Audio By Carbonatix

The Bank of Ghana (BoG) has confirmed that government support is expected as part of efforts to recapitalise the Central Bank, following the severe balance sheet pressures it endured during the Domestic Debt Exchange Programme (DDEP).

Previously, the Minister for Finance, Dr Cassiel Ato Forson, had ruled out the use of taxpayer funds for the recapitalisation of the BoG, referencing a ¢53 billion recapitalisation Memorandum of Understanding signed under the former Ernest Addison-led administration.

He maintained that any capital restoration should be achieved through internal reforms and restructuring rather than direct budgetary injections.

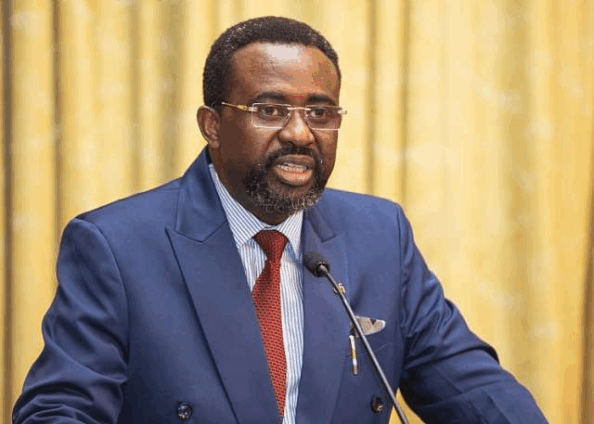

However, speaking at the 128th Monetary Policy Committee (MPC) press briefing on Wednesday, January 28, 2026, Governor of the Bank of Ghana, Dr Johnson Asiama, said discussions with government on restoring the Bank’s financial health have been positive, stressing that recapitalisation remains critical to the Bank’s credibility and independence.

“I believe in the commitment of government to recapitalise the Central Bank following the hit it took to protect the economy amid the domestic debt restructuring programme. So far, discussions with government have been fruitful, and there is support to help repair the Bank’s balance sheet”, Dr Asiama said.

He explained that rebuilding the BoG’s capital base is essential for the effective execution of its core mandate, including price stability, financial sector regulation and overall macroeconomic management.

“It is only fair that the wounds suffered as a result are addressed,” the Governor noted, adding that the recapitalisation effort would protect the Central Bank’s operational independence and reinforce confidence in monetary policy.

Beyond the Central Bank, Dr Asiama also provided an update on the recapitalisation of the commercial banking sector, pointing to notable improvements in resilience across the industry.

He disclosed that as of the end of December 2025, 21 out of the 23 licensed banks had met the required capital adequacy thresholds, with the remaining two institutions granted until the end of March 2026 to comply.

“We have two more banks that are yet to meet the requirement, but they have been given until the end of March 2026,” he said.

“Overall, we have made significant progress on the recapitalisation strategy, and we are monitoring closely to ensure full compliance.”

Latest Stories

-

Nana Agyei Baffour Awuah calls for law to standardise prima facie cases

3 minutes -

Cocoa Farmers in Western North demonstrate over price cut

6 minutes -

Australian presenter apologises for drinking before slurred Olympics report

13 minutes -

Let history record it right: Name the Radio Univers newsroom after Dr Alhaji Abubakari Sidick Ahmed

18 minutes -

I’m a traditionalist and herbalist – Kwaw Kese

38 minutes -

Police crack down on wanted robbery gang in Ashanti Region, 3 suspects arrested

52 minutes -

Learn and lead with humility – Chairman of insurance retirees forum advises

55 minutes -

Beyond the Cold: Debunking a dangerous myth of pneumonia in Ghana and around the world

56 minutes -

Shatta Wale – Stonebwoy brawl at 2019 VGMA: Bullgod details what actually happened

1 hour -

ECOWAS backs full probe into killing of Ghanaian traders in Burkina Faso attack

1 hour -

President Mahama signs 24-Hour Economy Authority bill into law

1 hour -

Ghana engages Latvian authorities in high-level talks to pursue Justice for Nana Agyei Ahyia

1 hour -

UniMAC SRC secures private hostel in Osu to ease student accommodation challenges

2 hours -

“I’m happy about this decision” – Sulemana Braimah on dismissal of petitions against SP, EC

2 hours -

Police strengthens partnership with Nigerian Transport Operators Association to combat human trafficking

2 hours