Audio By Carbonatix

The quest to salvage key assets within the hospitality portfolio of the Social Security and National Insurance Trust (SSNIT) has hit a deadlock, with a leading parliamentary watchdog attributing the failure to attract investors to the deep politicisation of state economic issues.

Davis Ansah Opoku, Vice Chairperson of the Public Accounts Committee (PAC), delivered a scathing assessment on Friday, November 7, emphasising that the institutional imperative to secure pensioners' future is being undermined by a corrosive public environment that stifles private sector intervention.

Mr. Opoku highlighted the urgent need to divest from loss-making ventures to protect the trust’s massive investment base, which stood at a total portfolio of GH¢15,918.69 million as of December 31, 2023.

This impressive figure, which reflects a compound annual growth rate (CAGR) of 16.31% over the past few years, is jeopardised by the bleeding hospitality sector.

Mr. Opoku pointed to a worrying three-year period during which crucial assets have remained unattractive to potential buyers.

“SSNIT is an institution that holds monies for pensioners, and when these monies are invested in ventures that ought to be profitable but end up running at losses, it is important to bring these matters to the fore,” he stated in an interview with Channel One.

“For the past three years, we have still not had any investor showing interest in these defunct hotels. For me, it points to one thing being clear: the politicisation of issues in this country hurts the country. If a local investor has what it takes to invest in these hotels that are running losses, we ought to encourage them.”

He further championed the involvement of local expertise to turn around these distressed assets.

“I am one person who has been a champion of local investors taking over state interests that need a bit of surgery,” he added.

The Numbers: A GH₵233.8 Million Burden on the Trust

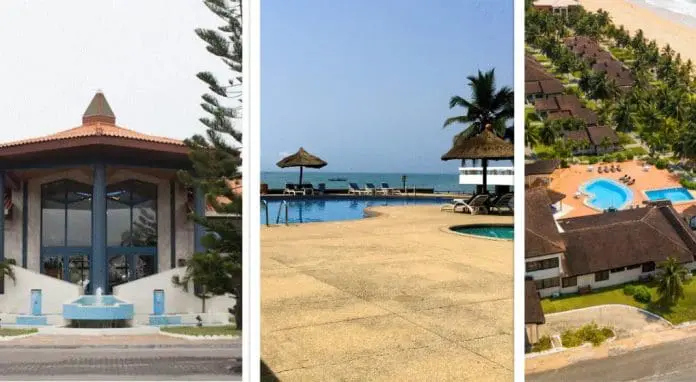

The Public Accounts Committee confirmed SSNIT’s current strategy: actively seeking strategic investors for struggling entities under the Golden Beach Hotels Group, specifically naming La Palm Beach Hotel and Elmina Beach Resort.

It was clarified that high-performing assets such as the Labadi Beach Hotel, Ridge Royale, and SSNIT Guest House are explicitly not part of this urgent investment drive.

The financial data underscores why intervention is critical for the underperforming hotels:

| Hotel Property | Loss Years (Out of 14) | Dividend Payments | 5-Year Average Profitability | Average Return on Equity (ROE) |

| La Palm Beach Hotel | 11 | Never Paid | GH₵6.7 million | -4.2% (2012-2017) |

| Elmina Beach Resort | 9 | Never Paid | GH₵740,604 | -4.8% (2010-2017) |

| Busua Beach Resort | 9 | Never Paid | GH₵32,268 | -31.7% (2010-2017) |

| Labadi Beach Hotel | 2 | Consistent | GH₵18 million | 5.2% (2012-2022) |

In total, SSNIT has poured a colossal GH₵233.8 million into La Palm, Elmina, and Busua, in the form of payments, including shareholder loans, yet the Trust has received zero return on equity or loan servicing. In stark contrast, the Labadi Beach Hotel alone has reportedly paid GH₵48.1 million in dividends over the last five years, demonstrating the massive discrepancy in performance across the portfolio.

The Failed 2024 Rock City Bid and Political Fallout

The current investor search follows the dramatic collapse of the 2024 attempt to offload a 60% stake in a bundle of SSNIT hotels to Rock City Hotel Limited, a company owned by the then Minister of Food and Agriculture, Dr. Bryan Acheampong.

The proposed deal, which initially included the performing Labadi Beach Hotel, triggered widespread political and labour opposition, leading to the bid’s withdrawal.

Key details surrounding the controversy:

- The Target: The deal involved a 60% stake in four hotels: Labadi Beach Hotel, La Palm Royal Beach Resort, Ridge Royal Hotel, and Elmina Beach Resort.

- The Valuation: SSNIT claimed that Rock City’s bid of $61.2 million for the 60% stake exceeded the Transaction Advisor's total valuation of $59.1 million.

- Labour Opposition: The Trades Union Congress (TUC) and Organised Labour declared an indefinite nationwide strike threat, set to begin on July 15, 2024, demanding the termination of the sale process.

- Withdrawal: Rock City formally withdrew its bid on July 12, 2024, citing "undue negativity" and SSNIT’s perceived "failure to engage all its stakeholders properly."

The debacle cemented the PAC's argument: that a combination of political resistance, labour scrutiny, and public outrage—regardless of the technical or financial merits of a deal—effectively creates an uninvestable climate for state-owned enterprises, leaving assets to languish.

Latest Stories

-

Supreme Court declines AG’s bid to review ruling on Adu-Boahene case

1 minute -

Laryea Kingston eyes ‘big first-team job’ in five years

2 minutes -

Supreme Court ruling on Kpandai seat vindicates legal process – Gary Nimako

13 minutes -

NDC rejects Hajia Amina’s request for virtual vetting over Islamic widowhood rites

15 minutes -

Ghana’s building inflation falls to 4.4% in December 2025

16 minutes -

NDC ‘grieved’ by Supreme Court ruling restoring NPP’s Kpandai MP – Deafeamekpor

25 minutes -

NPP bans gatherings at polling centres ahead of presidential primary

31 minutes -

‘We’re with you every step of the way’ — Lands Minister tells Chamber of Mines in meeting to promote extractive sector

34 minutes -

Cedi slips about 4% against major currencies in early 2026

51 minutes -

Supreme Court overturns High Court judgment on Kpandai election

1 hour -

Late Ayawaso East MP’s wife seeks virtual vetting in NDC primary amid widowhood observance

1 hour -

Gov’t seals $2bn Jubilee gas deal to cut prices and raise output – John Jinapor

1 hour -

IGP promotes 17 police officers for exceptional operational performance

1 hour -

Swiss sportswear On welcomes Steeplechase champion Soufiane El Bakkali to its athlete roster

1 hour -

Gov’t settles over GH¢10bn road contractor arrears in 2025 – Roads Minister

1 hour