Audio By Carbonatix

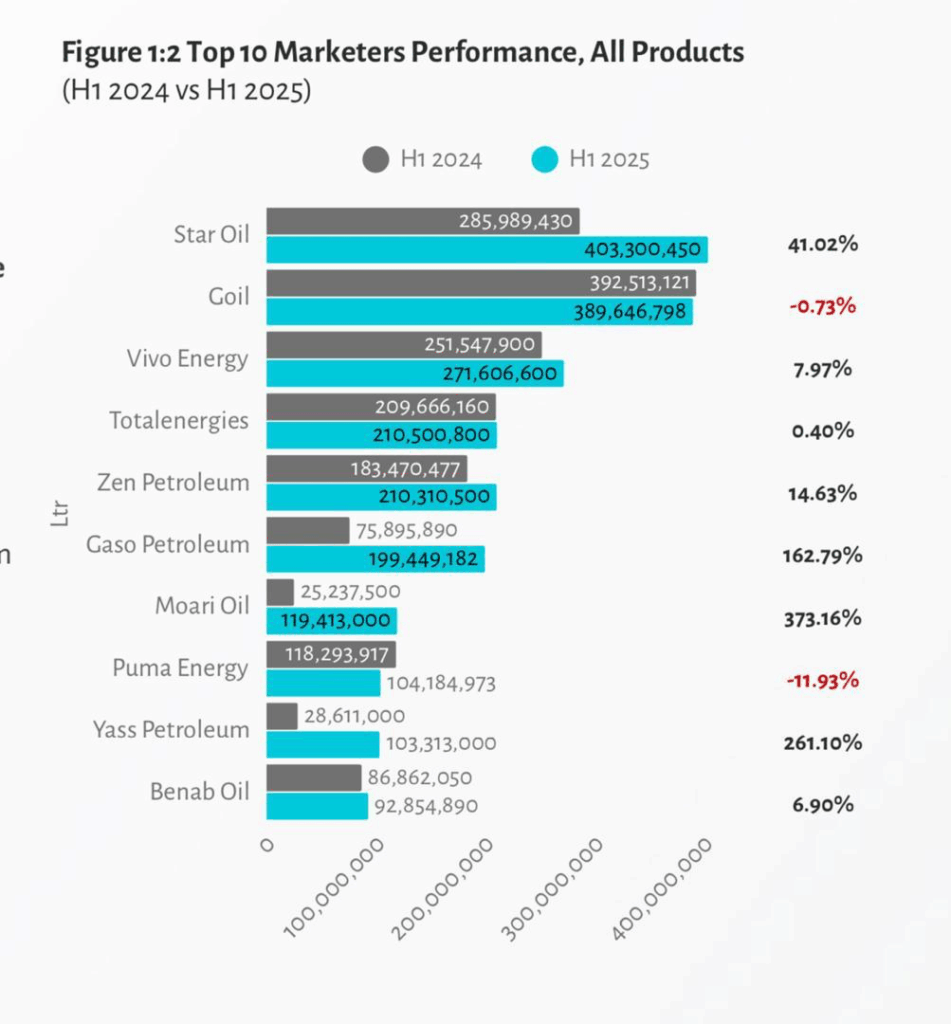

Star Oil has consolidated its position as the leader in Ghana’s Oil Marketing industry, according to new industry data for the first half of 2025.

The report shows that the company recorded a 41.02% increase in product volumes, reaching 403.3 million litres, thereby overtaking GOIL PLC in market share.

Its dominance was anchored in strong performances in gasoline and diesel sales.

Fastest Growth Rates Among Emerging Players

While Star Oil led in total volumes, the most dramatic growth came from Moari Oil (373.16%), Yass Petroleum (261.10%), and Gaso Petroleum (162.79%).

Gaso Petroleum’s gains were driven by its strong niche in industrial and maritime fuels, especially for power plants and mines.

In contrast, Puma Energy recorded an 11.93% decline in market share during the same period.

New entrants, Moari Oil and Yass Petroleum, each achieved impressive market share growth, with volume increases exceeding 70 million litres.

Performance of Established Players

Among the established brands, Zen Petroleum (14.63%) and Vivo Energy (7.97%) posted steady growth, while TotalEnergies (0.40%) remained largely flat.

Conversely, Puma Energy (-11.93%) saw a sharp drop, and GOIL (-0.73%) slipped slightly despite maintaining strong sales volumes.

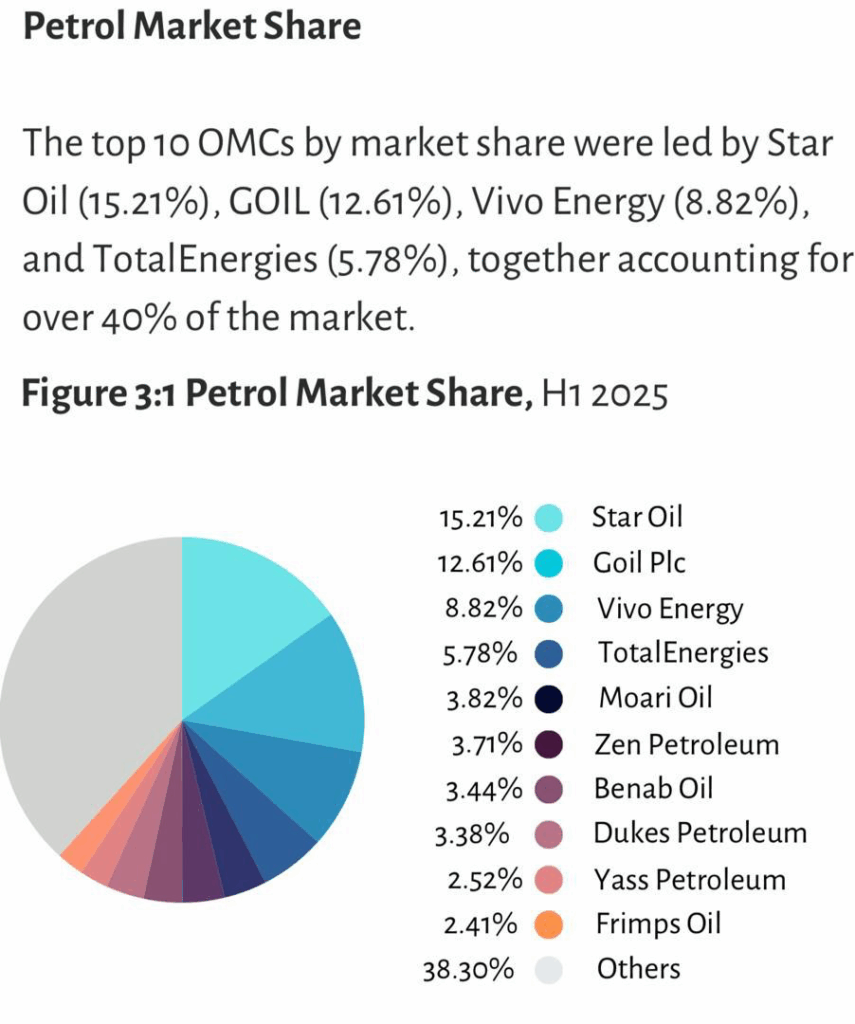

The top 10 OMCs by market share were led by:

- Star Oil – 15.21%

- GOIL – 12.61%

- Vivo Energy – 8.82%

- TotalEnergies – 5.78%

Together, these four accounted for over 40% of the total market share.

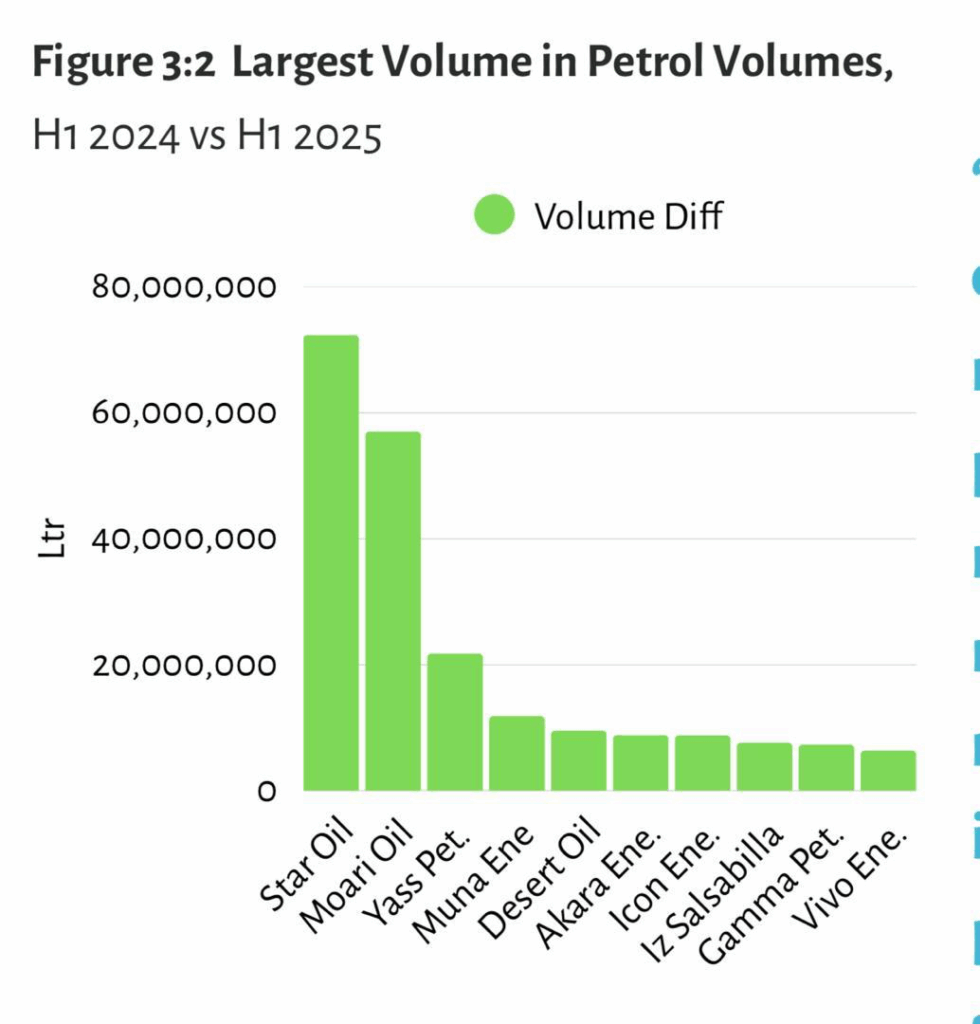

Between January–June 2024 and 2025, Star Oil (+72.36m litres) and Moari Oil (+57.04m litres) recorded the largest increases in petrol volumes, followed by Yass Petroleum (+21.81m litres), Muna Energy (+11.89m litres), and Desert Oil (+9.59m litres).

The first half of 2025 also saw extraordinary percentage growth among new entrants scaling from low 2024 volumes — Moari Oil (18,368.76%), Veros Petroleum (4,300.00%), Wabendso Energies (3,288.48%), and Life Energy (3,181.48%) emerged as standout gainers.

LPG Market Performance

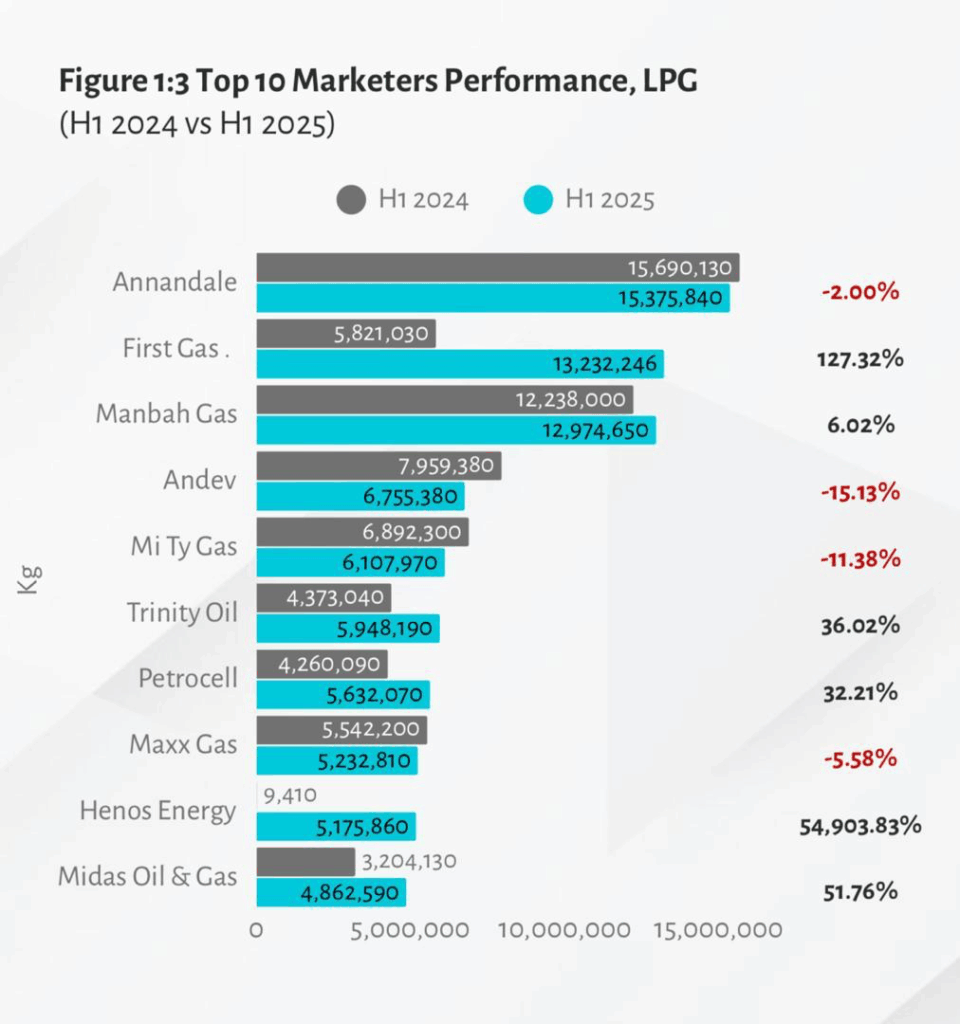

In the LPG segment, Annandale retained the top position with 18.9% market share, despite a slight dip in volumes from the previous year.

First Gas rose sharply to 16.3%, taking second place, while Manbah Gas held third with 16.0%.

Mid-tier players Andev (8.3%), Mi Ty Gas (7.5%), and Trinity Oil (7.3%) recorded comparable volumes. Petrocell (6.9%) and Maxx Gas (6.4%) followed closely.

At the lower end of the top ten, Henos Energy (6.4%) achieved a strong breakthrough given its minimal volumes in 2024, while Midas Oil & Gas (6.0%) rounded out the list.

Bulk Oil Distribution Firms (BIDECs)

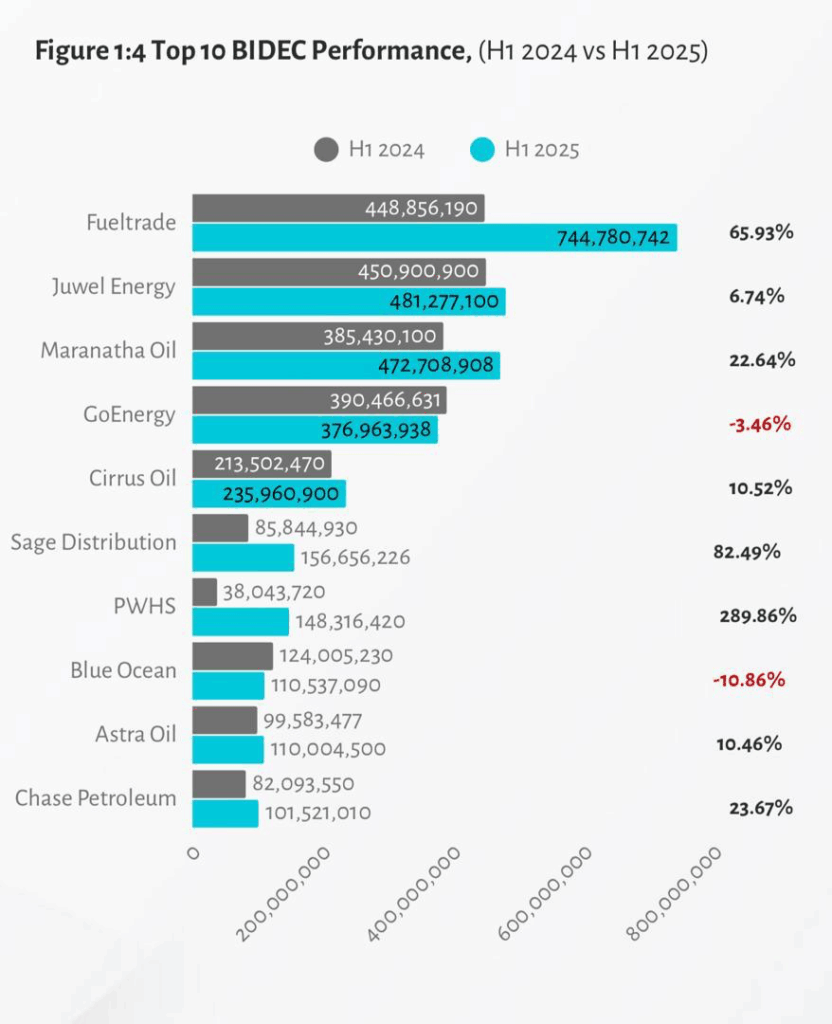

For the first half of 2025, Fuel Trade maintained its position as Ghana’s largest Bulk Import, Distribution and Export Company (BIDEC), expanding imports by 65.93% to 744.8 million litres.

Its strength lies in diversification — spanning gasoline, diesel, LPG, marine fuels, and power plant supply — making it the most dominant player in the sector.

The fastest growth rates were recorded by Sage Distribution (82.49%), driven by LPG imports, and PWHS (289.86%), which scaled rapidly across gasoline and ATK.

Maranatha Oil (22.64%), Chase Petroleum (23.67%), and Cirrus Oil (10.52%) posted steady gains, consolidating their mid-tier positions.

In contrast, GoEnergy (-3.46%) and Blue Ocean (-10.86%) saw declines in volume and market share — trends reflected in their affiliated OMCs, GOIL and Puma Energy, during the same period.

The evolving landscape also underscored niche strategies: Astra Oil focused on power plant fuels with over 115 million litres, while Sage Distribution established itself as the leading LPG-focused BIDEC.

Latest Stories

-

JUSAG suspends intended strike as government responds to concerns

27 seconds -

NAIMOS officer shot, one assailant killed in Bono Region anti-galamsey operation

31 minutes -

U.S immigration tribunal independent, not swayed by protests – Prof Appiagyei-Atua

46 minutes -

Ghana-China trade hits $15bn as Vice President bids farewell to outgoing Chinese Ambassador

58 minutes -

Vote a flagbearer who prioritises Ashanti Region to restore dominance – NPP delegates told

60 minutes -

Public barred from Ken Ofori-Atta’s US Immigration court hearing: Blow-by-blow account of how it happened

1 hour -

The GoldBod and the strategic realignment of national resource governance: A macroeconomic and comparative analysis

1 hour -

Legacy of impact: Richard Nii Armah Quaye cemented as a Titan of Industry in the 2025 Ghanaian Powerlist

1 hour -

Ken Ofori-Atta’s U.S. immigration case hearing

3 hours -

CCC’s StartWell Conference 2026 to champion transformational leadership

3 hours -

Honour Yaw Sarpong’s legacy – Kumasi residents urge MUSIGA, gov’t

3 hours -

Protests at US Embassy won’t expedite Ofori-Atta’s return – Frank Davies

3 hours -

QNET commends law enforcement, welcomes convictions, reaffirms zero tolerance for fraud and brand misuse

3 hours -

VORSAG-GCTU celebrates Opong-Fosu for exemplary leadership

3 hours -

Savage 4 releases ‘Abonten’ with Novelist and Smallgod, ushering in Ghana Grime

4 hours