Audio By Carbonatix

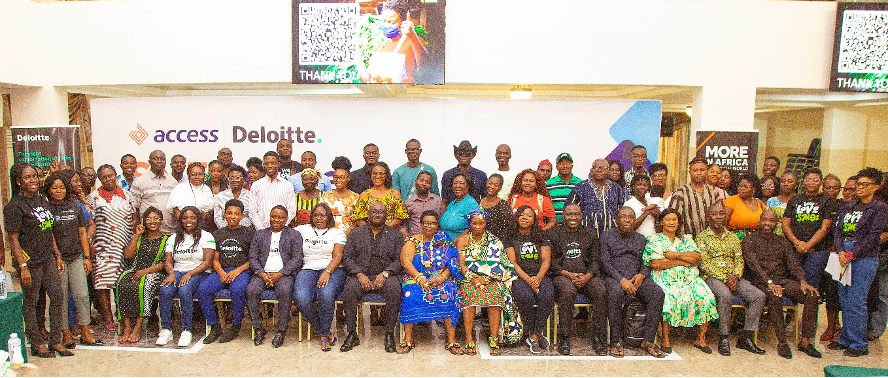

Access Bank Ghana in collaboration with Deloitte Ghana, successfully hosted the 5th edition of the Small and Medium-sized Enterprises (SMEs) Business Interaction Series.

This reinforces the bank’s commitment to empowering SMEs with essential financial literacy skills for sustainable growth.

The event, held on Tuesday, February 25, 2025, brought together the Eastern Regional Minister, Rita Akosua Adjei Awatey, traditional authorities, SME owners, financial experts, and industry stakeholders for insightful discussions on financial planning, risk management and strategic decision-making.

Participants were guided on best practices for managing their finances, accessing funding opportunities, and positioning their businesses for long-term success.

Speaking at the event, Group Head of Business Banking at Access Bank Ghana, Jones Darmoe reaffirmed the bank’s commitment to supporting SMEs.

“Over the years, Access Bank has supported over 200,000 SMEs across the country through financial facilities, advisory services, SME fairs, among other initiatives.

"The financial literacy programme further deepens our commitment to contribute to the growth of SMEs in Ghana.

"Through this initiative, we are equipping SMEs with the right financial management tools to help them navigate challenges, seize opportunities, and contribute meaningfully to Ghana’s economy.”

Participants expressed appreciation for the initiative, highlighting the relevance of the topics discussed and the practical knowledge gained.

The SME Business Interaction Series is part of Access Bank’s broader strategy to empower businesses with the resources and expertise needed to thrive in an ever-evolving economic landscape.

Since its inception, the SME Business Interaction Series has touched the lives of over 8,500 entrepreneurs, equipping them with the financial knowledge and tools needed to strengthen and grow their businesses.

Through this initiative, many SMEs have gained access to tailored financial solutions, helping them better manage cash flow and plan for the future.

Additionally, SMEs have transitioned onto digital platforms, making their businesses more efficient and resilient in an increasingly digital world.

Furthermore, 60% of the participants are women-led businesses, reaffirming Access Bank’s dedication to supporting women achieve their financial goals. Participant businesses that have engaged with this program have seen an average growth of 37%.

Over the years, Access Bank (Ghana) Plc has demonstrated an unwavering commitment to understanding its customers' needs, consistently delivering exceptional service, and empowering individuals and businesses alike.

With a focus on financial education, innovation and customer service excellence, Access Bank has become a trusted partner in helping customers achieve their financial goals, driving sustainable growth and fostering a prosperous community.

Latest Stories

-

Morocco and Senegal set for defining AFCON final under Rabat lights today

23 minutes -

Trump tariff threat over Greenland ‘unacceptable’, European leaders say

48 minutes -

Evalue-Ajomoro-Gwira MP kicks against VALCO sale

1 hour -

Mercy Johnson withdraws alleged defamation case against TikToker

2 hours -

Ghana accepted Trump’s deported West Africans and forced them back to their native countries

2 hours -

No evidence of theft in Unibank Case – A‑G explains withdrawal of charges against Dr Duffour

3 hours -

Labourer remanded for threatening to kill mother

3 hours -

Court remands farmer over GH¢110,000 car fraud

3 hours -

Tension mounts at Akyem Akroso over ‘sale’ of royal cemetery

3 hours -

Poor planning fueling transport crisis—Prof. Beyuo

4 hours -

Ahiagbah slams Prof. Frimpong-Boateng over “fake” party slur

4 hours -

Family traumatised as body of Presby steward goes ‘missing’ at mortuary

5 hours -

Why Ghana must maintain the NPA’s price floor in the petroleum market

5 hours -

Serwaa Amihere apologises to PRESEC community over ‘homosexual breeding ground’ comment

6 hours -

Dr Arthur Kennedy slams NPP’s “dubious” plot to expel Prof Frimpong-Boateng

6 hours