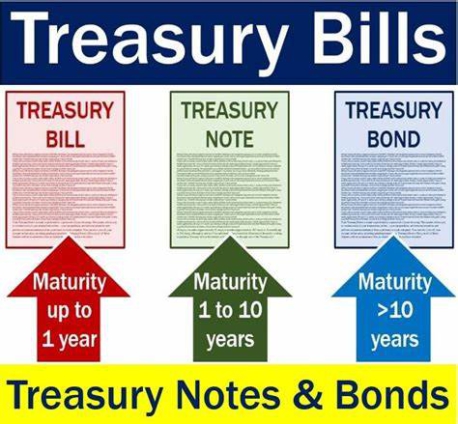

For the first time since the third week in November, sale of Treasury bills to investors have been undersubscribed in the weekly auctioning of the short-term securities.

But this time around, the under-subscription is very significant.

Right after the December 7th elections, the weekly Treasury bills sale was highly oversubscribed by about 21%.

But that has been short-lived as there has been a huge under-subscription

by investors.

Whilst government was looking for GH¢1.79 billion, it rather got GH¢971.7 million for the 91-day, 182-day and 364-day Treasury bills.

For the 3 months T-Bill, government accepted all the bids worth GH¢759.8 million, whilst it accepted GH¢154.9 and GH¢56.9 million for the six months and one year Treasury bills respectively.

Interest rate for the 91-day and 182-day T-Bills however still hover around 14.08% on the average, whilst that of the one year bill is going for 16.9%.

Analysts believe the successful sale of the 3-year fresh bond and the 20-year Treasury bond during the past week could be attributed to the lower participation of investors in the weekly T-Bills auctioning.

“There were two other offers in the same week which raised substantial sizes. I believe these dual offers provided significant competition for the T-bills. The 3-year offer, which raised GH¢1.66 billion provided the main competition at 19.25% and attracted most of the interbank liquidity for the week”, Courage Martey, Senior Economic Analyst with Databank Research told Joy Business.

Secondly, banks and retail investors may be looking to hold more cash balances ahead of the Christmas holidays. This could also have restrained investment demands and weighed on subscription at the T-bills auctions.

Meanwhile, there is an anticipated slight fall in interest rates in the coming weeks because of decline in inflation.

Interest rate ease on short-end of market

Interest rate trends on the money market reflected mixed developments as

yields on the short to medium term instruments eased, but broadly tightened at the longer end, the Bank of Ghana said in its Monetary Policy Report.

On a year-on-year basis, the 91-day Treasury bill rate declined to about

14.1% in October 2020 from 14.7% a year ago.

Similarly, the interest rate on the 182-day instrument declined to 14.1%

from 15.1%.

With the exception of the 6-year bond, yields on the 7-year, 10-year, 15-

year, and 20-year bonds all increased.

Latest Stories

-

Let’s prioritize research quality in higher education institutions for industrial growth-Prof. Nathaniel Boso

4 hours -

Herman Suede is set to release ‘How Dare You’ on April 24

7 hours -

Heal KATH: Kuapa Kokoo, Association of Garages donate 120k to support project

7 hours -

KNUST signs MOU with Valco Trust Fund, Bekwai Municipal Hospital to build student hostel

8 hours -

The influence Ronaldo has on people, Cadman Yamoah will have same on the next generation – Coach Goodwin

8 hours -

Gender Advocate Emelia Naa Ayeley Aryee Wins prestigious Merck Foundation Awards

9 hours -

South Africa bursary scandal suspects granted bail

10 hours -

Ecobank successfully repays $500m Eurobond due April 18

10 hours -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

10 hours -

Extortion and kidnap – a deadly journey across Mexico into the US

10 hours -

Rihanna says fashion has helped her personal ‘rediscovery’ after having children

10 hours -

Development Bank Ghana targets GH¢1bn funding for commercial banks in 2024

10 hours -

Shatta Movement apologises to Ghana Society of the Physically Disabled after backlash

11 hours -

Sammy Gyamfi writes: Tema-Mpakadan Railway Project; A railway line to nowhere

12 hours -

Bright Simons: Is the World Bank saving or harming Ghana?

12 hours