The Bank of Ghana’s updated Composite Index of Economic Activity (CIEA) for July 2021 reflected continued recovery in domestic economic activity.

According to the Central Bank, the real CIEA recorded a 20.0% year-on-year growth in July 2021, compared with 20.2% in June 2021, and 3.9% growth in July 2020.

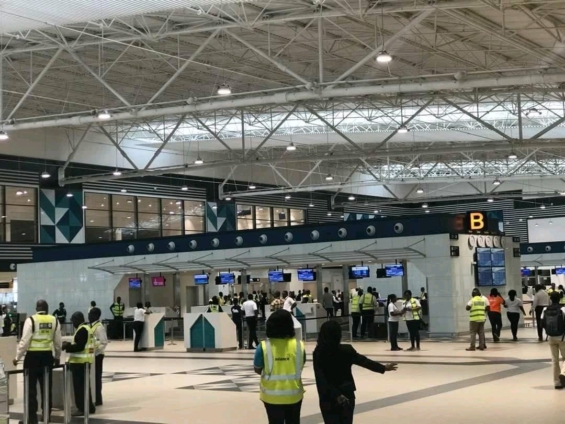

The growth in the indicators the Central Bank said were somewhat broad-based with port activity, imports, domestic VAT, and air-passenger arrivals accounting for the increase.

But the Ghana Purchasing Managers Index fell in August 2021 mainly on the back of rising input costs. The decline in the Purchasing Managers Index, according the Bank of Ghana, was consistent with the results of the Bank’s latest confidence surveys, conducted in August 2021, and which indicated some softening of business sentiments.

The survey results revealed the inability of businesses to meet their short-term company targets driven by high input costs, unavailability of raw materials, weak consumer demand, and rising labour costs. However, consumer confidence, improved, reflecting optimism about current and future economic conditions.

Also, the pace of growth in total liquidity moderated in August 2021. Broad money supply (M2+) increased, on a year-on-year basis, by 20.2% in August 2021, compared with the 24.8% growth recorded in August 2020.

The slower growth, the Central Bank, said was due to a contraction in the Net Foreign Assets (NFA) of the banking sector. Reserve money, on the other hand, increased significantly by 36.7%, compared with 20.2% over the same comparative period, largely reflecting the net build-up in the Bank’s foreign reserves, higher cocoa purchases than anticipated, and continued implementation of COVID-related policy measures.

Latest Stories

-

Let’s prioritize research quality in higher education institutions for industrial growth-Prof. Nathaniel Boso

5 hours -

Herman Suede is set to release ‘How Dare You’ on April 24

8 hours -

Heal KATH: Kuapa Kokoo, Association of Garages donate 120k to support project

9 hours -

KNUST signs MOU with Valco Trust Fund, Bekwai Municipal Hospital to build student hostel

9 hours -

The influence Ronaldo has on people, Cadman Yamoah will have same on the next generation – Coach Goodwin

9 hours -

Gender Advocate Emelia Naa Ayeley Aryee Wins prestigious Merck Foundation Awards

10 hours -

South Africa bursary scandal suspects granted bail

11 hours -

Ecobank successfully repays $500m Eurobond due April 18

11 hours -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

11 hours -

Extortion and kidnap – a deadly journey across Mexico into the US

11 hours -

Rihanna says fashion has helped her personal ‘rediscovery’ after having children

11 hours -

Development Bank Ghana targets GH¢1bn funding for commercial banks in 2024

12 hours -

Shatta Movement apologises to Ghana Society of the Physically Disabled after backlash

12 hours -

Sammy Gyamfi writes: Tema-Mpakadan Railway Project; A railway line to nowhere

13 hours -

Bright Simons: Is the World Bank saving or harming Ghana?

13 hours