Audio By Carbonatix

The International Monetary Fund (IMF) is expected to reach a staff-level agreement with Ghana on the 5th Programme Review today, October 10, 2025.

This projection is based on a careful analysis by Joy Business of Ghana’s performance under the IMF programme, using key economic indicators and criteria assessed by the visiting mission team.

A review of the data shows significant progress in several areas, including inflation, which has now hit single digits, debt restructuring, energy sector reforms, GDP growth, and financial stability.

The Bank of Ghana’s efforts to control liquidity have also helped slow inflation to single digits.

Economic Indicators

Ghana has made notable progress on key IMF programme targets. Based on trends from previous reviews, the IMF mission is expected to announce a staff-level agreement, subject to Executive Board approval.

If approved, Ghana could receive a disbursement of slightly over US$360 million that should come in December 2025, after a board approval.

Securing this agreement is expected to help restore investor and donor confidence in the Ghanaian economy while reaffirming the government’s commitment to the IMF programme.

IMF Mission Review

The IMF began its fifth review of Ghana’s performance under the Fund Programme on September 29.

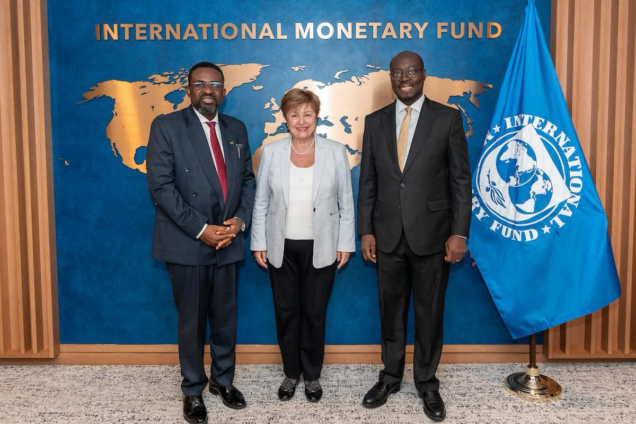

The full team, led by Mission Chief Dr. Ruben Atoyan, arrived in Accra for a two-week engagement with technical staff of the Ministry of Finance and the Bank of Ghana, as well as Members of Parliament.

They also held meetings with the Governor of the Bank of Ghana, Dr. Johnson Asiama, and the Minister of Finance, Dr. Ato Forson.

Joy Business understands that discussions focused on unresolved arrears clearance issues, finalising audits of last year’s expenditure on construction and projects, and whether the Bank of Ghana’s recent policy rate cuts are adequate, given the sharp fall in inflation. The mission also reviewed the Bank’s reserve build-up and dollar interventions.

This fifth review is the penultimate one, with the final review scheduled for April 2026 before Ghana concludes the programme in May 2026.

It is considered particularly crucial, as some market analysts fear Ghana may struggle to maintain fiscal discipline once the programme ends.

Focus of the 5th Programme Review

Joy Business has gathered that the review will focus on Ghana’s economic data up to June 2025. Key areas of discussion include:

- Inflation performance

- Sustainability of reserve build-up

- Audit of arrears

- Weak private sector banks requiring recapitalisation

- State-owned banks needing recapitalisation, similar to NIB

- Fiscal policy shortfalls amid an appreciated currency, with adjustments needed to meet the 1.5% of GDP primary surplus target

- Arrears build-up in NHIL, GETFund, Road Fund, and other areas

- Social spending shortfalls

Ghana’s IMF Programme and Priorities

On May 17, 2023, the IMF Executive Board approved an SDR 2.242 billion (about US$3 billion) 36-month Extended Credit Facility (ECF) arrangement for Ghana.

This approval allowed for an immediate disbursement of SDR 451.4 million (about US$600 million), with the remaining amount released in tranches every six months following successful programme reviews.

The programme seeks to:

- Restore public finances to a sustainable path through revenue mobilisation and improved spending efficiency while protecting the vulnerable. For example, allocations to the LEAP cash transfer and school feeding programmes have doubled under recent budgets.

- Support fiscal adjustment and resilience with structural reforms in tax policy, revenue administration, public financial management, energy, and cocoa.

- Curb inflation through monetary tightening and ending direct central bank financing of the budget, while maintaining a flexible exchange rate to rebuild reserves.

- Preserve financial stability.

- Encourage private investment, growth, and job creation through broader reforms.

Latest Stories

-

Man United interim boss Darren Fletcher sought Ferguson ‘blessing’

1 hour -

Semenyo to undergo Man City medical after agreement with Bournemouth

3 hours -

Nvidia unveils self-driving car tech as it seeks to power more products with AI

3 hours -

Car giant Hyundai to use human-like robots in factories

3 hours -

Nestle issues global recall of some baby formula products over toxin fears

4 hours -

Central African Republic president wins third term by landslide

4 hours -

Israel’s foreign minister on historic visit to Somaliland

4 hours -

Government can pay – Austin Gamey backs nurses and midwives’ salary claims

4 hours -

Protests won’t fix pay crisis – Austin Gamey urges patience for unpaid nurses and midwives

5 hours -

‘You’re invisible, you don’t exist’ – life without a birth certificate

5 hours -

At least 22 Ethiopian migrants killed in ‘horrific’ road crash

5 hours -

Uganda denies plans to block internet during election

5 hours -

Amad stars as AFCON holders Ivory Coast ease into last eight

6 hours -

Swiss ski bar not inspected for five years before deadly fire, mayor says

6 hours -

Wiyaala to be enskinned paramount queenmother of Funsi as Pulung Festival debuts

6 hours