Audio By Carbonatix

The Acting CEO of Ghana Cocoa Board has revealed that for the 2024/25 cocoa season, COCOBOD did not secure a syndicated loan.

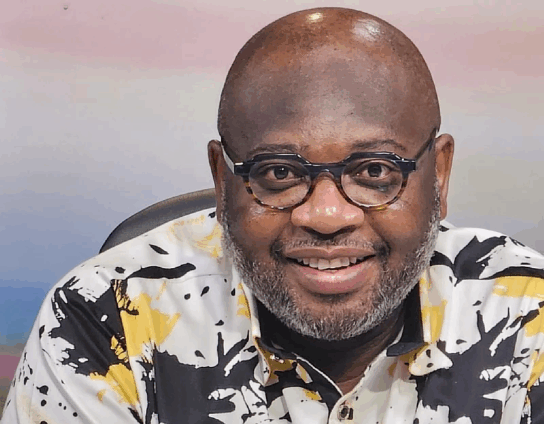

Dr. Randy Anerley Abbey said this effectively cuts off the traditional seed funding support to Licensed Buying Companies (LBCs), especially the indigenous ones.

“There was no syndicated loan, so no seed fund,” Dr. Abbey said in a blunt assessment of the current financial strain in Ghana’s cocoa sector.

“What we realise is that, although it is saving COCOBOD in terms of the financing cost… now the indigenous LBCs are unable to operate.”

Dr. Abbey explained that in previous years, COCOBOD would raise an annual syndicated loan with international banks to finance the purchase of cocoa beans.

A portion of that loan would then be used to create “seed money”, which was disbursed to LBCs to enable them to buy beans from farmers.

“Under the syndicated loan, COCOBOD creates what it calls the seed money. And this seed money is what is given to the LBCs to go and purchase the bean.”

But this year, that system has been disrupted.

“We are not doing the syndicated loan. We are not doing 2025/26. For 2026/27, I don’t know, okay, but for 2025/26 we are not,” he stated.

The COCOBOD boss also noted that the financing climate has become increasingly hostile.

He warned that if COCOBOD had proceeded with a loan this year, it would have had to borrow around GH¢3 billion or GH¢3.5 billion, with banks demanding high interest rates.

“Because of the nature of our finances, you even have banks asking for 8% to 10% on $1.”

As a result, many local LBCs have been left in limbo, struggling to mobilise funds to purchase cocoa, a situation Dr. Abbey described as dire.

“If we continue with this financing model, I fear that most of them might go extinct.”

In a bid to prevent a collapse, COCOBOD is engaging the Bank of Ghana with a bold proposal.

Dr. Abbey said he has asked the central bank to release a portion of the Cash Reserve Ratio—the mandatory deposit commercial banks keep with the Bank of Ghana—to support cocoa purchases.

“Look, you have the Cash Reserve Ratio, where all the banks put 25% of their deposits at the central bank. This is idle, not doing anything. Now we have a critical industry, the indigenous LBC, dying off. Can we look at apportioning 2% or 3%…to support indigenous LBCs?”

He added that any funding released through this channel could be ring-fenced strictly for cocoa purchases.

“We can restrict it to cocoa purchases, just to ensure that they also don’t go using it for oil, tin tomatoes and all those things.”

Dr. Abbey stated that the Bank of Ghana had requested a formal letter to consider the proposal, and COCOBOD has complied accordingly.

“I’ve done that. This is one of the discussions we had with the central bank. We believe that if there’s a positive response, it will be able to help.”

He further indicated that COCOBOD is maintaining a 60-40 buying structure with cocoa buyers as part of its revised operational approach.

“So it’s the reason why I went to Europe and North America to meet the buyers and all that. We’re still doing the 60-40 with the buyers.”

Latest Stories

-

Esther Cobbah urges women founders to make trust and excellence their competitive edge

21 minutes -

Adonis Adamado

32 minutes -

‘Control lies with private capital’ – COPEC warns NPA’s fuel stock assurance not enough amid Iran attack

45 minutes -

10 illegal miners feared dead, 30 critical after mine cave-in at Manso Tontokrom

45 minutes -

GPL 2025/2026: All Blacks hold leaders Medeama at home

1 hour -

Ghana has over 5 weeks of fuel stock despite Middle East tensions – NPA

1 hour -

Middle East tensions may hit Ghana’s pumps soon – Duncan Amoah

2 hours -

WPL 2025/26: Hasaacas beat Army Ladies as Ampem Darkoa Ladies draw

2 hours -

Five facts about Baba Sadiq, Ghana’s High Commissioner Designate to Nigeria

2 hours -

Baba Sadiq Abdulai appointed as High Commissioner to Nigeria

3 hours -

Playback: The Probe examined Israel-Iran-US tensions and Ghana’s energy security

3 hours -

T-bills auction: Investor appetite remains at all-time high; interest rates tumble to 5.3%

3 hours -

Yes, we “eat Macroeconomics” because it is the foundation of every meal

3 hours -

Annoh-Dompreh launches Nsawam-Adoagyiri Eye Care Project 2026, screens 3,000 residents

3 hours -

British Iranians take to streets of Manchester hours after US-Israeli strikes

4 hours