Audio By Carbonatix

The International Monetary Fund has stated that Ghana breached the Debt Sustainability Analysis (DSA) thresholds, a situation that led the country into debt distress.

In a statement titled “Request for an arrangement under the Extended Credit Facility Programme”, the Fund said Ghana is in debt distress. It added that the country's debt level is also unsustainable.

“Given the ongoing debt restructuring and large and protracted breaches to the Debt Sustainability Analysis (DSA) thresholds, Ghana is in debt distress, and debt is assessed as unsustainable”.

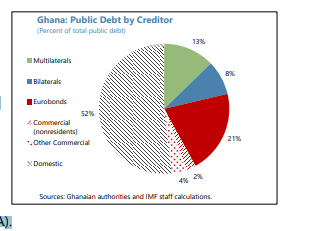

It pointed out that public debt increased to 88.1% of Gross Domestic Product by end-2022, almost evenly split between external (42.4% of GDP) and domestic (45.7% of GDP).

Again, the Fund mentioned that gross financing needs have reached about 19% of GDP.

“Under the proposed programmes baseline projections, which do not consider the possible outcome of the ongoing debt restructuring, the ratios of present value of public and external debt to GDP, and the ratios of external debt service to revenues and exports are and would remain above their LIC-DSF thresholds over the medium and long term”, it added.

Outlook subject to significant downside risks

The Fund further said that the outlook is subject to significant downside risks.

It explained that the baseline projections are predicated on successful programme execution and swift progress in implementing the authorities’ comprehensive debt restructuring and plans to address the large stock of domestic arrears, including to independent power producers (IPPs).

Notwithstanding mitigation strategies, it said that the domestic debt exchange presents significant risks to domestic financial sector stability, adding “exchange rate, credit, and liquidity risks further add to the vulnerabilities”.

“The authorities’ debt restructuring plans still leave a substantial need for T-bill [Treasury bills] issuance in the near term and expose Ghana to the uncertainty in domestic market conditions, though programme implementation and outreach may help mitigate financing risks. Domestic policy slippages represent a significant downside risk to the projections, further compounded by risks associated to the end-2024 general elections.”

Latest Stories

-

Journalists urged to prioritise safety when reporting on children

5 minutes -

Make Accra Beautiful Again (MABA)

20 minutes -

Love Beyond Roses: Olive Tower ignites hearts at ‘Time with Mama Portia’ Valentine seminar

24 minutes -

Gov’t warns against non-essential travel to high-risk areas after Burkina Faso attack

25 minutes -

DoorMaster launches SECURE+, Ghana’s first security doors with built-in insurance protection

38 minutes -

GAUA warns against use of court processes to halt university strikes

49 minutes -

Learning to stand alone: Love, loss, and the quiet strength of faith

56 minutes -

Mahama orders air evacuation of injured Ghanaians from Burkina Faso

1 hour -

Ghanaians death toll in Burkina Faso terror attack now 8

1 hour -

Ken Ashigbey demands probe into 14 containers of changfang machines

1 hour -

The NDC doesn’t need a southerner or northerner

1 hour -

NSA assures service personnel of allowance payments by week’s end

2 hours -

Why COCOBOD’s pay cut is a band-aid on a gaping national wound

2 hours -

We cannot stop cross-border trade but must protect our traders – Dumelo

2 hours -

Port security lapses exposed in importation of illegal mining machines – Ashigbey

2 hours