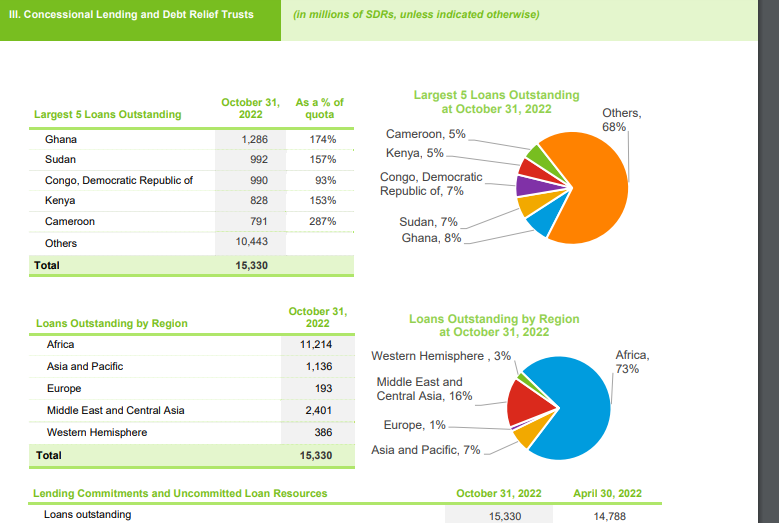

Ghana’s outstanding loans to the International Monetary Fund fell slightly to 1.28 billion Special Drawing Rights (SDR), equivalent to $1.68 billion as of the end of October 2022.

According to the Fund’s Quarterly Finances, the country is still ranked as number one in Africa with the largest outstanding debt to the Bretton Wood institution.

The outstanding debt represents 8% of the total number of African countries indebted to the Fund.

This is however one percent lower than what was recorded in July 2022. It is also equivalent to 174% of the country’s quota or share of monies borrowed from the Bretton Wood institution.

In July 2022, the country’s loans outstanding to the Fund were estimated at 1.31 billion SDR, equivalent to about $1.69 billion.

The loans outstanding exclude the Covid-19 support of which the country received more than $1.2 billion to fight the pandemic and aid economic recovery. However, the country’s debt to the IMF will go up after the approval of a programme by the Board of the Fund by the first quarter of 2023.

As of September 2022, the nation’s external debt was estimated at $28.4 billion, with majority of the loans being commercial.

Meanwhile, Sudan and Democratic Republic of Congo maintained their 2nd and 3rd positions in Africa with the largest outstanding loans of 992 SDR and 990 SDR to the Fund.

The country’s loan exposure to the Bretton Woods institution is classified as concessional lending. Concessional loan comes with a low-interest financing.

The Board of the IMF is expected to approve a $3 billion programme for Ghana by the first quarter of 2023, to aid its economic recovery.

Latest Stories

-

Ghana’s Antoine Semenyo fires Bournemouth to victory against Wolves

1 min -

Everton 2-0 Liverpool: Everton apply final blow to Liverpool title challenge

10 mins -

Akufo-Addo nominates Felicia Attipoe as Tema West MCE

12 mins -

Today’s front pages: Thursday, April 25, 2024

20 mins -

We’ll not engage in opaque and obscure deals when elected – Prof Opoku-Agyemang

45 mins -

Energy and Finance Ministries must provide funding to fix energy challenges – IES

53 mins -

Reintroduce Fiscal Responsibility Act to tackle election budget overrun – Osafo Marfo

54 mins -

Prioritise transparency, avoid suppressing the truth – Opoku-Agyemang advises EC

59 mins -

In times of setbacks, I won’t say I was only the driver’s mate – Naana Jane assures Mahama

1 hour -

Joselyn Dumas opens up on why single mothers struggle to find partners

1 hour -

Three damaged ECG pylons result in power outage for 9 Shama communities

1 hour -

Dual citizens eligible for Chief Justice, Chief Director, other positions – Supreme Court rules

2 hours -

SIGA urges increased financial support for SOEs

2 hours -

Akufo-Addo vows to enhance Ghana’s power supply

2 hours -

19 steps for getting over even the most devastating breakup fast

5 hours