Audio By Carbonatix

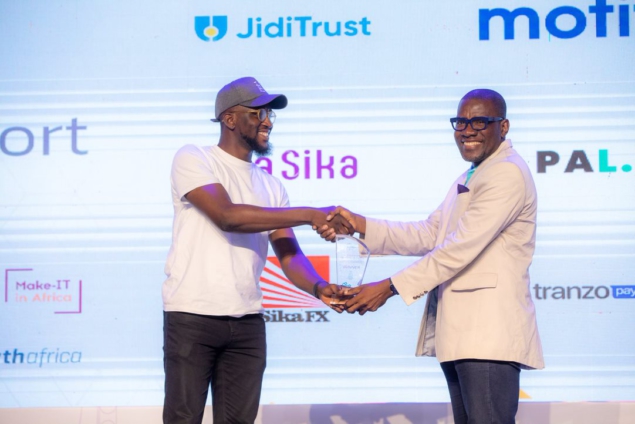

MyFIG was selected as the winner of the Demo Day pitch contest held as part of the climax of the Ghana Digital Innovative Week 2022 after it was selected over 12 other competing startups of the NextGen Fintech Generator.

Figtech Limited’s winning pitch was the showcasing of its flagship app MyFIG, which aggregates and compares offerings in Life Insurance, Investment and Pensions to allow customers to easily purchase packages in their own optimal configuration or portfolio.

The app fills the gap by easing the complexity and information required to make decisions on what pension or financial packages to choose. Some of MyFIG’s unique offerings included a personalised portfolio dashboard and purchasing interface.

Figtech is working with potential partners and service providers in the space to hit the Ghanaian market.

Figtech, a 14-month-old company, successfully made its pitch to a panel of seasoned industry experts, regulators, government agencies and potential partners out of which they were shortlisted with two other companies out of the total 12 startups that participated in the pitch demo competition.

“The company’s vision is to support the Financial Services sector (Life Insurance, Investments, and Pensions) to improve customers' financial health through digital technology to make them and loved ones financially resilient during challenging moments”, the company’s CEO, Festus William Amoyaw said.

According to him, the company has developed the Minimum Value Product (MVP) and is testing the API interface with some Life Insurance Companies.

The future opportunity for the Life Insurance market is estimated between $2.5 billion to $4 billion based on the data from the National Insurance Commission.

Life Insurance penetration can increase in Ghana over the current 0.5% (NIC, 2019).

Again, the National Pension Regulatory Authority (NPRA) says the total workforce in Ghana is about 11 million, with only a little above 2.6 million in a minimum one pension scheme.

He said digital technology would complement the traditional channels of reaching the customer to enhance service delivery.

The award humbles the company, but, at the same time, we are motivated to continue developing the product whiles engaging with the requisite stakeholders for a successful launch.

The NextGen Fintech Accelerator program was an initiative of Stanbic Bank and GIZ and was implemented by Growth Africa.

Latest Stories

-

Plan International Ghana launches 9.4 million CAD support for women’s rights groups

7 minutes -

KsTU adjudged best technical university, 4th best university in Ghana in 2026 QS sub-Saharan Africa rankings

11 minutes -

Ghana considers extradition option in intimate image leak case – Gender Minister

30 minutes -

Bawumia launches NPP rebuild, announces new policy unit ahead of 2028

30 minutes -

We’re strengthening cross-border and cybersecurity collaboration to combat online abuse – Gender Minister

33 minutes -

Obama clarifies views on aliens after saying ‘they’re real’ on podcast

38 minutes -

Russia killed opposition leader Alexei Navalny using dart frog toxin, UK says

41 minutes -

OMCs commence fuel price increases: GOIL sells petrol at GH¢10.24 as diesel rises to GH¢12.83

42 minutes -

Modern, Vertical, Visionary: PUNA officially launched in Accra

52 minutes -

Bishop Joel Duncan-Williams pays courtesy call on Central Regional Minister during evangelical visit to UCC

53 minutes -

Mother of Alexei Navalny says poison finding confirms he was murdered

1 hour -

Gov’t approves cabinet directives following review of over 8,000 land leases nationwide

1 hour -

In an uncertain trade landscape, cooperation still delivers

1 hour -

7 Ghanaian traders killed in Titao terrorist attack buried in Burkina Faso

1 hour -

Northern teachers protest ‘fake appointment’ claims

1 hour