Audio By Carbonatix

The Ghana Revenue Authority (GRA) seems to be preparing the grounds for the implementation of the yet-to-be-approved Electronic Transfer Levy (E-Levy).

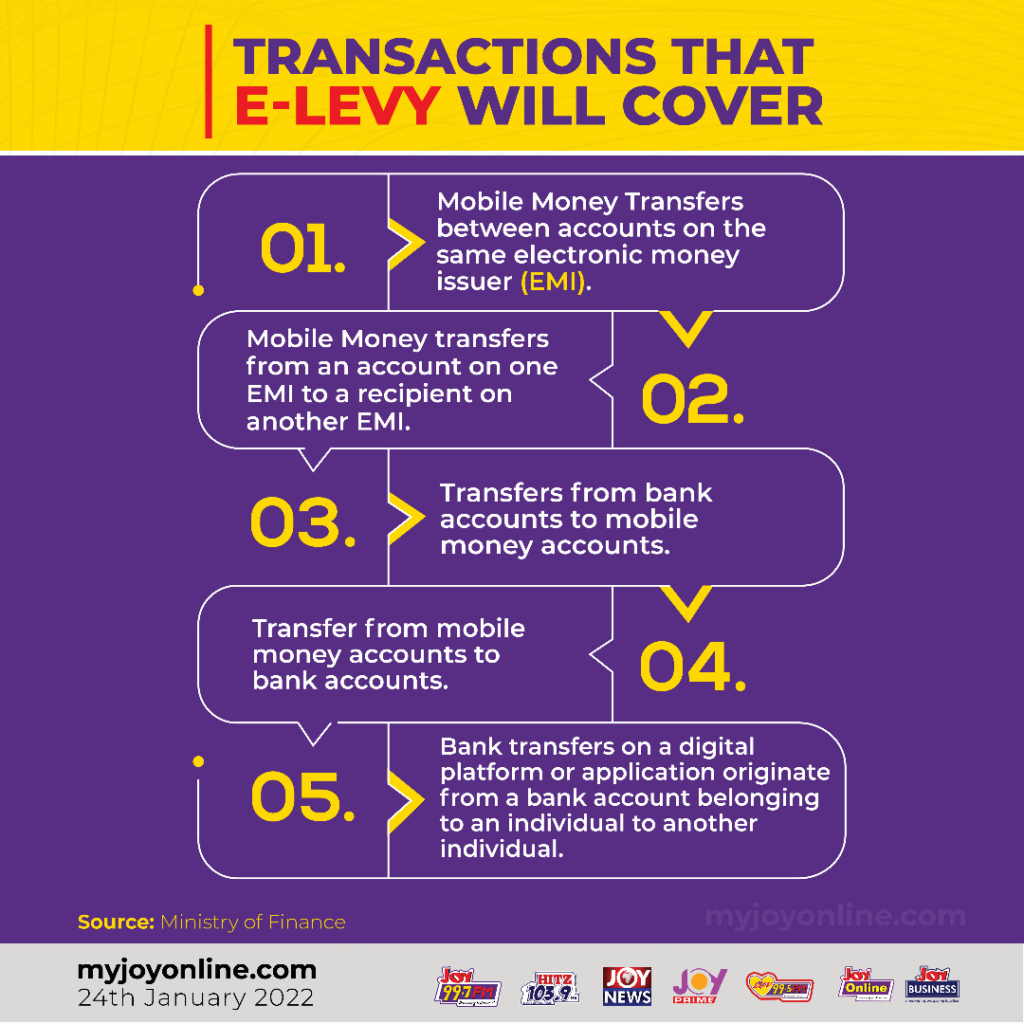

The tax proposal currently in Parliament will see the government deducting 1.75% tax on some electronic financial transactions by citizens.

The E-Levy has been the bone of contention since government presented its 2022 Budget statement to the House last year.

According to the Finance Ministry, the move will increase the country’s tax-to-GDP from 13% to a targeted 16% or more and $6.9 billion in revenue.

But the Minority insists that the 1.75% tax is a tool to exacerbate the plight of the ordinary Ghanaian, which the Covid-19 pandemic has already impacted.

A section of the populace and experts have also greeted the yet-to-be approved levy with disapproval.

However, ahead of its approval, a letter from the GRA sighted by Myjoyonline.com is directing partners to trigger processes awaiting the passage of the controversial bill.

The letter signed by Commissioner-General Ammishaddai Owusu-Amoah explained that "While we await the passage of the bill, I wish to inform you to hold yourself in readiness for the implementation of the By in three (3) phases as soon as the Bill is passed into law,"

The January 31 statement further revealed that the execution will be undertaken in three phases.

This is to enable the GRA to adequately factor the new tax into its revenue collection regime.

The Authority added that it is "currently developing a monitoring platform for the full implementation of the e-levy and would be inviting you to collaborate with its Technical Team in this respect."

Citing Bloomberg’s report on Ghana’s economy, government says approving the e-levy would help address the issue of the downgrade of Ghana’s credit rating from B to B-.

Finance Minister, Ken Ofori-Atta also noted that the levy would be the driving force to move the country towards a more sustainable debt level.

Latest Stories

-

GoldBod Jewellery clarifies it did not sponsor UK Women of Valour event

9 minutes -

‘Such crimes are against humanity’ — Otokunor backs prosecution of former COCOBOD officials

28 minutes -

COCOBOD’s rollover contracts cost Ghana nearly $1bn – Otokunor

41 minutes -

Gov’t bought 581,000 tonnes of cocoa at $7,200 — prices then plunged: Otokunor explains

50 minutes -

Rotary Club commissions GH¢210,000 mechanised borehole for Agyemanti

57 minutes -

After “I Do” 15 Years Later, What Really Keeps Love Alive?

58 minutes -

Cocoa farmer frustrations began years before price cut – Otokunor

1 hour -

Ignatius Osei-Fosu open to Kotoko job but says ‘timing has to be right’

1 hour -

Cocoa farmers received as little as 30% of FOB price under Akufo-Addo – Otokunor

1 hour -

Reverse Kim Lars’ Black Stars appointment due to postponed WAFCON – Ignatius

1 hour -

Gov’t can’t set cocoa prices without global market realities – Otokunor

1 hour -

Today’s Front pages: Monday, March 9, 2026

2 hours -

Step away from politics for a moment and imagine something every contemporary Ghanaian understands very well

2 hours -

Working in the Dark: Ghana’s employment crisis and the documentation gap nobody wants to close

2 hours -

NPP leadership to meet over challenges in ongoing membership registration exercise

2 hours