Sam Bankman-Fried, who once ran one of the world's biggest cryptocurrency exchanges, has been found guilty of fraud and money laundering at the end of a month-long trial in New York.

The jury delivered its verdict after just four hours of deliberations.

It concludes a stunning fall from grace for the 31-year-old former billionaire and one of the most public faces of the crypto industry.

Bankman-Fried was arrested last year after his firm, FTX, went bankrupt.

He now faces decades in prison. His sentencing has been set for 28 March 2024.

"Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history - a multibillion-dollar scheme designed to make him the king of crypto," US attorney Damian Williams said in a statement after the verdict.

"This case has always been about lying, cheating, and stealing, and we have no patience for it," he added.

Prosecutors had accused Bankman-Fried of lying to investors and lenders and stealing billions of dollars from cryptocurrency exchange FTX, helping to precipitate its collapse. They charged him with seven counts of fraud and money laundering.

He had pleaded not guilty to all the charges, maintaining that, while he had made mistakes, he had acted in good faith.

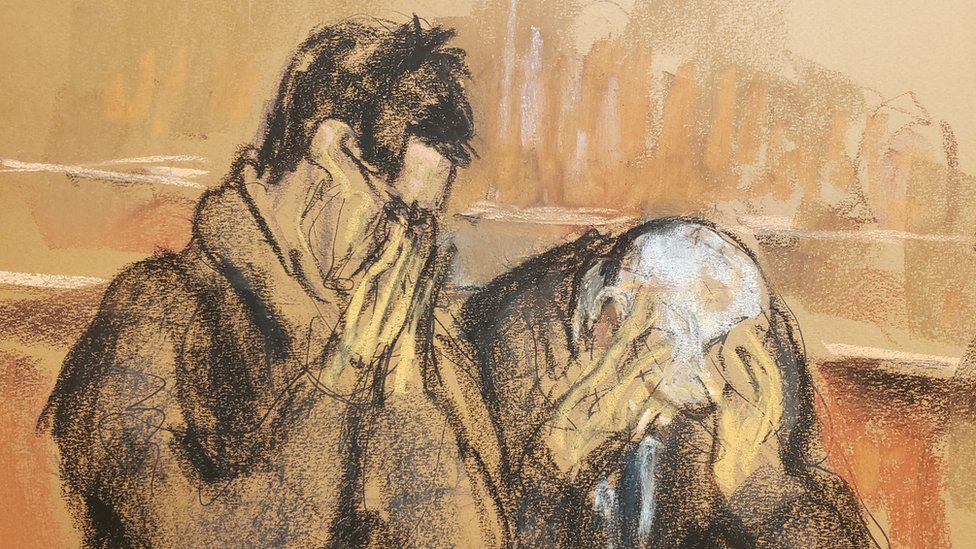

After the verdict Bankman-Fried's lawyer Mark Cohen said: "We respect the jury's decision. But we are very disappointed with the result."

"Mr Bankman-Fried maintains his innocence and will continue to vigorously fight the charges against him," he added.

A spokesperson for Bankman-Fried did not immediately respond to a BBC request for comment on whether he planned to appeal the verdict.

Three of Bankman-Fried's his former close friends and colleagues, including his ex-girlfriend Caroline Ellison, pleaded guilty and agreed to testify against him in hopes of reducing their own sentences.

They are to be sentenced at a later date.

"The government won this case by putting a lot of pressure on cooperators, getting deals with them very early on and trying this case in a very streamlined way," said former federal prosecutor Renato Mariotti.

"Instead of overcomplicating the case, turning it into some complicated crypto case, they tried it as a garden variety fraud."

The prosecution presented evidence that Bankman-Fried's crypto trading firm Alameda Research received deposits on behalf of FTX customers from the early days of the exchange, when traditional banks were unwilling to let it open an account.

Instead of safeguarding those funds, as Bankman-Fried repeatedly pledged to do in public, he spent the money to repay Alameda lenders, buy property and make investments and political donations.

When FTX went bankrupt last November, Alameda owed it $8bn (£6.5bn).

"He took the money. He knew it was wrong. He did it anyway, because he thought he was smarter and better and that he could figure his way out of it," assistant US attorney Nicolas Roos said in his closing arguments.

Bankman-Fried made the risky move of taking the stand in his own defence, hoping to convince jurors that prosecutors had failed to prove he acted with criminal intent.

"There was bad judgment," said defence lawyer Mark Cohen, offering a portrait of a nerdy mathematician who was overwhelmed as his companies grew rapidly.

"That does not constitute a crime."

Bankman-Fried defended the money transfers between his firms as "permissible" and testified that he was largely unaware of the financial hole described by his deputies until a few weeks before the FTX collapse last year.

The downfall left many customers unable to recover their funds.

Lawyers working on the bankruptcy case have since said they have recovered the vast majority of the missing money.

Bankman-Fried's trial was closely watched for its implications for the crypto industry as a whole, which has failed to recover from last year's market turmoil.

He has been seen as a poster child for the problems in the sector, which top regulators in the US have described as rife with criminality.

Before the collapse of his companies, he was known for hobnobbing with celebrities and appearing frequently in Washington and in the media, to discuss the sector.

The rapid growth of FTX and his deal-making last year, when a market downturn hit other crypto firms, earned him the moniker "the king of crypto".

With Congress unlikely to pass new rules for crypto anytime soon, Mr Mariotti said he expected US courts to continue to be the site of battles over the industry.

"I really think having specific crypto regulations in the United States would reduce the sort of crime that occurred in this particular case," he said.

"Sadly I don't think we're going to see regulation in the very short term… But it certainly means that the fight is going to continue in courts and civil cases litigated by the SEC [Securities and Exchange Commission] and CFTC [Commodity Futures Trading Commission]" he added, referring to US financial regulatory agencies.

Latest Stories

-

SML is just Agyapa in suit and tie – Bright Simons

16 mins -

Domelevo condemns selection of KPMG to audit GRA/SML contract as illegal and unprofessional

28 mins -

SML/GRA contract: OSP should have released its report by now – Inusah Fuseini

1 hour -

KPMG report exonerates us – SML

1 hour -

Works and Housing Ministry seeks lasting solutions to challenges with stakeholders engagement

1 hour -

President’s statement on GRA-SML contract underlines Fourth Estate’s revelation – MFWA

2 hours -

Our services are one of a kind, not done by NPA – SML insists

2 hours -

We operate legally and collaborate with world-class partners – SML

2 hours -

Director urges parents to protect children from abuse

2 hours -

Imani-Ghana criticises Akufo-Addo for not lauding Fourth Estate’s contribution to social development

2 hours -

Man remanded for allegedly stabbing businessman with broken bottle and screwdriver

3 hours -

Population in Kumasi Central Prison surges to 1800, threefold exceeding capacity

3 hours -

NPP to conduct La Dadekotopon parliamentary primary today

3 hours -

KPMG’s report on GRA and SML deal, government white paper on report and matters arising

3 hours -

I won’t reply to Chris Brown tour criticism – Ayra Star

3 hours