Audio By Carbonatix

Pan-African Banking Group, Ecobank Group, has announced Koree, a fintech company based in Cameroon, as the overall winner of the 2023 Ecobank Fintech Challenge.

The announcement was made by a distinguished panel of judges during the competition’s Grand Finale at the bank’s headquarters at the Pan African Centre in Lomé, Togo.

Koree emerged the winner after facing fierce competition from seven other fintechs, all of whom pitched their innovative fintech solutions to an independent panel of five judges.

These eight finalists were carefully selected from an initial pool of over 1,400 fintechs from 64 countries, underscoring the significant growth in popularity of the competition since its inception six years ago, as well as the wealth of innovation and ingenuity, particularly on the African continent.

The eight finalists are Flexpay Technologies (Kenya), IPOXcap AI (South Africa), Kastelo (South Africa), Koree (Cameroon), Kori Tech (Senegal), Smart Teller Technologies (Nigeria), Rubyx (Belgium) and Wolf Technologies (DRC).

Koree was declared the ultimate winner after three judging rounds and will receive a cash prize of $50,000 for this outstanding achievement.

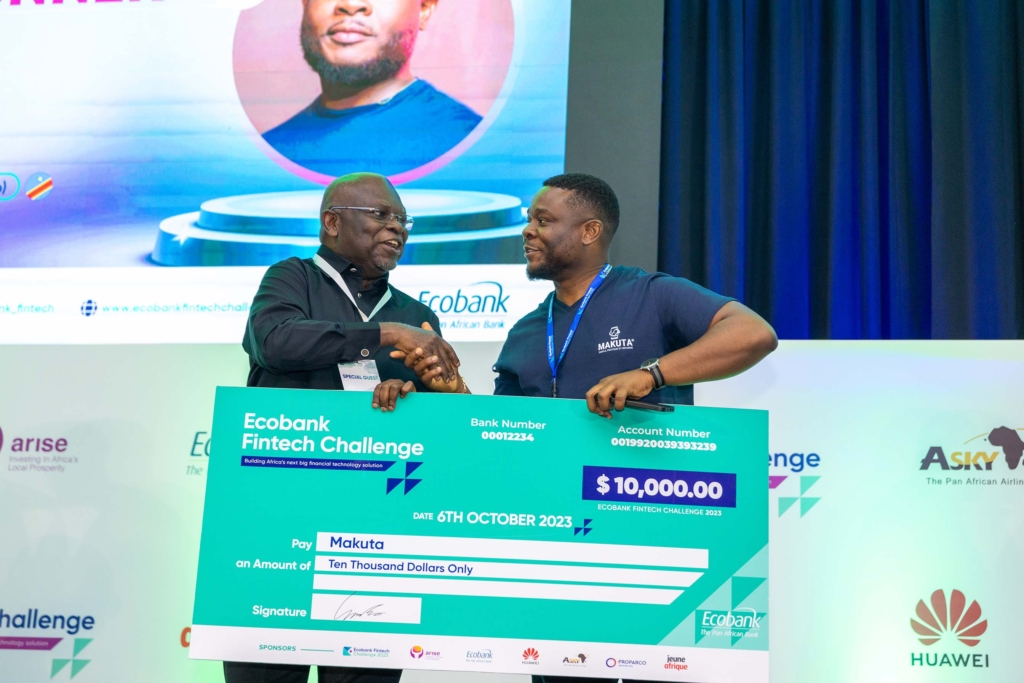

Wolf Technologies, who were the first runner-up, will take home $10,000, while Flexpay Technologies, second runner-up, receives $5,000.

1st runner-up Wolf Technologies (DRC) receives the cash prize of $10,000 out of the hands of Dr Segun Sina, President of the Africa Fintech Network

The Ecobank Fintech Challenge cash prize is one of the most substantial no-strings-attached fintech cash prizes available in Sub-Saharan Africa, specifically aimed at encouraging innovation within the fintech sector. With their card wallet payment solution that digitizes merchant payments, Koree impressed the judges, securing their well-deserved victory.

The winner, along with the other seven finalists, were inducted into the prestigious Ecobank Fintech Fellowship.

This unique programme offers fintech companies the opportunity to explore potential commercial partnerships with Ecobank, including the possibility of seamless integration with the bank’s platforms and the potential for scaling up their fintech ventures across Ecobank’s 35 African markets.

Jeremy Awori, Chief Executive Officer of Ecobank Group, said: “This year's eight finalists have demonstrated exceptional innovation and promise.

Fred Pelser, Senior Investor Arise hands over the cash prize of $5,000 to 2nd runner-up Flexpay (Kenya)

"We look forward to collaborating with them to develop groundbreaking products, services and solutions that will ultimately benefit our valued customers and contribute to the advancement of our continent.

"We are convinced that forging sustainable partnerships with fintechs and the overall tech ecosystem remains a viable strategy in our pursuit of delivering convenient, affordable services to our customers.”

Acknowledging the winner, Jeremy Awori added, "We extend our warmest congratulations to Koree, the first ever female-led fintech winner of our challenge, for their outstanding victory and innovative contributions to the fintech landscape. We look forward to a greater collaboration."

Mr. Awori delivered his remarks during the Grand Finale, which was also attended by Madam Cina Lawson, Minister of Digital Economy and Transformation, Republic of Togo.

In his speech, he expressed Ecobank’s profound gratitude to the jury and conveyed appreciation to the sponsors and partners, including Huawei, this year’s gold sponsor, Arise, Proparco, Asky Airlines, Jeune Afrique and The Africa Report.

Of special note, sponsor Asky Airlines, which flies to 28 destinations across Africa, awarded free roundtrip tickets to the top three winners. Asky CEO, Esayas Woldemariam handed over the tickets to the winners during the event.

Magalie Gauze-Sanga, CEO of Koree, expressing her excitement of winning the Fintech Challenge, commented: “Koree winning the Ecobank Fintech Challenge is a triumph for innovation and for diversity.

"We are very proud that the technological innovation we have been implementing in Cameroon for many years has been rewarded, and it is also noteworthy that this is the first time a woman has won the Ecobank Fintech Challenge prize.

"We’re excited to work with Ecobank Group across its large footprint to further transform the financial landscape in Africa by digitizing cash-based payments while simultaneously empowering millions of consumers and bringing value to local brands and retailers.”

Since its inception in 2017, the Ecobank Fintech Challenge has attracted over 5,500 submissions from fintech innovators representing 64 countries across its six editions. Out of this impressive pool of talent, 60 exceptional fintechs have been inducted into the Ecobank Fintech Fellowship.

Other partners in this year’s challenge include Konfidants, TechCabal, Africa Fintech Network, ALX Ventures, Afrilabs, MEST Africa, Africa Business Angels Network, BlueSpace, and Naija Start-ups.

Latest Stories

-

Opanin Joseph Kofi Nti

2 hours -

Flights cancelled and new travel warnings issued after Iran strikes

2 hours -

Helicopter crash: Children’s support fund surpasses GH¢10.15m

3 hours -

MobileMoney Ltd breaks silence on viral TikTok fraud claim, urges public to dial 419

4 hours -

Blind refugee found dead in New York after being released by immigration authorities

5 hours -

Stanbic Bank Ghana leads $205m financing for Engineers & Planners

5 hours -

MobileMoney Ltd responds to viral TikTok video by Healwithdiana, advises customers to report fraud on 419

5 hours -

Mobile Money Ltd’s Paapa Osei recognised in Legal 500 GC Powerlist: Ghana 2026

5 hours -

Flights in and out of Middle East cancelled and diverted after Iran strikes

6 hours -

Dr Maxwell Boakye to build 50-bed children’s ward at Samartex Hospital in honour of late mother

6 hours -

One killed and 11 injured at Dubai and Abu Dhabi airports as Iran strikes region

6 hours -

Former MCE, 8 others remain in custody over alleged land fraud in Kumasi

6 hours -

Black Queens players stranded in UAE over Israel-Iran conflict

7 hours -

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

7 hours -

Trump threatens strong force if Iran continues to retaliate

7 hours