to VAT record-keeping, input VAT claims, and VAT calculations, and will make recommendations for further review.

In addition, nationwide education and sensitization programs will be intensified to guide traders through the transitional process and ensure widespread compliance with the new VAT regime.

The GRA has pledged its full support to traders moving away from the Flat Rate Scheme, emphasizing a collaborative approach to implementation. GUTA, in turn, has urged its members to adhere to the new law.

Both organizations reaffirmed their commitment to continued dialogue, prioritizing the interests of traders, consumers, and national development.

Latest Stories

-

Do not despair, perseverance led to my three PhDs – TTU registrar urges all

38 minutes -

Alisson injury not ‘a big thing’ despite missing Galatasaray

3 hours -

Scholes ‘did not intend to be offensive’ to Carrick

4 hours -

23 players sent off after mass brawl in Brazil

4 hours -

Court remands pastor over alleged child abuse images

4 hours -

Anthropic sues US government for calling it a risk

4 hours -

Live Nation reaches settlement in US monopoly case

4 hours -

G7 to take ‘necessary measures’ to support energy supplies

4 hours -

Star Assurance rewards 10 more customers in grand finale draw of “40 Reasons to Smile” promo

4 hours -

Guinea opposition leader urges ‘direct resistance’ after 40 parties dissolved

4 hours -

Suhum MP calls for sincere dialogue on labour issues, warns against politicisation

5 hours -

We have instituted measures to diversify our reserves – BoG Governor

5 hours -

Ban on pay-TV services at the Presidency in force; my office is the only place with DSTV – Kwakye Ofosu

5 hours -

Fuel prices could hit GH¢17 if the Middle East crisis persists – COMAC

5 hours -

Cedi records modest appreciation on improved liquidity, but external risks linger

5 hours