Audio By Carbonatix

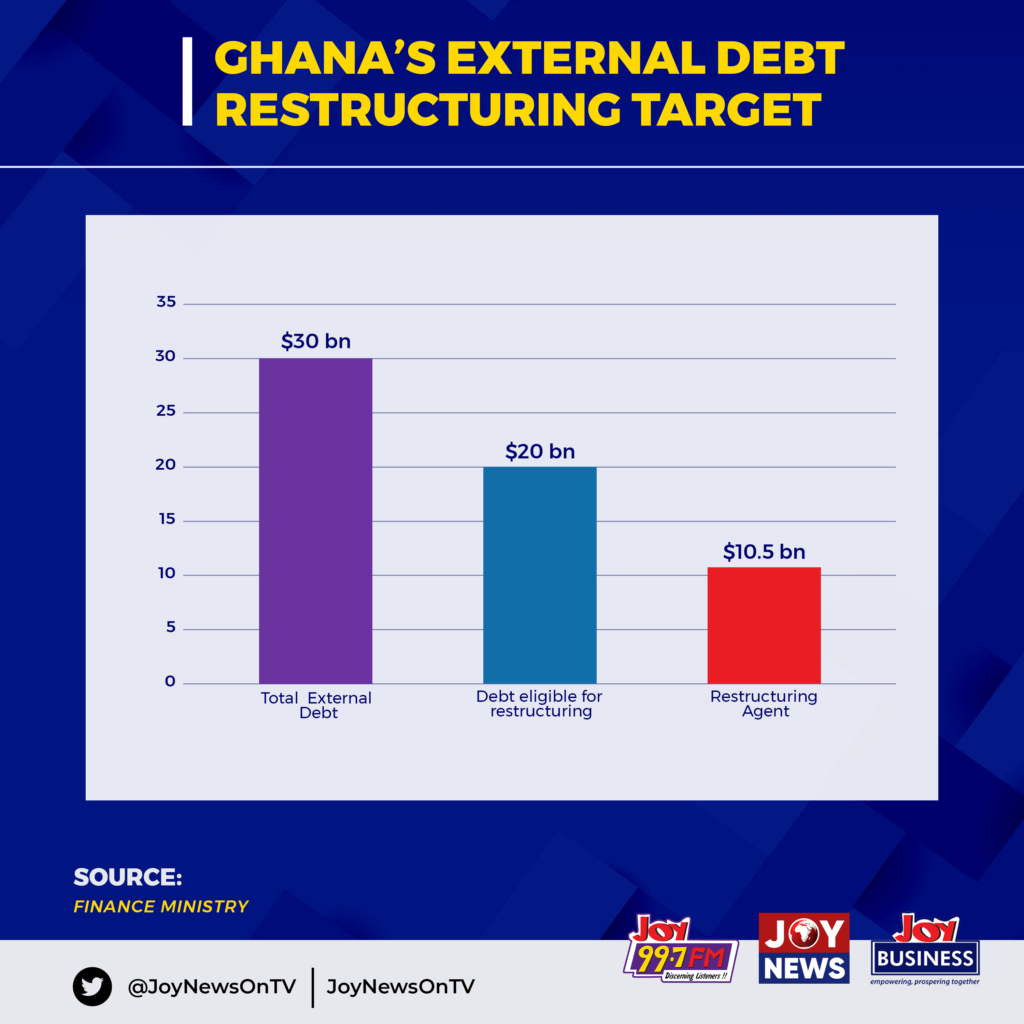

Ghana is currently working hard to reduce its external debt stock by some $10.5 billion. To obtain this debt relief, the country has identified bonds worth $20 billion that are eligible for restructuring. This is to help trim Ghana’s total debt portfolio to a sustainable level and alleviate balance of payment pressures in both the medium and short term.

Ghana's external debt restructuring target

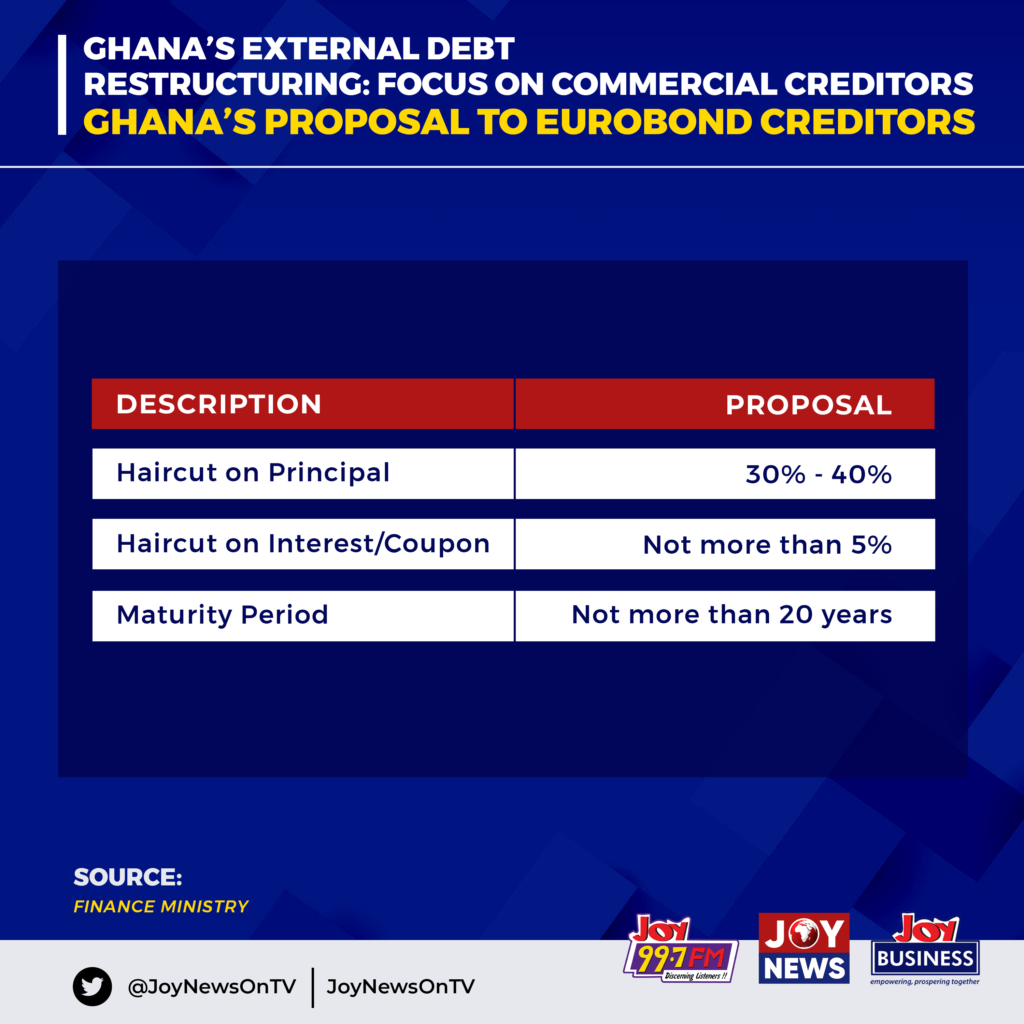

A significant part of Ghana's debt relief is expected to come from its commercial creditors (Eurobonds especially). However, the nation faces a monumental challenge as it navigates the intricate process of negotiating debt restructuring with external commercial creditors.

A recent update by the Finance Minister, Ken Ofori-Atta indicates that Ghana has pinpointed bonds amounting to $14.6 billion in the external commercial sector as eligible for restructuring and has boldly tabled a proposal which contains a 30 to 40 percent haircut on principal.

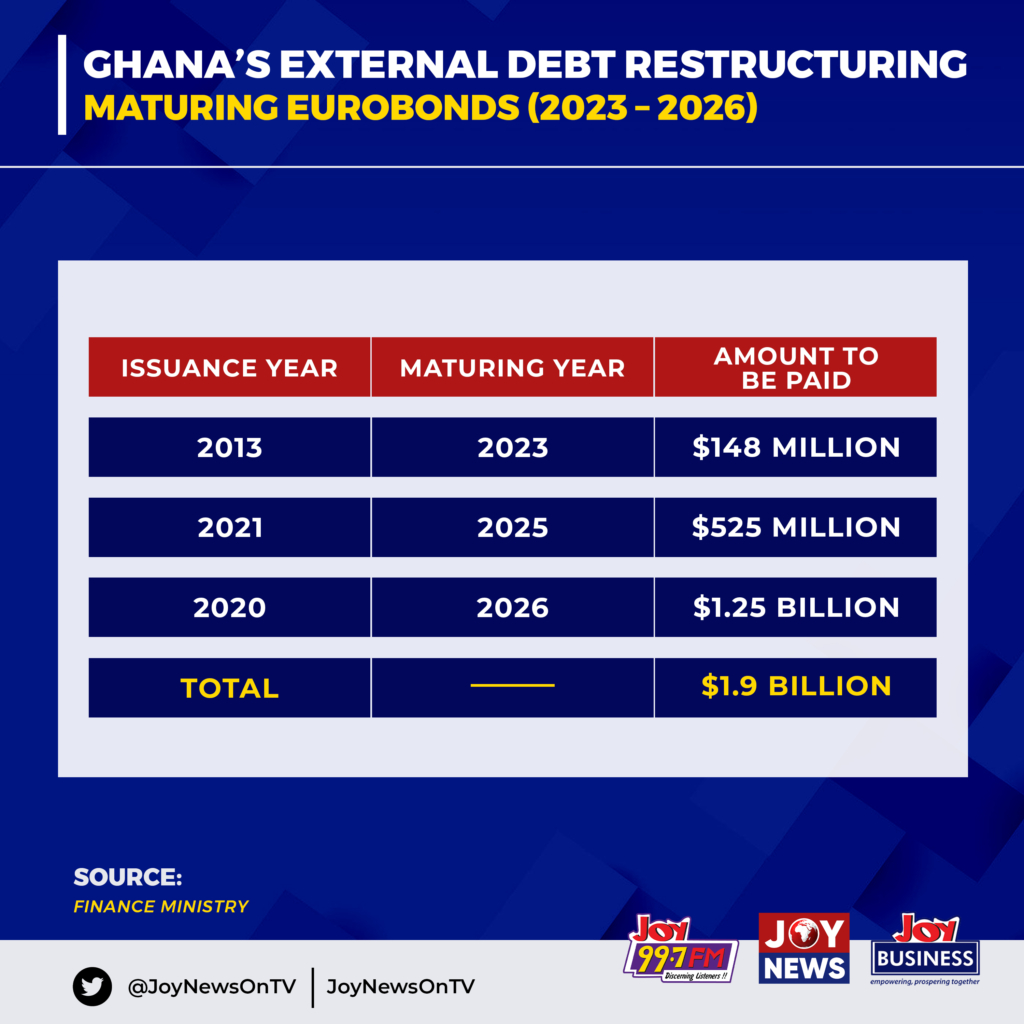

The West African nation's sovereign dollar bonds experienced a significant decline on Tuesday, following the government's announcement of its request for a percentage write-off on the principal and interest of its Eurobonds. The reaction in the bonds market was swift, leading to some bonds reaching their lowest levels in three months. The Black Star of Africa is expected to service maturing Eurobonds worth $1.9 billion (2023-2026) which is 60% of the total IMF bailout package. Projected interest payments on foreign loans crossed $3 billion this year.

In fact, Ghana's journey towards external debt restructuring is riddled with challenges and complexities. The negotiation process involves delicate diplomacy and strategic financial planning. The government's proposal to secure a significant reduction in principal and interest payments is essential to alleviate the country's economic burden. However, this pursuit is met with scepticism and potential opposition from creditors. Balancing the necessity of debt relief with the concerns of creditors who may be wary of financial losses poses a significant hurdle.

Latest Stories

-

From Young Nurse to Hypertension Champion: Betty Twumasi Ankrah’s Journey

47 minutes -

Ghana to mark Africa Safer Internet Day on February 10

1 hour -

‘A Tax For Galamsey’: Dr Manteaw warns NDC against shielding ‘galamsey’ DCEs

3 hours -

When a TV is not a vote but the Gospel according to the television set

3 hours -

Ghana can significantly expand domestic revenue without raising tax rates -UGBS Finance Professor

3 hours -

Policeman killed in bloody robbery on Zebilla–Widnaba road

3 hours -

Cedi under seasonal pressure as Q1 demand intensifies; one dollar equals GH¢11.80 at forex bureaus

3 hours -

Roads Minister rejects Minority’s claim of downgrading Suame Interchange Project

3 hours -

Eco-Africa Network demands dismissal of culpable officials in explosive JoyNews exposé

4 hours -

Ayawaso East vote-buying: Party will take decision after committee findings – NDC

4 hours -

Ayawaso Zongo Chiefs warn of possible chaos if NDC annuls disputed primary

4 hours -

I didn’t see failure as an option: Chicago Fire forward Shokalook

4 hours -

TI-Ghana condemns alleged vote-buying in Ayawaso East NDC primary

4 hours -

Karim Zito resigns as Asante Kotoko head coach following MTN FA Cup elimination

4 hours -

“Is your cell phone bugged?” Why privacy may be an Illusion in the age of smart devices

5 hours