Audio By Carbonatix

Many sports and betting enthusiasts are eagerly anticipating the government's abolishment of the 10% betting tax.

But will removing the tax revive enthusiasm for betting and sports, or will it raise deeper concerns about the country’s revenue mobilization strategies?

JoyNews’ Clinton Yeboah sought public reactions ahead of the anticipated abolishment.

Stunner, an avid bettor, shares his perspective.

As part of his daily hustle, he turns to betting, hoping to double or even triple his money. The excitement of potentially winning hundreds, thousands, or even millions aligns with his goal of earning a living to support his family.

However, the joy of betting has been overshadowed by the 10% tax on winnings, which directly cuts into his earnings.

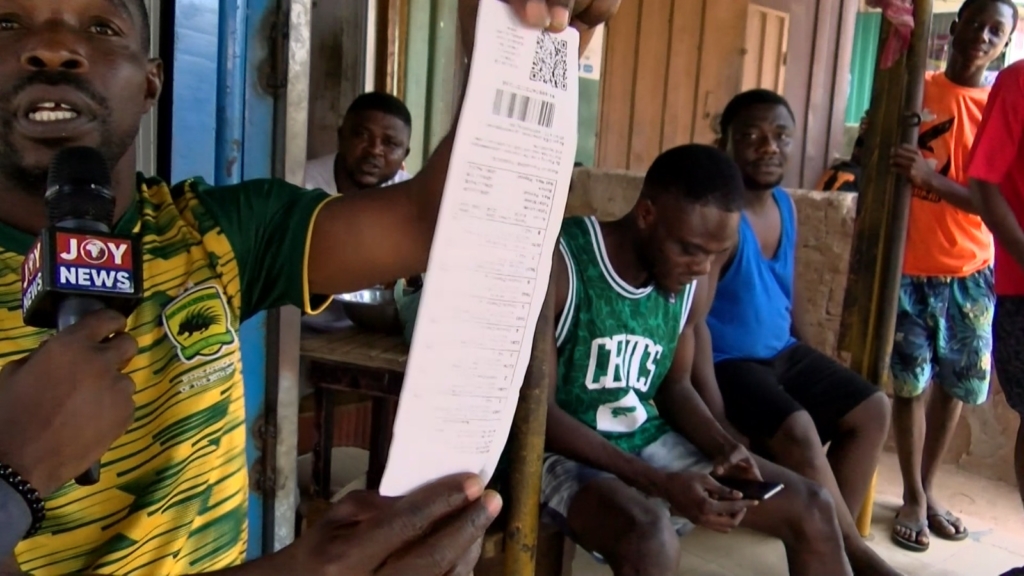

Stunner shows a betting receipt from the day, highlighting how his winnings have been reduced, leaving his income significantly affected.

“We are pleading. Betting tax should be scrapped now that he's assumed office. It will not help us, that's what we use to generate someone income. Jobs are limited. We are currently not able to stake as much we used to. Wining has become very difficult.

“Now is difficult to win. I can stake 30 to 25 cedis a day, and that was enough to win me huge sums. But now winning has been tightened. For over two month, I've not won anything,” he said.

Similar sentiments are echoed from this group of bettors, who say, the betting tax regime has removed the fun of betting and sporting, leading to a drop in participation.

They feel the tax has forced betting companies to tighten their systems, making it harder to win.

“Because of the tax we had no excitement staking it. Because I can't win 1000 cedis and you will be taking 100 cedis. It worried us the boys. We want Mahama to fulfil his promise. It's that simple. Individuals shouldn't be paying taxes on bets. Because of the tax, I think bet companies have also tightened their strategies and it is hard for us to win,” he said.

In 2023, the Akufo-Addo government introduced a 10% tax on all betting, remote interactive gaming, lottery, and other games of chance.

The government imposed the betting tax to discourage people from excessive betting, much like the taxation of alcohol and cigarettes.

Presently, the John Mahama administration aims to abolish the betting tax.

Bettors view this intervention as a way to encourage sports participation and economic freedom, as they admonish the president to stick to his promise.

“We voted because of that. If the promise is not fulfilled we will revolt. If they want the youth to be happy, they should remove it,” he said.

However, not everyone agrees.

Sports pundit and analyst, Stephen Zando, believes the tax should be maintained, but reduced in rate from 10% to 1%.

He suggests the revenue could be repurposed into sports development in the country.

“We have issues with sports development. The investment is insufficient, and this is a golden opportunity for that. We could rechanneled the funds to sports development, however, the rate should be reduced to 1%,” he said.

Public interest analyst, Eugene Osei Tutu, indicates the purpose of the tax has not been met, as the intention to deter people did not manifest.

He believes scrapping the tax will nonetheless reinstate the business landscape and the excitement of sports and betting.

“People take betting as a business venture. People stake huge sums of money, and for them, it’s enough activity for them to say they are working to earn money. Removing the tax will fasten the excitement, and boost some morale in sporting and its related businesses,” he said.

Finance Minister-designate, Dr. Cassiel Ato Forson, has pledged to remove both the E-Levy and the betting tax in the government's first budget for 2025.

Latest Stories

-

Renaming KIA to Accra International Airport key to reviving national airline – Transport Minister

11 minutes -

Interior Minister urges public not to share images of Burkina Faso attack victims

13 minutes -

Unknown persons desecrate graves at Asante Mampong cemetery

21 minutes -

I will tour cocoa-growing areas to explain new price – Eric Opoku

25 minutes -

Ghana to host high-level national consultative on use of explosive weapons in populated areas

30 minutes -

Daily Insight for CEOs: Leadership Communication and Alignment

48 minutes -

Ace Ankomah writes: Let’s coffee our cocoa: My Sunday morning musings

52 minutes -

Real income of cocoa farmers has improved – Agriculture Minister

56 minutes -

I’ll tour cocoa-growing areas to explain new price – Eric Opoku

58 minutes -

Titao attack should be wake-up call for Ghana’s security architecture – Samuel Jinapor

58 minutes -

New Juaben South MP Okyere Baafi condemns Burkina Faso attack, demands probe into government response

1 hour -

A/R: Unknown assailants desecrate graves at Asante Mampong cemetery

1 hour -

What is wrong with us: Africans know mining, but do not understand the business and consequences of mining

2 hours -

Ghana Sports Fund begins grassroots field assessment in Volta North, uncovers talent and infrastructure gaps

2 hours -

Persons with disabilities are not objects of pity — Volta Social Welfare Director urges mindset shift

2 hours