Audio By Carbonatix

The 2024 KPMG Customer Experience Survey has revealed that the Ghanaian investment landscape reflects a cautious approach to investments with interests in both low and medium risk opportunities as individuals navigate economic challenges in pursuit of financial security and independence.

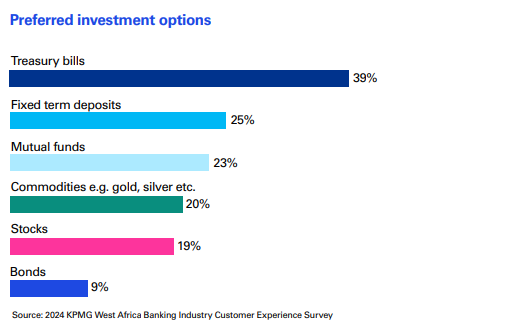

According to the report, the recent insights reveal that treasury bills remain the most preferred investment option, with 39% of respondents opting for these low-risk instruments.

Fixed or term deposits closely follow at 25%, further reinforcing the cautious approach among many Ghanaians, who prioritise stability and guaranteed returns amidst economic uncertainty.

However, the report said there are signs of gradual diversification in investment choices.

Mutual funds, selected by 23% of respondents, are gaining traction as a medium-risk option offering balanced returns.

Additionally, commodities such as precious metals and agriculture products, accounted for 20%, which demonstrated a growing appetite for alternative investments as a hedge against inflation and economic instability.

Expectedly, higher-risk instruments such as stocks (19%) and bonds (9%) remain underutilised, pointing to limited confidence.

The report added that the hesitancy of Ghanaians to adopt these investment options highlights the need for banks to provide education and solutions to bridge knowledge gaps and demystify complex financial products.

Despite these trends, the survey also revealed that 34% of respondents are willing to take risks with their investments, signalling an underlying desire for wealth creation and financial independence.

Despite these challenges, the survey also highlighted how Ghanaians are channelling resources toward personal growth, financial security and family welfare.

24% Ghanaians Invest in Skills Acquisition, Businesses

When asked about their top three priorities, approximately 24% of respondents are investing in skill acquisition and business ventures reflecting a desire for career advancement and financial independence.

Family obligations remained a central priority, with 24% dedicating funds to education, healthcare and general welfare.

Similarly, wealth generation through investments and property sales also gained traction, with 22% of respondents pursuing these strategies.

Latest Stories

-

Kenyans drop flowers for Valentine’s bouquets of cash. Not everyone is impressed

10 minutes -

Human trafficking and cyber fraud syndicate busted at Pokuase

18 minutes -

Photos: First Lady attends African First Ladies for Development meeting in Ethiopia

31 minutes -

2026 U20 WWCQ: Black Princesses beat South Africa to make final round

1 hour -

World Para Athletics: UAE Ambassador applauds Ghana for medal-winning feat

2 hours -

Photos: Ghana’s path to AU Chairmanship begins with Vice Chair election

2 hours -

Chinese business leader Xu Ningquan champions lawful investment and deeper Ghana–China trade ties

2 hours -

President Mahama elected AU First Vice Chair as Burundi takes over leadership

3 hours -

Police work to restore calm and clear road after fatal tanker crash on Suhum–Nsawam Highway

3 hours -

Four burnt, several injured in Nsawam-Accra tanker explosion

4 hours -

Police arrest suspect in murder of officer at Zebilla

5 hours -

SUSEC–Abesim and Adomako–Watchman roads set for upgrade in Sunyani

5 hours -

CDD-Ghana calls for national debate on campaign financing

6 hours -

INTERPOL’s decision on Ofori-Atta: What it means for his U.S. bond hearing and the legal road ahead

6 hours -

Parties can use filing fees to cover delegates’ costs, end vote-buying – Barker-Vormawor

6 hours