Stocks fell and the dollar advanced on Thursday after the Federal Reserve pledged to keep interest rates low for a long time but stopped short of offering further stimulus to shore up a battered U.S. economy.

European stocks are expected to follow suit, with the futures for the bellwether Euro Stoxx 50 index trading 0.96% lower in early trade.

MSCI’s broadest index of Asia-Pacific shares outside Japan lost 1.01%, running out of steam after five straight days of gains. Japan’s Nikkei shed 0.63%.

U.S. S&P 500 futures fell 1.03% in Asia on Thursday following a 0.46% drop in the S&P 500 on Wall Street.

Tech shares fared worse, with the Nasdaq Composite dropping 1.25% on Wednesday. Nasdaq futures fell 1.14% in Asia.

“In essence, high-tech shares were overbought and we’ve seen a correction since early this month,” said Soichiro Monji, chief strategist at Nishimura Securities in Kyoto. “I think that is still continuing, with the Fed just being a fresh trigger.”

The Fed said it would keep interest rates near zero until inflation is on track to “moderately exceed” the central bank’s 2% inflation target “for some time.”

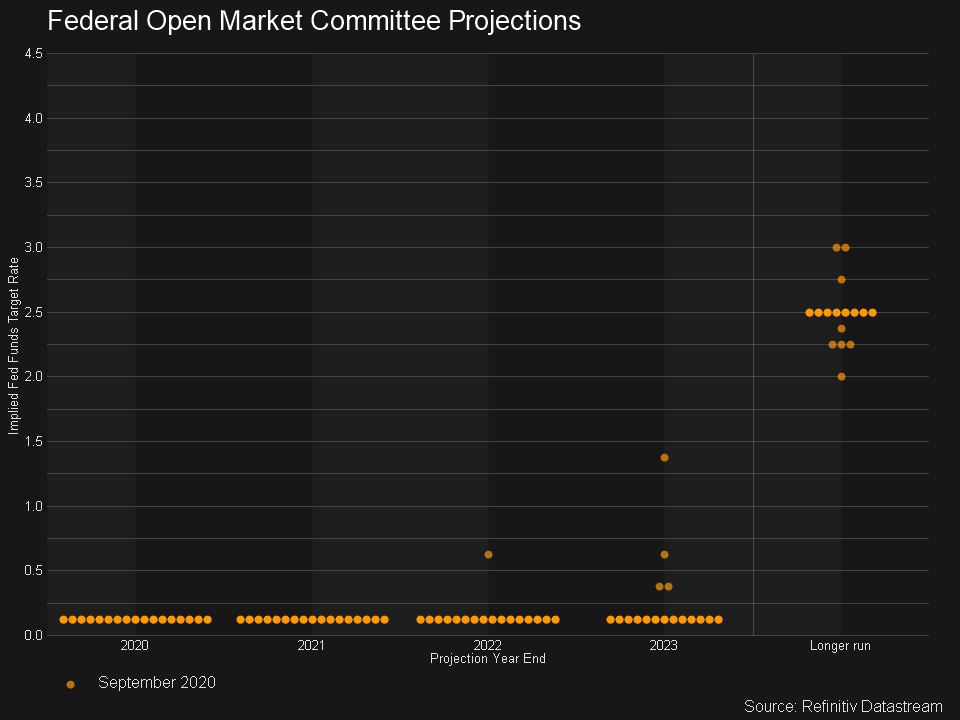

New economic projections released with the policy statement showed most policymakers see interest rates on hold through to at least 2023, with inflation not breaching 2% over that period.

“Of course, sensible people wouldn’t really hold anyone to macro forecasts that far out so we’ll cross that bridge when we get to it,” said Derek Holt, head of capital markets economics at Scotiabank in Toronto.

“Nevertheless, markets are priced for basically one outcome here and that is little inflation and no hikes for years to come.”

(Graphic: Fed "dot plots", )

Still, with such expectations considered a foregone conclusion by many investors, there was some disappointment in the market.

“By and large the Fed delivered the minimum of what had been expected by markets with a key focus on the implications of a move to ‘flexible’ inflation targeting,” said Stephen Miller, investment strategist at GSFM in Sydney.

The 10-year U.S. Treasuries yielded 0.677%, a few basis points above its levels before the Fed.

The U.S. dollar gained against most other currencies.

The euro dropped 0.4% to $1.1767 while the Australian dollar lost 0.4% to $0.7278, having erased earlier gains made after stronger-than-expected local jobs data.

The Chinese yuan also dropped about 0.35% to 6.7686 per dollar, stepping back from a 16-month high hit on Wednesday.

The yen was little moved at 104.98 to the dollar having hit a 1-1/2-month high of 104.80 per dollar overnight.

With focus on new Prime Minister Yoshihide Suga, who is seen by some as a strong opponent of a higher yen, some traders said the market may be tempted to test his resolve on the currency.

“One interesting speculative trade in the near-term will be to long the yen ahead of the coming long weekend in Japan,” said a senior trading manager at a major Japanese bank.

The Bank of Japan maintained its policy as widely expected.

As the dollar gains, oil prices gave up some of their big gains made on Wednesday on a drawdown in U.S. crude and gasoline inventories, with Hurricane Sally forcing a swath of U.S. offshore production to shut.

Brent crude dropped 0.99% to $41.80 per barrel while U.S. crude fell 1.2% to $39.68 per barrel.

Gold also slipped 0.8% to $1,943.8 per ounce.

Latest Stories

-

Herman Suede set to release ‘How Dare You’ on April 22

54 mins -

Heal KATH: Kuapa Kokoo, Association of Garages donate 120k to support project

1 hour -

KNUST signs MOU with Valco Trust Fund, Bekwai Municipal Hospital to build student hostel

1 hour -

The influence Ronaldo has on people, Cadman Yamoah will have same on the next generation – Coach Goodwin

2 hours -

Gender Advocate Emelia Naa Ayeley Aryee Wins prestigious Merck Foundation Awards

3 hours -

South Africa bursary scandal suspects granted bail

3 hours -

Ecobank successfully repays $500m Eurobond due April 18

3 hours -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

3 hours -

Extortion and kidnap – a deadly journey across Mexico into the US

4 hours -

Rihanna says fashion has helped her personal ‘rediscovery’ after having children

4 hours -

Development Bank Ghana targets GH¢1bn funding for commercial banks in 2024

4 hours -

Shatta Movement apologises to Ghana Society of the Physically Disabled after backlash

5 hours -

Sammy Gyamfi writes: Tema-Mpakadan Railway Project; A railway line to nowhere

5 hours -

Bright Simons: Is the World Bank saving or harming Ghana?

5 hours -

CAF Cup: RS Berkane banned from entering Algeria because of a map of Morocco with its Sahara

6 hours