Audio By Carbonatix

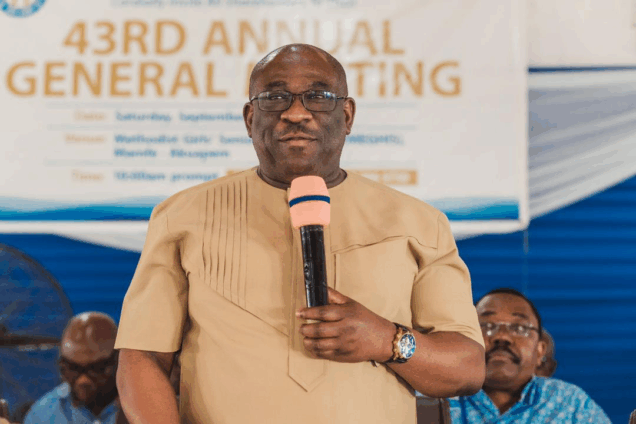

The Managing Director of the Agricultural Development Bank (ADB) PLC, Edward Ato Sarpong, has commended Akuapem Rural Bank PLC for its strong focus on empowering women through credit financing.

This he described as a key driver of financial inclusion and sustainable banking.

Speaking as the Guest of Honour at the Bank’s 43rd Annual General Meeting (AGM), Mr Sarpong praised the institution’s Credit with Education (CwE) programme, which has consistently directed about 50 per cent of annual loan disbursements to women.

He noted that in 2024 alone, the Rural Bank advanced GH¢60.33 million, representing 49.93 per cent of total loan disbursements, to 5,267 women.

This marked a 23 per cent increase over the previous year, with an impressively low non-performing loan ratio of 0.13 per cent.

“This achievement is not only commendable but also aligns with the Sustainable Development Goal of poverty alleviation, given its direct impact on households and communities”, he mentioned.

Mr Sarpong encouraged the Bank to deepen its investment in the CwE programme while also strengthening risk management systems and incorporating technology to expand outreach and enhance financial inclusion.

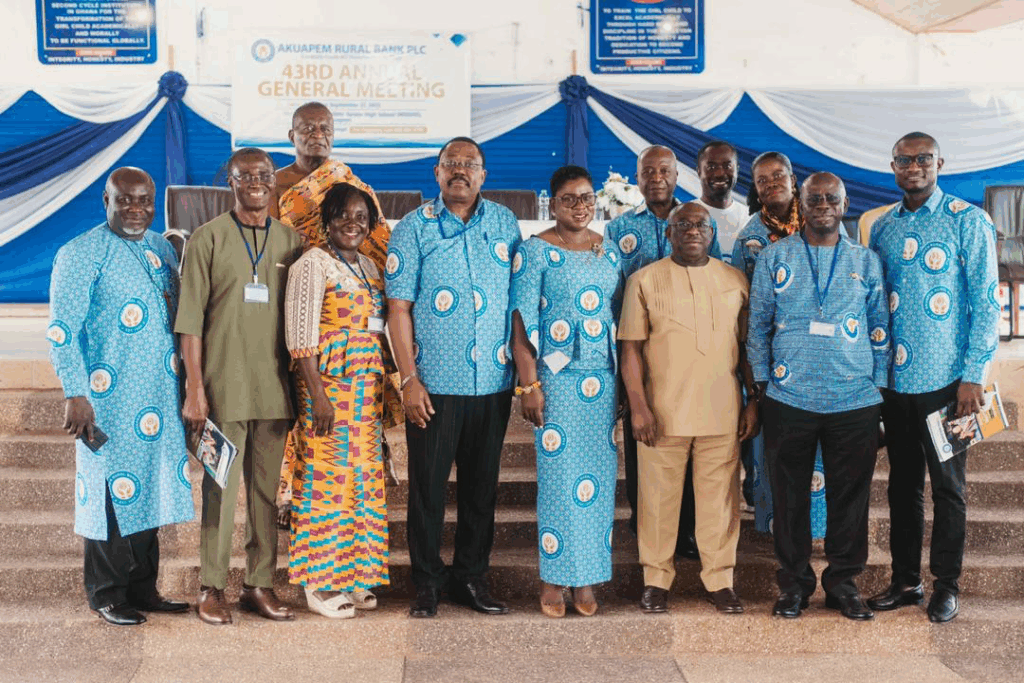

He further applauded the overall performance of the Rural Bank, attributing it to strong governance, quality leadership, and the support of shareholders.

“The quality of your Board is evident in the results achieved, and I urge shareholders to continue backing them to ensure further growth,” he noted.

The bank’s post-tax profit increased by 186% from GH¢1.35million in 2023 to GH¢3.85 million in 2024, and total assets grew from GH¢156 million in 2023 to GH¢208million in 2024.

The Board Chairman of the bank, Dr Ernest Obuobisa-Darko noted deposit growth of 30.77% (from 137.1million in 2023 to 179.3million in 2024), loan growth of 29.01% and investment growth of 33.15% which all contributed immensely to the overall growth in profitability and assets.

He expressed gratitude to Management and staff for their hard work in achieving growth in all of its key financial indicators in 2024.

The 43rd AGM brought together shareholders, board members, management, and invited guests.

Latest Stories

-

Mahama approves operating licence for UMaT mining initiative

5 minutes -

NDC condemns vote-buying in Ayawaso East primaries, launches investigation

19 minutes -

Ayawaso East NDC primary: Sorting and counting underway after voting ends

50 minutes -

Africa must build its own table, not remain on the menu — Ace Anan Ankomah

1 hour -

US wants Russia and Ukraine to end war by June, says Zelensky

1 hour -

Let’s not politicise inflation – Kwadwo Poku urges NDC

2 hours -

(Ace Ankomah) At our own table, with our own menu: Africa’s moment of reckoning – again

2 hours -

Land dispute sparks clash in Kpandai; 3 motorbikes burnt

2 hours -

15 injured as Ford Transit overturns at Gomoa Onyaazde

2 hours -

Government pays School Feeding caterers 2025/26 first term feeding grant

2 hours -

Mz Nana, other gospel artistes lead worship at celebration of life for Eno Baatanpa Foundation CEO

4 hours -

Ayawaso East NDC Primary: Baba Jamal campaign distributes TV sets, food to delegates

4 hours -

MzNana & Obaapa Christy unite on soul-stirring gospel anthem Ahoto’

4 hours -

Ayawaso East: 5 vie for NDC ticket for March 3 by-election

4 hours -

Loyalty is everything in politics; Bawumia must decide on Afenyo-Markin – Adom-Otchere

5 hours