Audio By Carbonatix

The University Teachers Association of Ghana (UTAG) has rejected the government's new proposed debt restructuring offer, which includes pension funds.

The Association, in a release issued on April 17, maintains its earlier resistant stance during the implementation of the Domestic Debt Exchange Programme.

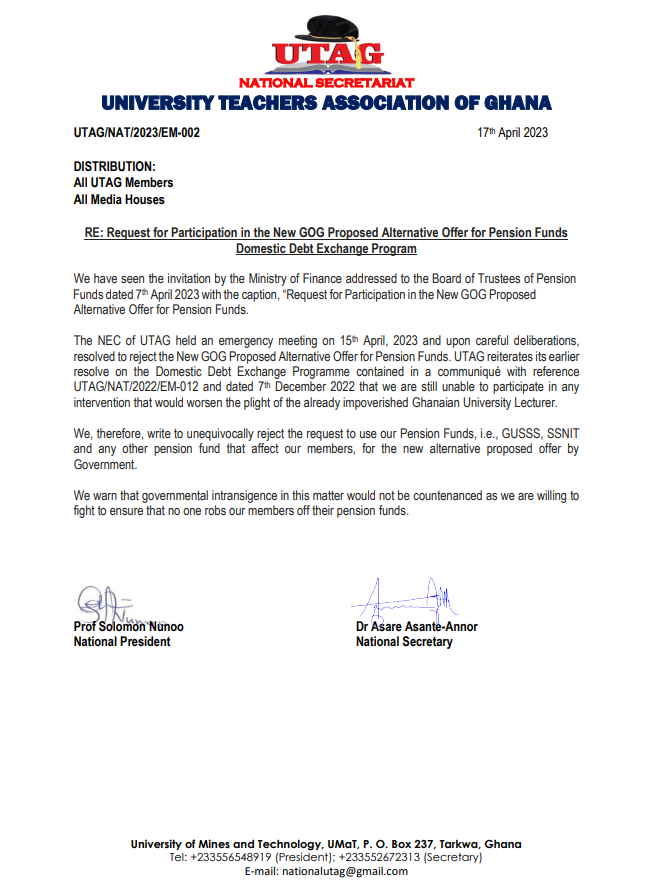

“The NEC of UTAG held an emergency meeting on 15th April, 2023 and upon careful deliberations, resolved to reject the New GOG Proposed Alternative Offer for Pension Funds,” portions of the statement said.

According to the release, UTAG is “unable to participate in any intervention that would worsen the plight of the already impoverished Ghanaian University Lecturer.”

“We, therefore, write to unequivocally reject the request to use our Pension Funds, i.e., GUSSS, SSNIT and any other pension fund that affects our members, for the new alternative proposed offer by Government,” it added.

UTAG statement follows the Finance Minister on Friday urging the Board of Trustees of Pensions Funds to allow for pension funds to be included in government’s new proposed debt restructuring offer.

The communique was signed by the UTAG President, Prof Solomon Nunoo and National Secretary, Dr Asare Asante-Annor.

According to the minister, the new proposal is aimed at alleviating the cash constraints on the government in the coming years, while fully compensating the pension funds for the value of their current holdings.

He explained in a release that the new offer has been “crafted to facilitate the execution of the MoU, addressing the Government financial needs while maintaining the value of the pension funds."

Breaking down the new offer, the statement noted that “the proposed offer entails exchanging your current holdings of Treasury Bonds, ESLA bonds and Daakye Bonds for a menu of the currently outstanding New Bonds (issued in February 2023 and maturing in 2027 and 2028 respectively.

“New Bond 2027 and New Bond 2028 featuring an average coupon of 8.4 % with a ratio of 1.15x, thus entailing an increase in patrimonial value.

“This is complemented by an additional cash payment of 10% (strip coupon). The stream of coupons to be received as part of this proposal will therefore be 21% compared to the current 18.5% of the outstanding of old bonds.”

It continued “In 2023 and 2024, both instruments will pay 5% coupon in cash and the remainder will be capitalized into the nominal amount of the two bonds in order to comply with the cash constraints and the macro-framework defined under the programme with International Monetary Fund (IMF).”

According to the statement, the alternative offer has been designed to:

- Achieve the same average maturity as pension funds current holdings of the old bonds (currently between 4 and 5 years)

- Achieve a similar average coupon (currently at 18.5%) while

- Alleviating the cash constraints for the government over the first two years.

As a result, Mr Ofori-Atta urged that the Board of Trustees of pension funds to consider the proposal, adding that government is targeting to settle the offer by end of April, 2023.

But UTAG has rejected the new offer and further cautioned that “governmental intransigence in this matter would not be countenanced as we are willing to fight to ensure that no one robs our members of their pension funds.”

Latest Stories

-

Farmers hopeful as government moves to expedite cocoa payments

18 minutes -

Tensions at Agbogbloshie market women oppose AMA drain cleaning exercise, items confiscated

19 minutes -

Lyse Doucet: In Tehran, rallies for Iran’s revolution overshadowed by discontent and defiance

29 minutes -

Education Minister orders full audit of free sanitary pads in schools over quality concerns

38 minutes -

IGP promotes 12,000 police officers, clears all backlog

48 minutes -

Buduburam firefighters prevent gas explosion at Big Apple

50 minutes -

Emigoh marks 20 years with launch of two new Yomi Yoghurt flavours

58 minutes -

National Vaccine Institute takes step forward with audit committee launch

60 minutes -

SOSA ’99 launches Year of Return 2027, donates towards SUSEC Clinic

1 hour -

Berima Sydney pays tribute to Ebony at Naughty Saturday in Sunyani

1 hour -

Adolescents from 6 countries lead urban dialogue in Accra

1 hour -

Republic Bank reveals benefits of joining the “Republic Verse” – A bold banking universe

2 hours -

Workers calling for my resignation have not paid attention to GIADEC law – CEO dismisses calls for removal

2 hours -

Cocoa farmers who sell farms to galamsey operators will face jail – Concerned Farmers Association

2 hours -

Crush Smoothies, Luv FM to host unforgettable ‘Luv and Music’ Valentine’s event in Kumasi

2 hours