Audio By Carbonatix

Prudential Life Insurance Ghana and Fidelity Bank Ghana Limited working in collaboration with the UK Ghana Chamber of Commerce (UKGCC), Petra Trust and the National Insurance Commission have held a webinar to educate the public on the best ways to build financial security.

The webinar follows the renewal of the partnership between Prudential Life Insurance Ghana and Fidelity Bank Ghana Limited.

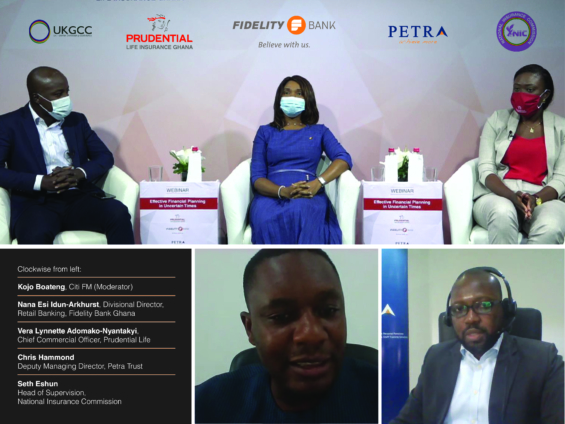

The webinar, which streamed live on Facebook, was under the theme Effective Financial Planning in Uncertain Times, brought together seasoned industry practitioners to discuss innovative ways that individuals can take charge of their finances for a better future.

The webinar which was moderated by Kojo Akoto Boateng of Citi FM/Citi TV, featured panelists such as Vera Lynnette Adomako-Nyantakyi, Chief Commercial Officer, Prudential Life Ghana; Nana Esi Idun-Arkhurst, Divisional Director, Retail Banking, Fidelity Bank Ghana Limited; Chris Hammond, Deputy Managing Director, Petra Trust; and Seth Eshun, Head of Supervision, National Insurance Commission (NIC).

Beginning the discussions, Nana Esi Idun-Arkhurst noted that everyone needs a financial plan to cater for the uncertainties of life.

“Irrespective of how much you earn, you must build a culture of savings and deliberately save to help in uncertain times. Fidelity Bank has the right blend of transactional, savings and investment accounts to assist with effective financial planning,” she said.

Highlighting the need to invest in insurance products, Vera Lynnette Adomako-Nyantakyi commented “How long can you operate and sustain your lifestyle in uncertain times? If you cannot boldly answer this question, I advise that you save more, spend less and subscribe to a good insurance policy at Prudential Life Insurance.”

Chris Hammond said “You cannot have a complete financial plan without a retirement plan. Up to 16.5% of one’s income may be saved into a Tier 3 long-term personal savings pension scheme for a sound retirement plan.”

Seth Eshun advised employees to verify with the Social Security and National Insurance Trust (SSNIT) if their Tier 1 pension is being paid and to confirm which institution is the trustee for their Tier 2.

He added that the NIC will ensure that insurance companies treat their customers fairly in all their dealings.

In his closing remarks moderator Kojo Akoto Boateng added that Ghanaians should save not only for a rainy day but also to enjoy some of life’s pleasures, such as taking a family vacation.

The thought-provoking webinar saw the seasoned panelists share insights, tools, values and habits to guide Ghanaians on their journey to effective financial planning.

Some participants who joined the webinar expressed their delight in gaining financial insights to be in a better position to provide security for their families and choosing the right type of insurance to secure their future, even in uncertain times.

Latest Stories

-

Ghana to replicate digital innovation success in Malawi

13 minutes -

She Gives: The ripple effect of women who choose to give

34 minutes -

Nadowli-Kaleo District observes 69th Independence Day with cultural exhibition and academic awards

37 minutes -

Chambas Team of Red Alert, Narcotics Commission join forces to combat drug abuse

56 minutes -

Tano North MCE launches 75 km road project under DRIP initiative

1 hour -

Galamsey Chemicals and Air Pollution linked to rising Diabetes risk in children

2 hours -

EduSpots celebrates a decade of digitalised community-led education and shares future vision

3 hours -

Karpowership empowers female students as STEM sector remains predominantly male-dominated

3 hours -

Accra New Town Experimental 1 JHS students decry lack of laboratories, poor classroom conditions

3 hours -

Yale School of Management names Togbe Afede XIV as global chair

4 hours -

Citizen Attoh: The multifaceted voice of Ghana’s media and heritage

4 hours -

Breaking borders, building futures: How African-led AI is rewriting the rules of global innovation

5 hours -

Guinea orders dissolution of 40 political parties, including three main opposition groups

5 hours -

Dozens killed as Israeli special forces raid Lebanese village in search of 40-year-old remains

5 hours -

Trump demands ‘unconditional surrender’ from Iran as Putin speaks with Iran’s president

6 hours