Government is considering the reintroduction of the Electronic Transaction Levy percentage charge from 1.75 % to 1.5%.

This comes after the Deputy Majority Leader, Alexander Afenyo-Markin revealed that the Finance Minister, Ken Ofori-Atta, will withdraw the controversial E-levy in Parliament and re-introduce same.

Mr Markin made this known whiles presenting the business statement for next week to the House.

He said the e-levy will be withdrawn by government on Tuesday February 15, 2022.

He also noted that it will further be reintroduced after it has been reviewed on Friday, February 18, 2022.

Members of Parliament were however encouraged to “participate fully in the consideration of the Bill for the passing of a good piece of legislation for the benefit of all.”

Earlier, government had hoped to get the buy-in of the NDC MPs for the Bill to be passed.

This was after telecommunication companies agreed to reduce their 1% charge on transactions by 0.25%.

If this was upheld, the rate would be reduced from 1.75% levy to 1.5%.

But it was rejected by the Minority.

About E-levy

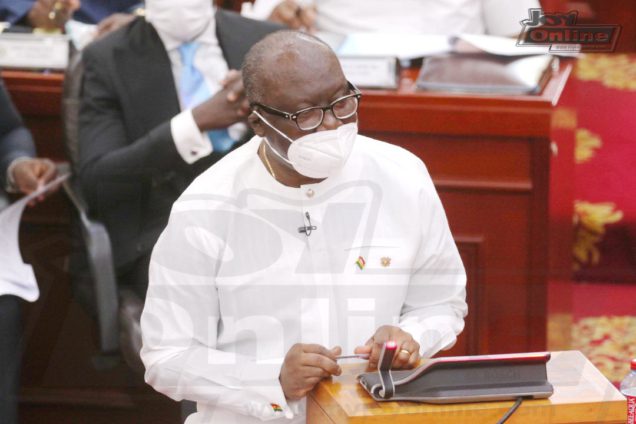

Finance Minister Ken Ofori-Atta, presenting the 2022 budget on Wednesday, November 17, announced that the government intends to introduce an Electronic Transaction Levy (e-levy).

The levy, he revealed, is being introduced to “widen the tax net and rope in the informal sector”. This followed a previous announcement that the government intends to halt the collection of road tolls.

The proposed levy, which was expected to come into effect in January, 2022, is a charge of 1.75% on the value of electronic transactions. It covers mobile money payments, bank transfers, merchant payments, and inward remittances. There is an exemption for transactions up to GH¢100 per day.

Explaining the government’s decision, the Finance Minister revealed that the total digital transactions for 2020 were estimated to be over GH¢500 billion (about $81 billion) compared to GH¢78 billion ($12.5 billion) in 2016. Thus, the need to widen the tax net to include the informal sector.

Although the government has argued that it is an innovative way to generate revenue, scores of citizens and stakeholders expressed varied sentiments on its appropriateness with many standing firmly against it.

Even though others have argued in support of the levy, a section of the populace believe that the 1.75% e-levy is an insensitive tax policy that will deepen the already prevailing hardship in the country.

Latest Stories

-

My selection is an affirmation of your belief in women – Naana Opoku tells Mahama

2 mins -

Our ticket will be a pair of experienced individuals – Mahama assures

12 mins -

NDC officially outdoors Prof Naana Opoku-Agyemang as running mate

25 mins -

+233 hosts Int. Jazz Day concert on April 30

30 mins -

Farmer arraigned over threat of death

48 mins -

Education Minister unveils new uniforms for basic schools

55 mins -

8th Ghana CEO Summit scheduled for May 27

1 hour -

Leaked intimate video has severely embarrassed me; I’m sorry – Serwaa Amihere

2 hours -

Poll results alone don’t constitute victory for any political party- Asiedu Nketia cautions NDC

3 hours -

Gyakie spills truth on her journey to fame

3 hours -

Energy sector CSOs challenge President Akufo-Addo to transparent value for money audit of SML contract

3 hours -

Plunderers of the State will face the music – Prof Jane Opoku-Agyemang promises

3 hours -

We don’t feel safe after inconsiderate conduct of Regional Minister – Ashanti ECG staff

4 hours -

Ghana needs urgent reset and inspiring leadership – Mahama

5 hours -

Asiedu Nketia cautions NDC: Don’t be complacent, election 2024 victory isn’t assured yet

5 hours