Audio By Carbonatix

Ghana’s public debt stock has surged again, rising by more than GH¢70 billion in just three months, reflecting pressures from the cedi’s sharp depreciation against the US dollar in the third quarter of 2025.

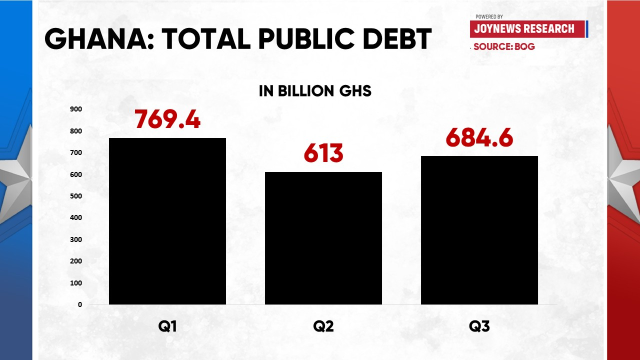

Latest Bank of Ghana data tracked by JoyNews Research shows that Ghana’s public debt increased by about GH¢71.6 billion in the third quarter, with projections indicating that total public debt could exceed GH¢700 billion by the end of the year if the cedi remains under sustained pressure against the dollar.

Total public debt, which declined by GH¢156.4 billion between the first and second quarters, has now risen to GH¢684.6 billion, heavily driven by the cedi’s renewed struggle against the US dollar in Q3.

The local currency lost about 24% of its value in the third quarter against the US greenback, after having appreciated by more than 40% in Q2.

Earlier this year, the Finance Minister, Dr Cassiel Ato Forson, revealed in the 2025 Mid-Year Budget that “prudent debt management and exchange rate appreciation have resulted in a significant improvement in Ghana’s debt profile.”

He noted that public debt declined from GH¢726.7 billion at the end of December 2024 to GH¢613 billion by the end of June 2025.

However, historical data show that exchange rate depreciation remains a key driver of Ghana’s rising debt levels. In 2023 alone, currency depreciation accounted for 62.5% of the increase in the total public debt stock, reinforcing concerns about the country’s exposure to foreign currency risks.

Also the slowdown in foreign exchange interventions by the Bank of Ghana, combined with rising import pressures, has contributed to the recent depreciation of the cedi.

Over the years, dollar injections by the central bank have helped cushion the cedi against excessive depreciation, a development that has in turn supported a more favourable public debt profile.

This year alone, the Bank of Ghana is reported to have supplied about US$10 billion to the foreign exchange market, operating under what it describes as a foreign exchange intermediation framework rather than direct market intervention.

The projection is that additional depreciation of the local currency could worsen the debt profile should the current pressures persist.

Watch the full analysis on JoyNews’ Beyond the Numbers here:

Latest Stories

-

Two arrested in connection with Effiakuma viral video

27 minutes -

Keta MP lays mother to rest

56 minutes -

We must put an end to cocoa politics – Victoria Bright

1 hour -

There is a cabal in electricity sector determined to rip off Ghanaians – Prof Agyemang-Duah

2 hours -

NSA pays January 2026 allowance to National Service Personnel

2 hours -

24-Hour Economy not just talk — Edudzi Tamakloe confirms sector-level implementation

2 hours -

Four arrested over robbery attack on okada rider at Fomena

2 hours -

NDC gov’t refusing to take responsibility for anything that affects Ghanaians – Miracles Aboagye

3 hours -

Parental Presence, Not Just Provision: Why active involvement in children’s education matters

3 hours -

24-Hour economy policy fails to create promised jobs – Dennis Miracles Aboagye

3 hours -

Ghana Embassy in Doha urges nationals to take shelter after missile attack

3 hours -

Government’s macroeconomic stability commendable, but we need focus on SME growth – Victoria Bright

4 hours -

Macro stability won’t matter without food self-sufficiency- Prof. Agyeman-Duah

4 hours -

How Virtual Security Africa is strengthening safety at Mamprobi Polyclinic

4 hours -

Ghana on right track macroeconomically, but structural gaps remain – Fred Dzanku

4 hours