Audio By Carbonatix

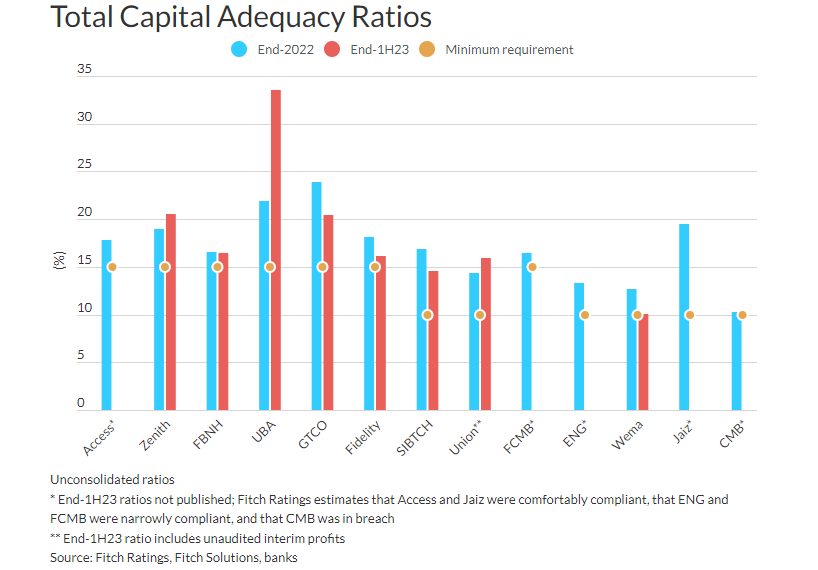

Nigerian banks’ balance-sheet structures have helped to ensure continued compliance with minimum capital requirements despite the devaluation of the Nigerian naira by about 40% since June 2023, Fitch Ratings has disclosed.

According to the UK-based firm, the risks to capital from further currency devaluation and loan quality pressures should not affect ratings for most banks.

However, the Rating Watch Negatives (RWNs) on the three banks most at risk of breaching minimum total capital adequacy ratio (CAR) requirements remain in place given these risks.

The sharp devaluation of the official exchange rate led to large FX revaluation gains in the first half year due to banks’ long net open positions in foreign currency (FC), it explained.

“FC risk-weighted asset inflation was limited by small FC loan books and low risk-weights on non-loan FC assets, helping banks to remain compliant with CAR requirements. Loan impairment charges increased significantly in 1H23 due to the weaker macroeconomic setting and the increased provisions needed for FC loans, but they were comfortably absorbed by the FX revaluation gains”, it added.

It further said banks with foreign subsidiaries, in particular United Bank for Africa (B-/Stable), also experienced large FC translation gains through other comprehensive income, while the CARs of banks with FC-denominated capital-qualifying debt instruments, notably Access Bank (B-/Stable), benefitted from these instruments inflating in naira terms.

Several banks, it pointed out have had their interim financials audited so that they can incorporate their interim profits into regulatory capital. FBN Holdings, Fidelity Bank, Wema Bank and Jaiz Bank (all rated ‘B-’/Stable) plan to raise core capital to strengthen buffers over CAR requirements.

Latest Stories

-

Strong institutions, strong economy – GNCCI calls for commercial justice reform

54 minutes -

IMF should move its headquarters to Ghana if we can’t manage after exit – GNCCI CEO

1 hour -

17 times is enough – GNCCI boss backs IMF exit, demands discipline

2 hours -

Nigeria’s NNPC in talks with Chinese company on refinery, CEO says

2 hours -

Trump’s one-year African Growth act extension offers brief but fragile trade reprieve, analysts say

2 hours -

Faith, Fame & Footprints: What really opens doors for gospel artistes

3 hours -

Louvre Museum crown left crushed but ‘intact’ after raid

5 hours -

Newly discovered Michelangelo foot sketch sells for £16.9m

5 hours -

Morocco urges residents to leave flood‑risk areas as evacuations exceed 108,000

5 hours -

Starmer apologises to Epstein victims for believing Mandelson’s ‘lies’

5 hours -

Businessman in court for allegedly threatening police officer with pistol

6 hours -

3 remanded, 2 hospitalised in Effutu Sankro youth disturbances

6 hours -

Somanya court convicts five motorcycle taxi riders for traffic offences

6 hours -

Ayew, Fatawu in danger of relegation as Leicester docked points for financial breaches

6 hours -

ChatGPT boss ridiculed for online ‘tantrum’ over rival’s Super Bowl ad

6 hours