Audio By Carbonatix

President Akufo-Addo has described Ghana’s recent deal with Eurobond debt holders as a sign of investor confidence in the economy.

He made the statement after government secured almost 100 percent participation from investors in the Eurobond Debt Exchange Programme, which ended on September 30, 2024.

The exercise was undertaken by Ghana as part of requirements from the International Monetary Fund for Ghana to renegotiate its rising debt stock for a 3-year 3 billion dollar bailout.

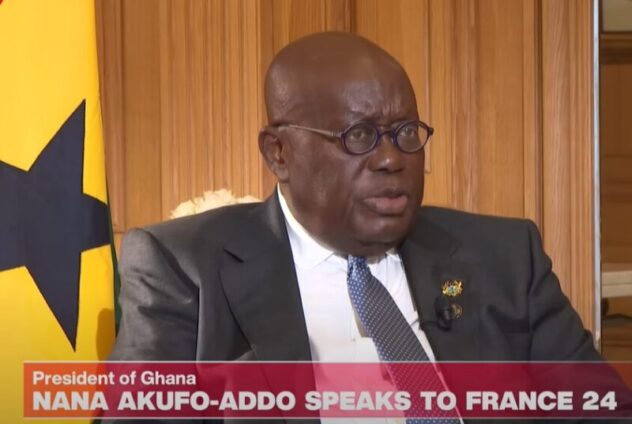

Speaking in an interview with France 24 TV Network, President Akufo-Addo noted that the agreement demonstrates economic recovery from the COVID-19 shocks.

He strongly argued that the participation level of the investors show their confidence in Ghana’s economy despite recent challenges.

“The 98.6 percent of those holding the commercial debt of Ghana have agreed on the reworking of the debt. The restructuring will be up to next week. They will exchange the bonds for new bonds with different terms”.

He explained that the restructured bonds will give Ghana a more flexible term to honour its debt obligations.

“There is different rates of interest. 13 billion dollars of the money was restructured as a result of the agreement, 5 billion dollars is off. 37 percent of the nominal value of our debt has been canceled and another 4.3 million dollars of savings on interest. Altogether, we are talking about savings to Ghanaian. About 10 billion dollars. That’s a significant amount of money. It means that Ghana’s economy is now back to where it was before the crisis” he said.

Expressing optimism about the future, President Akufo-Addo pointed out that some macro-indicators are beginning to show positive results.

He is hopeful the numbers will soon translate into economic development and impact on livelihoods.

Eurobond debt restructuring

A significant number of bondholders who participated in the Eurobond Debt Exchange Programme opted for the disco menu of new notes.

This means that the investors will take 37 percent haircut and receive interest payments of 5 percent from 2024 to July 2028, and 6 percent interest thereafter.

They are therefore expected to receive three new bond instruments.

On the other hand the rest of the bondholders opted for the par menu, which will result in them not facing any nominal losses but will bet 1.5 percent interest on the new bonds maturing in January 2037.

These details were captured in the consent document issued by the bondholders after they agreed to swap their old bonds for new papers during the Eurobond Debt Exchange Programme.

The bondholders in the document added that the successful completion of this Eurobond Debt Exchange programme is a critical component of Ghana’s debt restructuring process under its programme with the International Monetary Fund.

Investors will swap their securities for new notes on or around October 9, with the complete settlement process expected to be finalized shortly thereafter, the statement from the investors explained.

Latest Stories

-

Galamsey Chemicals and Air Pollution linked to rising Diabetes risk in children

4 minutes -

Karpowership empowers female students as STEM sector remains predominantly male-dominated

2 hours -

Accra New Town Experimental 1 JHS students decry lack of laboratories, poor classroom conditions

2 hours -

Yale School of Management names Togbe Afede XIV as global chair

2 hours -

Citizen Attoh: The multifaceted voice of Ghana’s media and heritage

3 hours -

Breaking borders, building futures: How African-led AI is rewriting the rules of global innovation

4 hours -

Guinea orders dissolution of 40 political parties, including three main opposition groups

4 hours -

Dozens killed as Israeli special forces raid Lebanese village in search of 40-year-old remains

4 hours -

Trump demands ‘unconditional surrender’ from Iran as Putin speaks with Iran’s president

5 hours -

Iran Embassy in Ghana opens Book of condolence after death of Supreme leader in US-Israel attacks

6 hours -

GPL 2025/26: Vision FC cruise past Berekum Chelsea with emphatic 3–1 win

6 hours -

GPL 2025/26: Samartex held by Dreams FC as winless run extends to five

6 hours -

New Juaben North MP challenges gov’t to provide evidence of jobs created and cheap loans

7 hours -

Nadowli-Kaleo District marks 69th Independence Day with cultural exhibition, academic awards

7 hours -

Confusion, tension rock NPP polling station registration exercise in Tarkwa-Nsuaem

8 hours