The Minister of Finance, Ken Ofori-Atta disclosed in the 2023 budget statement that Ghana’s public debt scaled-up by GH₵93 billion ($7.2 billion at current rate interbank rate) due to the depreciation of the Ghanaian cedi in less than 11 months this year.

According to the Minister, "It is not only the individuals and households who are adversely affected by the depreciation of the cedi. For us at the Ministry of Finance, the depreciation of the cedi seriously affects our ability to effectively manage our debt. Indeed, our stock of debt has increased by GH₵93 billion this year alone due to the depreciation of the cedi since the beginning of 2022."

This amount is equivalent to the estimated amount spent by the Qatari government in putting up 7 stadia from scratch for the ongoing 2022 FIFA World Cup.

The estimated $220 billion to have been spent on this year’s World Cup tourney, is more than 15 times the amount spent by Russia during the 2018 World Cup. In terms of key cost drivers, one of the most apparent issues is the stadiums. Seven of the eight venues have been built from scratch. The government says the cost of constructing all 8 stadia is $6.5 billion.

The much-anticipated 2023 budget was presented by Finance Minister Ken Ofori-Atta, who only reiterated the obvious. He disclosed the nature of Ghana's debt portfolio in a formal manner. A review of Ghana's debt, in his words, "shows a "moderate" rated debt carrying capacity and an overall risk rating of "high risk of debt distress" and unsustainable due to the negative impact of exogenous shocks on the economy that compounded existing vulnerabilities."

In simple terms, Ghana is finding it difficult to carry a debt burden worth $48.9 billion (as of September 2022), and debt restructuring is the only gateway to have access to the projected $3 billion IMF bailout package.

According to the International Monetary Fund, “in cases where a country’s debt is assessed as unsustainable, the IMF is precluded from providing financing unless the member takes steps to restore debt sustainability, including by seeking a debt restructuring from its creditors. The IMF and World Bank still need to conduct a thorough update of the debt situation through a new Debt Sustainability Analysis (DSA), which will then be presented to our Executive Board when it considers the authorities’ program request.”

Barely five days after the embattled Finance Minister confirmed the government's decision to carry out a debt operation exercise, an international credit rating agency, Moody’s dropped Ghana’s long-term sovereign bonds ratings to deeper junk territory.

According to Moody’s, “the ‘Ca’ rating reflects Moody's expectation that private creditors will likely incur substantial losses in the restructuring of both local and foreign currencies debts planned by the government as part of its 2023 budget proposed to Parliament on 24 November 2022.”

The IMF, a day after Ghana’s downgrade confirmed this decision. An update on the fund’s website stated that “authorities [Ghana] have assessed their public debt as being unsustainable over the medium term. Together with efforts to bring the government deficit down, they have announced their intention to conduct a debt operation to ensure debt sustainability.”

The IMF however, indicated that the “nature of engagements and debt operations between Ghana and its creditors are sovereign decisions.”

On 4th December 2022, the government fulfilled its sovereign component of the bargain; it finally announced a debt operation exercise called “Domestic Debt Exchange” which outlined the nature of debt restructuring for domestic creditors.

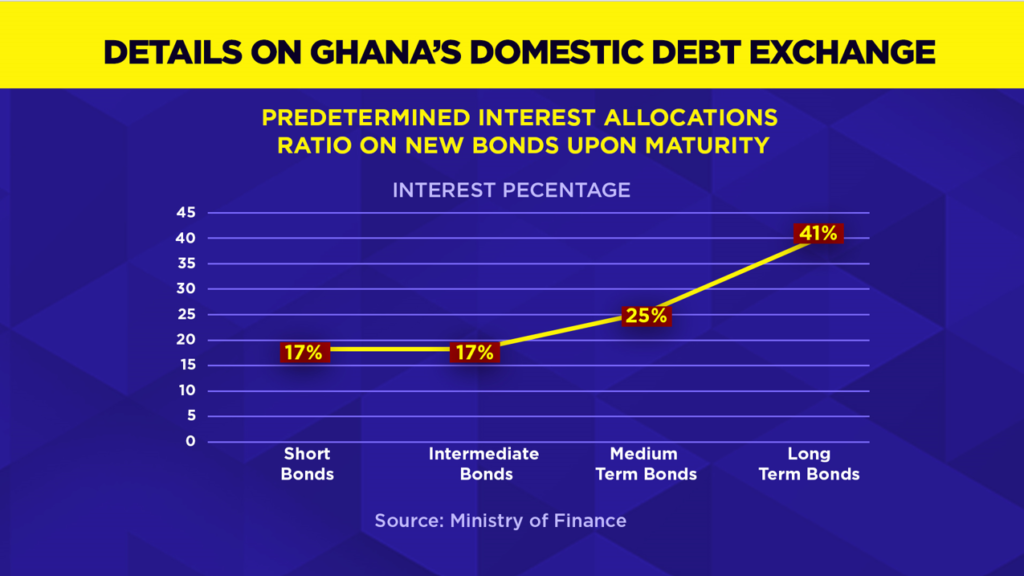

The Minister in charge of Finance indicated that “under the Programme, domestic bondholders will be asked to exchange their instruments for new ones. Existing domestic bonds as of 1st December, 2022 will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037. The annual coupon on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments will be semi-annual.”

He however emphasized that “the Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups.”

As a result, “Treasury Bills are completely exempted and all holders will be paid the full value of their investments on maturity.” The Finance Minister reiterated President Akufo-Addo’s earlier position that “there will be NO haircut” on the principal of bonds and that individual holder of bonds will not be affected.

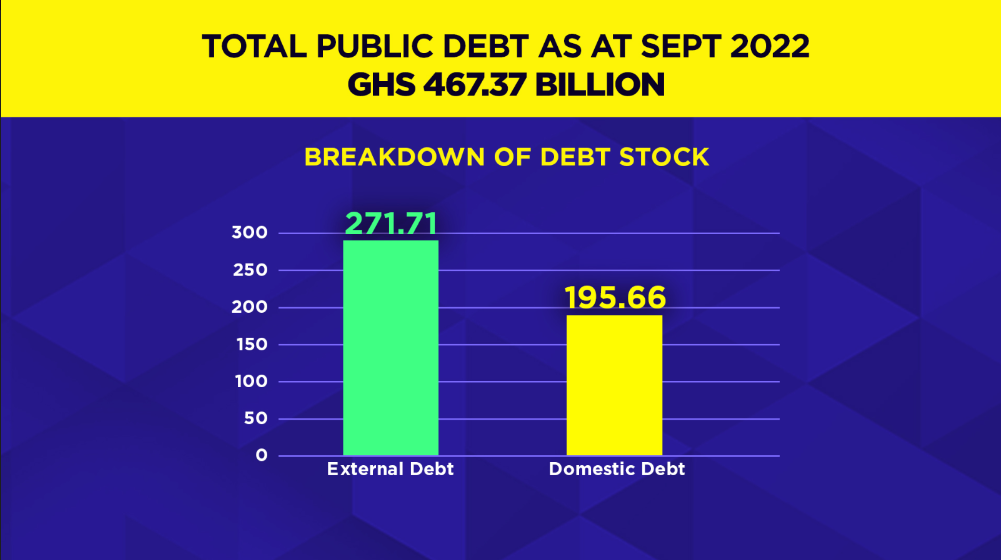

As of September 2022, government of Ghana’s sovereign debt portfolio stood at GH₵467.4 billion ($48.9 billion) with a domestic component worth GH₵195.7 billion ($20.5 billion) and an external slice of GH₵ 271.7 billion ($28.4 billion).

Ghana’s most recent annual debt report (2021) released by the Finance Ministry states that “domestic investors continued to deepen their participation in the domestic bond market in 2021. As a result, holdings of Government securities by local investors increased by 25.0% from GH¢121.93 billion in 2020 to GH¢152.40 billion in 2021, while foreign investor holdings grew by 4.7% in comparison, from GH¢27.69 billion in 2020 to GH¢28.99 billion in 2021. Consequently, the share of foreign holdings decreased from 18.5% to 16.0% between 2020 and 2021, while the share of local investors in the domestic debt portfolio increased from 81.5% to 84.0% over the same period.”

An analysis shows that the holding structure of Government securities continued to be dominated by the banking sector, including the Central Bank. At end-December 2021, the banking sector held 50.2% of the total domestic debt stock, which is a slight decrease from 51.3% recorded in 2020.

However, the sector’s nominal holdings increased from GH¢121.93 billion at end-December 2021 to GH¢152.40 billion as at end-December 2021, this was mainly attributed to increases in its stock of both the short and medium-term instruments.

The holdings by the non-bank sector increased in 2021 to 33.8% from 30.2% in 2020. This was mainly attributed to the increased participation of individual investors as well as firms and institutions.

Latest Stories

-

Fitch affirms ETI at B-; Outlook stable

33 mins -

Bawumia meets Pope Francis

41 mins -

Former Bibiani GoldStars midfielder Frank Adjei Jr continues fine form in Swedish League

45 mins -

J.B. Dankwah Adu’s Murder: Court orders Sexy Dondon to open his defence

48 mins -

Marrakech 2024: Five para-athletes to represent Ghana in WPA Grand Prix in Morocco

59 mins -

U.S Senate approves bill to ban TikTok

1 hour -

T-Pain involved in hit-and-run, warns culprit he’ll find them

1 hour -

Cedi hits GH¢14.00 to a dollar; depreciates 12.08%

1 hour -

Major portions of Kasoa-Winneba road to open to traffic in 8 months

1 hour -

Kwadaso onion traders reject new location, express fear over future eviction

2 hours -

Pensions: 81% of pensioners had benefit shortfalls in 2020 – Abdallah Mashud

2 hours -

All Regional Games: Torch relay ceremony hits Oti Region

2 hours -

CSO calls for immediate removal of COCOBOD CEO from office

2 hours -

How a young female geologist’s thesis is paving the way for Ghana’s Green Mineral Future 5 decades later

2 hours -

Pensions: The last time government paid Tier-2 funds was in June 2023 – Angel Carbonu

2 hours