Audio By Carbonatix

The Bank of Ghana (BoG) Governor, Dr Johnson Asiama, has disclosed that the central bank is working to reduce the Non-Performing Loan (NPL) ratio to 10 per cent by the end of 2026.

The current NPL ratio stands at 19.5% as of October 2025.

According to the Governor, the target forms part of a broader strategy to ensure that asset quality within the banking sector remains a top priority, especially as interest rates begin to ease.

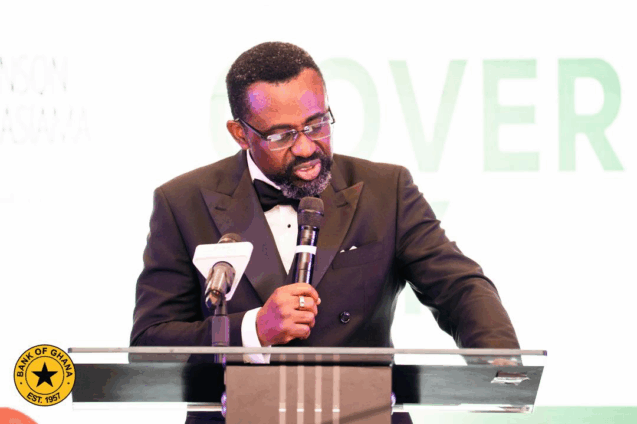

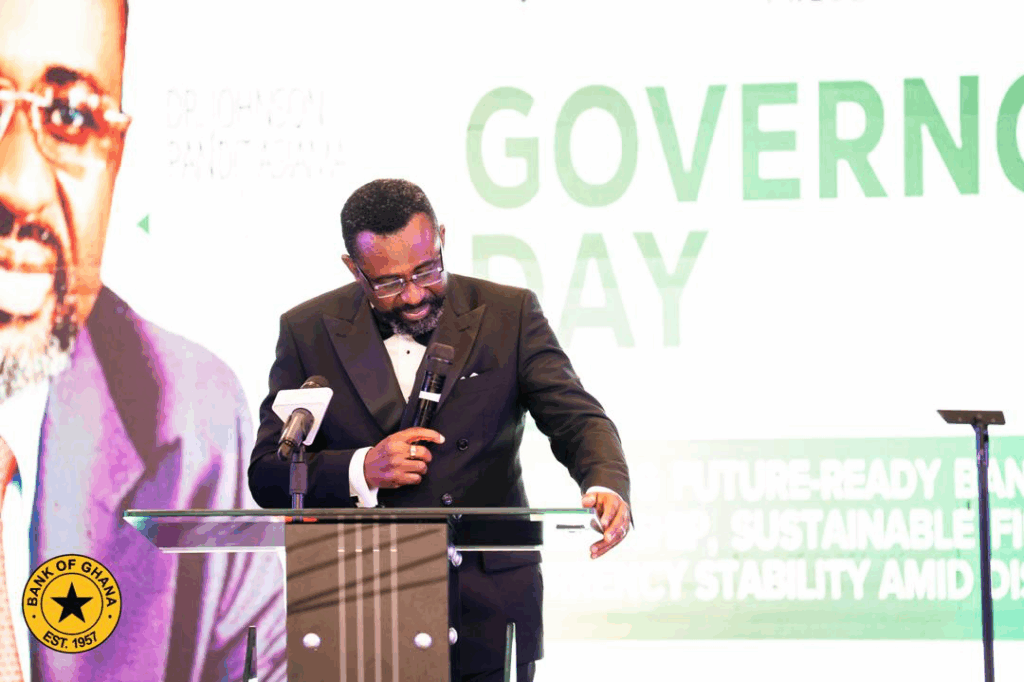

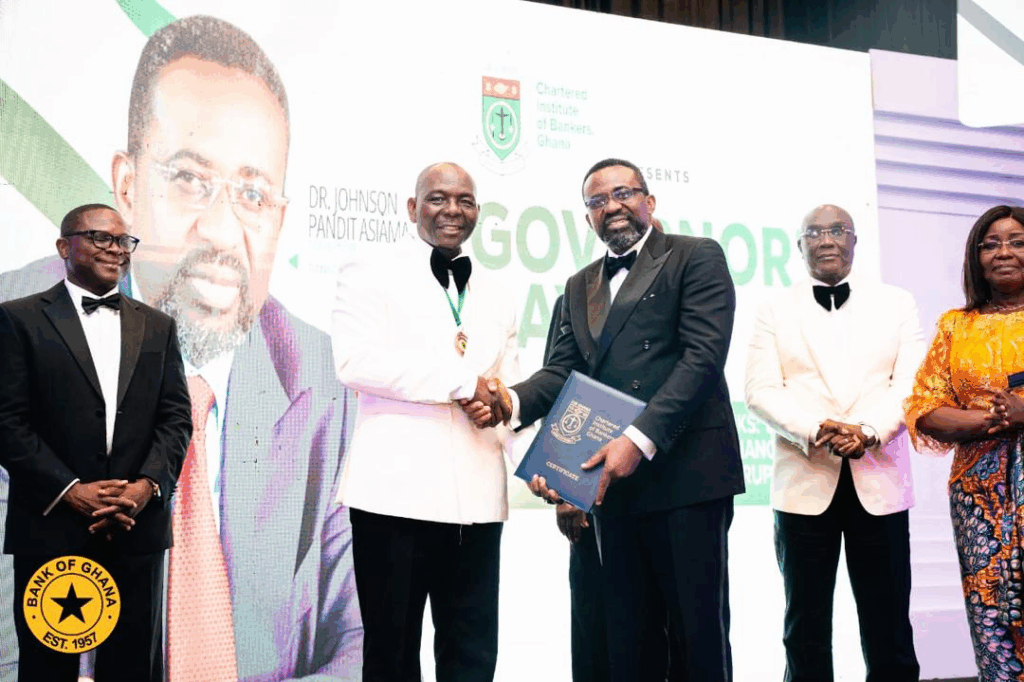

Dr Asiama made the disclosure in a speech delivered at the Governor’s Day Annual Bankers’ Dinner, organised by the Chartered Institute of Bankers.

He explained that the improving macroeconomic environment should provide room for intelligent loan restructuring by commercial banks, without compromising prudential standards.

“As we turn toward 2026, the central question is no longer whether stability can be restored. The question is how that stability is used,” the Governor stated.

He added that, “If 2025 was the year confidence was rebuilt, then 2026 must be the year that confidence is put to work—carefully, productively, and with judgment—in service of a stronger, more competitive Ghanaian economy.”

Supporting Ghana’s Exports

Dr Asiama also urged commercial banks to intensify their support for Ghana’s export strategy as the country heads into 2026.

He called on banks to strengthen export finance desks, support agro-processing and non-traditional exports, and engage more deliberately with trade opportunities under the African Continental Free Trade Area (AfCFTA).

The Governor stressed that banks must play a more active role in financing export-oriented enterprises, managing trade risks, and supporting firms in transitioning from domestic markets to regional and global value chains.

“The banking sector must not sit on the sidelines of Ghana’s export agenda but help shape it,” he said, adding that this is the moment for banks to design export-ready loan products, build sector-specific expertise, support risk-sharing and hedging instruments, invest in digital trade platforms, and actively support exporters from production to payment.

“When banks nurture exporters, they are not doing charity; they are expanding the country’s foreign exchange base, strengthening their own balance sheets, and deepening the resilience of the financial system,” he noted.

He observed that every container shipped, every processed good sold abroad, and every new export contract strengthens both the real economy and the banking sector that supports it.

Reflections on 2025

Reflecting on the past year, Dr Asiama described 2025 as a period marked by difficult choices and decisions whose consequences extended far beyond the moment they were taken.

“As the year 2025 draws to a close, I find myself, like many of you, taking a moment to breathe out,” he said.

He recalled that when he assumed office earlier in the year, the challenge was not a lack of ideas or policy tools, but an erosion of confidence—confidence in signals, coordination, and the consistency of policy implementation.

“At the time, market behaviour reflected uncertainty rather than conviction, and in such an environment, even well-intended actions struggled to gain traction,” he added.

Proposed Reforms Implemented in 2025

The Governor highlighted several reforms undertaken in 2025, which he said played a critical role in restoring monetary and market discipline.

He noted that these reforms helped stabilise the cedi and significantly slow inflation. According to him, inflation, which stood above 23 per cent at the start of the year, declined steadily into single digits by November, reaching levels not seen since 2019.

“Over the same period, the cedi appreciated cumulatively by over 20 per cent, reflecting a return of order rather than speculation,” he stated.

Dr Asiama further explained that sustained disinflation allowed the Monetary Policy Committee (MPC) to reduce the policy rate by a cumulative 1,000 basis points over the course of the year—an outcome he said would not have been credible without earlier policy discipline.

He emphasised that the reforms extended beyond monetary policy to the commercial banking sector, which entered 2025 still grappling with the effects of the Domestic Debt Exchange Programme (DDEP) and capital adequacy pressures.

As of the end of 2024, eleven banks recorded capital ratios below the prudential threshold. However, by November 2025, that number had reduced to five, reflecting recapitalisation efforts, enhanced supervision, and improved macroeconomic conditions.

Dr Asiama also announced that the Bank of Ghana is laying the foundation for the next phase of financial sector growth, aimed at positioning Ghana’s financial system for long-term resilience and expansion.

He disclosed that significant progress has been made in modernising the payments ecosystem, with the completion of the National Payment Systems Strategy for 2025–2029.

The strategy provides a coordinated roadmap for interoperability, cybersecurity, instant payments, and broader infrastructure modernisation.

Latest Stories

-

Prudential Bank, Mastercard discuss support for SMEs and corporates

2 hours -

Threat of further violence looms after Mexican cartel rampage

2 hours -

Abesim murder case: Footballer sentenced to life imprisonment

2 hours -

Third force not the answer – Yaw Nsarkoh questions Ghana’s political fix

2 hours -

Prudential Bank champions tree crop investment at TCDA anniversary dialogue

2 hours -

Roc Nation Sports International kicks off inaugural youth football tournament in Ghana

3 hours -

‘Ghanaians are not genetically disorderly’ – Yaw Nsarkoh says consequences create order

3 hours -

Electoral Cost Efficiency in Emerging Democracies: A Comparative Analysis of Cost per Voter in Ghana’s 2020 and 2024 General Elections

3 hours -

BBC edited a second racial slur out of Bafta ceremony

3 hours -

Nigeria denies report it paid ‘huge’ ransom to free pupils in mass abduction

3 hours -

Gender Minister oversees safe discharge of rescued baby, settles bills and engages police on probe

4 hours -

Bawumia receives Christian Council goodwill visit after NPP flagbearer win

4 hours -

Afenyo-Markin urges Bagbin to summon Korle-Bu, Police, Ridge Hospitals over alleged denial of care to hit-and-run victim

4 hours -

Police reject GH₵100k bribe, arrest drug suspects with 209 slabs

5 hours -

Declare galamsey child health emergency – Pediatric Society to President Mahama

5 hours