The final article in the“BOG MPC AND DEFICIT FINANCING” series calls on Parliament to re-examine the revised 2020 Budget and COVID-19 fiscal gaps that it approved to mitigate the effects of the pandemic.

The areas to examine include (a) the use of “offsets” to show a lower fiscal gap for the approval; (b) besides a lower GDP, extra costs that increase the budget deficit materially from Ghc18.89 billion to Ghc25.1 billion; and (c) since the extra COVID-19 costs are funded, highlight the reasons for using the virus spread as an excuse for Bank of Ghana (BOG) to finance over 50 percent of the disclosed 2020 budget deficit.

It is not transparent to use COVID-19 to resurrect the proposed BOG deficit-financingwhich existed since 1970s but was abolished.

The IMF and other multilateral/bilateral loans and drawdown from the Stabilization Fund now cover COVID costs. As we noted in past articles, since GOG uses about 98 percent of tax revenues on interest payment and compensation only, it was creating financing problems, even without COVID-19.

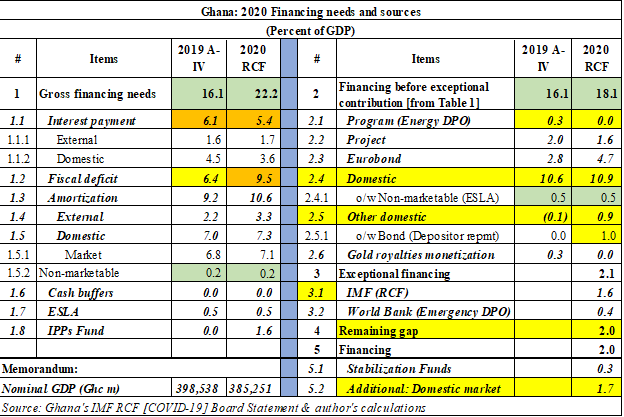

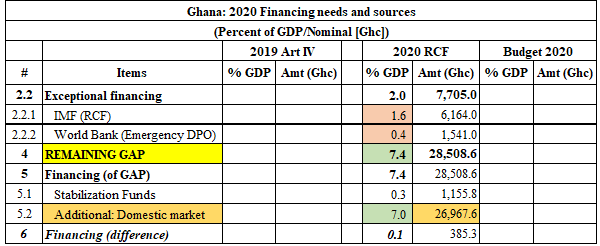

This article uses the IMF’s Article IV (December 2019) and Rapid Credit Facility (RCF)/COVID (April 2020) Reports to show the original 2020 Budget gap (above fiscal deficit) and the gap relating to COVID19. Table 1 is from the RCF/COVID-19 Report.

Table 1 corrections and use in ensuing sections will show that the reasons for the financing pressure are partly due to GOG’s continued use of fiscal “offsets”.

- Arithmetic errors: addition errors of 6.1% plus (-0.2) % percent [Art. IV] and 5.3% plus a further 4.1% [RCF-COVID] in the totals (Lines 1 and 2).

- Fiscal “offsets”: the figures 6.1% and 5.3% in the bullet point above are equal to the interest payment items for Article IV and RCF columns respectively (Line 1.1).

The second point is that GOG has met the projected COVID-19 costs in Table 1 and, therefore, it is not credible to use the virus as the entire excuse for BOG’sdeficit-financing.

- Weak reasons for deficit financing: MPC’s reasons for the tight domestic market conditions and significantly high-interest rates are insufficient but more transparent than MOF.

- Self-inflicted higher deficit: GOG’s use of the narrow base to exclude exceptional costs from so-called “headline” deficits diverges from financing and public debt on a broad basis.

- “Offsets” show “impressive” outcomes: as with “interest payments” in this article, GOG uses implicit offsets and neutralized fiscal items (arrears and exceptional costs) to equate budget deficits to fiscal balances (both cash and commitment basis).

Since the correction of these anomalies is not related to the policy actions on COVID-19, the House must engage in a full debate on proper fiscal rules for recording and reporting budget, financing, and debt outcomes—in considering the MOF request for deficit-financing.

Table 1: IMF RCF (COVID-19) Fiscal Gap Computation

Fiscal pressuresstarted with understating budget deficits

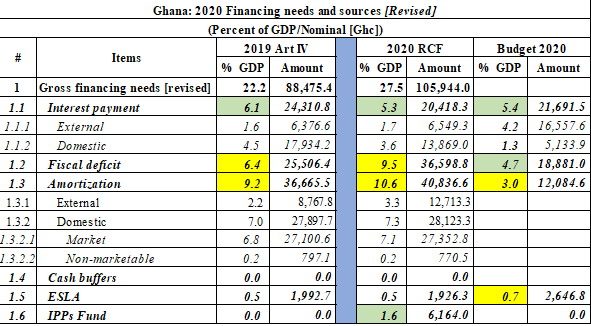

Tables 2 to 6 correct and separate the IMF’s pre-Corona and post-Corona financing needs and possible sources of funding. From the Article IV in 2019, it repeats Table 1’s bases to (a) use “routine” grants or loans to pay for the 2020 Budget deficit and (b) “exceptional” financing for COVID-19. The main conclusions from Table 2 are as follows—

- Borrowing for Budget items: GOGborrow for (a) the normal fiscal deficit; (b) debt service (i.e., interest and amortization); and (c) exceptional expenditures such as energy costs and bailout cost (from ESLA).

- Borrowing usually excludes debt service: however, as Table 2 shows, the rise in the deficit from Ghc18.9 billion to Ghc25.5 billion (Art. IV) and Ghc36.6 billion (RCF) excludes the entire debt service and reverses ESLA “self-financing” for energy and road arrears.

- Inadequate domestic revenue: The Budget can only meet (a) salaries and allowances); (b) goods and services; (c) transfers (e.g., DACF, etc.); and (iv) capital expenditure.

- Errors (“offsets”) exacerbate the gap: As noted, the errors or “offsets” (equal to interest payments in both Art. IV and RCF) increase the burden of financing.

To reiterate, the country is borrowing to repay public debt (principal and interest) and increase in 2020 fiscal deficit from 6.4 to 9.5 percent of GDP—a reflection of GRA’s inability to raise sufficient revenues to support an expanded GOG expenditure program.

Table 2: Budget financing needs

- Crisis not deterring MOF’s use of fiscal “offsets” to impress

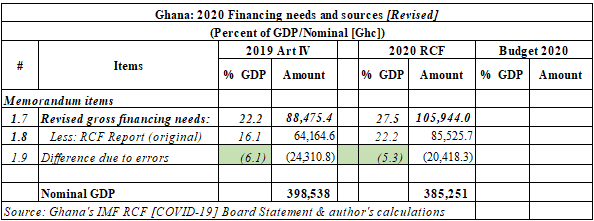

Table 3 shows the [writer’s] adjustments or corrections of “offsets” in calculating the2020 Budget and COVID-19 financing gaps. The precedent is clear: similar abuse of fiscal rules to reduce the budget deficit from 10.3 percent to 6.3 percent of GDP (old basis) in the same fiscal year (2016). Hence, the article concludes beyond a mere fiscal error to use of “offsets” to equate neutralize “interest payments” in Article IV and RCF columns in the Tables. The article continues with the corrected fiscal gaps of 22% (Art. IV) and 27.5 (RCD/COVID).

Table 3: Correction of “financing needs” gap

- The difficult domestic [market] financing situation

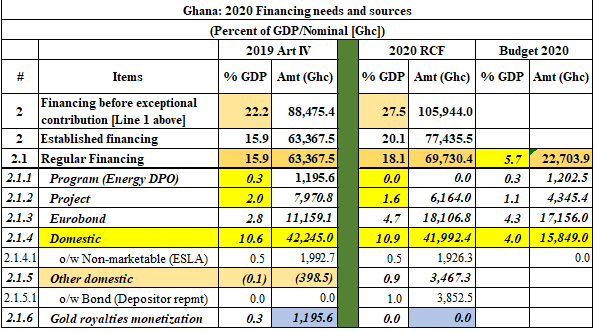

GOG is relying heavily on a“developing” domestic market to finance the 2020 and COVID-19 fiscal gaps. Table 4 shows that correcting the fiscal gap puts more pressure on the Government to look for alternative or unorthodox sources of financing. The article adds some 2020 Budget items for comparison.

Table 4: Financing of 2020 Budget Items

The IMF reports combine Table 4 and Table 5 but, while they overlap, separates the “routine” 2020 Budget and “exceptional” COVID-19 financing needs. The following are some critical observations on financing the routine budget balance (Table 4).

- Inclusion of “off-budget” or “exceptional” items: the IMF shows a narrow basis (i.e., so-called “headline” deficit)separately but adds all exceptional costs (i.e., bank bailout costs and energy sector arrears) to the overall deficit or balance.

- Heavy reliance on domestic market: GOG expects to raise about 65.84 percent (Art. IV) or 60.22 percent (after IMF RCF etc.,) from a relatively weak domestic market—which COVID state got worse for its primary and secondary dealer banks.

From August 2015, as part of the “smart-borrowing” initiative, GOG launched specific measures to deepen the domestic capital market: notably, the book-building “bid” approach for medium and long-term GOG instruments and establishing the Ghana Fixed Income Market (GFIM). These structures are not yet strong to support such high GOG debt market and any spillovers from COVID-19.

Table 5 shows (a) estimates for exceptional COVID-19 expenses and revenue shortfalls, and (b) external and domestic source of financing. Table 5: Exceptional financing of COVID-19 estimates

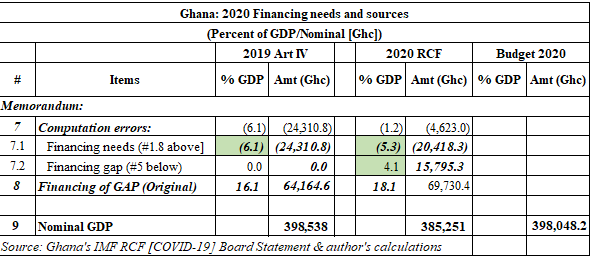

Table 6 shows the Memorandum Table that corrects “offsets” and omissions from the IMF extract in the substantive Tables above.

Table 6: Correction of errors and offsets

- Other signals of tightening domestic financial market

As BOG’s MPC statement noted, the issue is a tightening domestic capital that can now only cater for GOG’s new issuances and rollovers at “significantly high-interest rates”.

- Exceptional domestic financing: after the IMF, World Bank, and other COVID-19 support, GOG must raise an extra 1.7 percent of GDP from the same domestic markets, which takes the overall financing to about 70 percent.

- Financing rollovers: the financing discussed above does not include sourcing funds from the same domestic market to rollover maturingGOG bills and bonds.

- Exit of non-resident investors: the exit of non-resident investors with 50 to 60 percent share of medium-term bonds (not allowed in the short-term treasury and notes markets).

- Increasing use of “tap-ins”: recent large “uncovered” auctions and “build-building” bids result in “tap-ins” (private deals) to refinance existing or take new issues offers.

The government got to its peaks with the use of oil revenues and debt to finance high consumption expenditures. The uses for the 2020 Sovereign Bond include routine current expenses such as the Free Senior High School and expensive initiatives—items that cannot be sustained on borrowing and debt that is expected to hit 70 percent at end-2020. Neither is tapping BOG Balance Sheet sustainable, given the deferral of its debt service commitments.

- Conclusion

GOG’s own 2020 Budget summarizes the domestic financial market situation from 2019 (Q1 to Q3) clearly as follows (p34 par.138 and 139): “The higher-than-programmed financing (especially from domestic sources) stems mainly from the frontloading of financing requirements to meet Government expenditures and other debt service obligations, including the settlement of uncovered Government auctions, following substantial revenue shortfalls.

“As a result, total Domestic Financing, including the drawdown of Government deposits at the Central Bank, domestic market operations, and other sources of domestic financing constituted about 59.6 percent of total financing, amounting to Ghc9.3 billion (2.7% of GDP) against the target of Ghc3.7 billion (1.1% of GDP)”

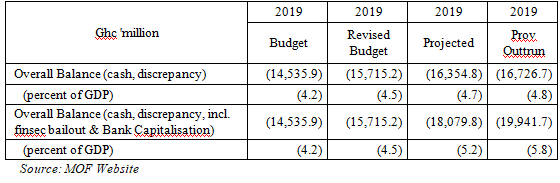

These are based on the narrow deficit basis—excluding exceptional costs—since earlier it states: “Mr. Speaker, following Government's fiscal operations, the overall fiscal balances on cash basis resulted in a deficit of Gc15.7 billion, equivalent to 4.5 percent of GDP) against the target of Ghc14.2 billion (or 4.1 percent of GDP”.

Table 7 from the MOF Website (updated January 2020), continues to show the wide difference between GOGdata and IMF reports. First, the outturn to end-2019 is impressive but hardly credible, and, second, even the addition of exceptional costs by GOG diverges widely from the IMF Article IV and RCF/COVID disclosures.

Table 7: Budget and Fiscal Out turn for 2019

The financing difficulties that are now drawing BOG unorthodox fiscal practices and rules are partly self-inflicted. They derive from the brazen use of unorthodox accounting and fiscal rules such as “offsets”, flattening fiscal balances to equal budget deficits, and excluding “exceptional costs” to impress. These are contrary to passing a comprehensive Public Financial Management Act (PFMA) in 2015 and its “derivative” 2018 Budget Responsibility Act (BRA).

Despite overlaps, Parliament should separate the correction of budget deficit anomalies from measures to minimize the impact of COVID-19 pandemic. Examples of fiscal overlap include the fall in domestic taxes from COVID-19 actions (e.g., lockdown, shutdowns, border closures, etc.,) and OPEC (Russia versus Saudi) crude oil price fall. After all, the fiscal data to end-2019 and 2020 were available before the declaration of the COVID pandemic in March 2020.

Latest Stories

-

CAF Cup: RS Berkane banned from entering Algeria because of a map of Morocco with its Sahara

2 mins -

The media isn’t doing what is expected of journalism – Sulemana Braimah

16 mins -

Truck driver alleged to have caused train accident jailed 6 months

25 mins -

Music review: Okyeame Kwame proves rap dexterity on ‘No Competition’

32 mins -

How a 23-year-old fooled the internet with an AI Kendrick Lamar diss track

53 mins -

No man should be intimidated by the strength of a woman – Charlotte Oduro

55 mins -

Ghana is not immune to terrorist attack – National Security

56 mins -

WAFU B U-17 Championship: Ghana drawn in Group A, face Benin and Cote d’Ivoire

1 hour -

Two hit by stray bullet as Police clash with ‘wee smokers’

2 hours -

Okyeame Kwame aims for another Artiste of the Year win after 15 years

2 hours -

NAGRAT gives government one-week ultimatum to redeem unpaid pensions for 700,000 workers

2 hours -

Deloitte launches Technology, Media and Telecom predictions for 2024

2 hours -

Meta AI expands to Ghana, Nigeria and other countries in Africa; adds new features

2 hours -

GPL: Expect a new Kotoko against Samartex – Ogum tells fans

3 hours -

Court orders service of notice for DNA test to Mohbad’s wife

3 hours