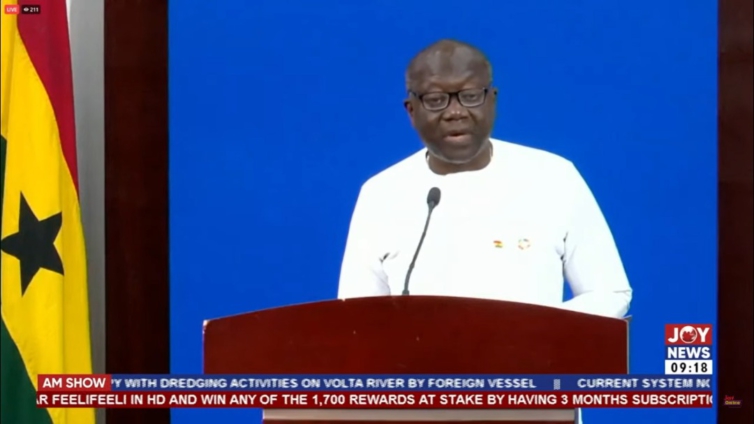

Finance Minister Ken Ofori-Atta has revealed that government expends 70 per cent of the country’s tax revenue on debt serving.

Explaining reasons the Domestic Debt Exchange is being introduced, Mr Ofori-Atta said the move has become necessary due to the challenges with debt servicing.

According to him, “debt servicing is consuming “almost of government’s revenue and also 70 per cent of tax revenue. Which is why we are announcing this to restore our capacity to service debt.”

Mr Ofori-Atta said domestic bondholders will be asked to exchange their instruments for new ones

“Existing domestic bonds as of December 1, will be exchanged for a set of four new bonds maturing in 2027, 2029, and 2037.”

The annual coupons on all of these bonds will be set at 0 % in 2023, 5% in 2024 and 10% from 2025 until maturity.

He, therefore, asked bondholders to support government's course to revamp the economy.

Latest Stories

-

Manchester City thrash Brighton to go second in table

16 mins -

NDC’s running-mate speech proves readiness to lead – Asah-Asante

33 mins -

Further win for nibima as another KNUST study supports medicinal prowess

35 mins -

World Bank’s food price index eases; maize, wheat prices hit 3-year low

2 hours -

2020 polls all about pulling Ghana back from precipice of destruction, corruption – Naana Jane

2 hours -

Guru expresses interest in contesting SRC election at UG

2 hours -

Oil prices projected to average $84 in 2024 – World Bank

2 hours -

Meet 2 Ghanaian entrepreneurs on a mission to connect 1m African professionals to global companies by 2034

3 hours -

NCA approves Starlink’s satellite broadband application

3 hours -

Government orders FGR to revamp mining operations; assures workers of commitment to their welfare

3 hours -

Arne Slot philosophy could suit Liverpool – Van Dijk

3 hours -

EC replies Mahama: You also appointed someone who was tagged NDC

3 hours -

See colourful outdoor of Prof Naana Opoku-Agyemang as NDC’s running mate

4 hours -

Akufo-Addo commissions 15MWP Kaleo Solar Power Plant

4 hours -

GCB Bank PLC leads African financial integration, hosts ZICB delegation

4 hours