Audio By Carbonatix

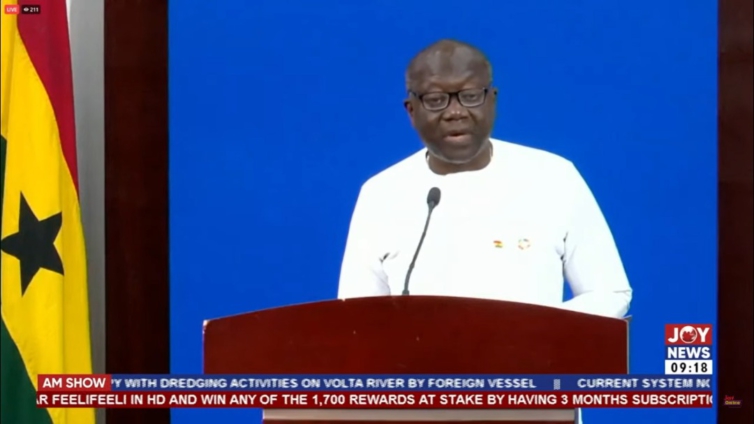

The government has invited eligible bondholders to exchange approximately ¢137.3 billion of its domestic notes and bonds, E.S.L.A. Plc and Daakye Trust Plc for a package of New Bonds.

This is part of the Debt Exchange Programme.

The terms and conditions of the invitation are described in the exchange memorandum.

A statement from the Finance Ministry said the invitation is available only to registered holders of Eligible Bonds that are not Individual Investors or that are otherwise authorized by the Government of Ghana, in its sole discretion, to participate in the Invitation.

Eligible Holders tendering their Eligible Bonds pursuant to the Invitation will also receive New Bonds of the Republic (Ghana) on the terms and subject to the conditions described in the Exchange Memorandum.

The statement further added that all offers to exchange Eligible Bonds made by Eligible Holders are irrevocable subject to withdrawal rights under certain limited circumstances. By tendering their Eligible Bonds, Eligible Holders represent and warrant that such Eligible Bonds constitute all the Eligible Bonds owned by them and consent to the blocking by the Central Securities Depository (CSD) of any attempt to transfer them prior to the Settlement Date or the termination of the invitation by the Republic.

Interest on the New Bonds will not accrue until 2024, starting at 0% coupon in 2023 which steps up to 5% in 2024, and 10% from 2025 onwards. The first interest payment on the New Bonds will however be made in 2024.

Offers may only be submitted starting today December 5, 2022, and end at 4:00 p.m. on December 19, 2022 (the “Expiration Date”).

However, Ghana may at its sole discretion extend the Expiration Date including for one or more series of Eligible Bonds.

Eligible Holders who deliver valid offers at or prior to the Expiration Date that are accepted by the Republic will receive at the Settlement Date in exchange for their Eligible Bonds accepted by the Republic, the same aggregate principal amount distributed across new bonds due in 2027 (the “New 2027 Bond”), 2029 (the “New 2029 Bond”), 2032 (the “New 2032 Bond”), and 2037 (the “New 2037 Bond,” and collectively the “New Bonds”).

All calculations by the government will be final and binding on Eligible Holders save in the event of manifest error.

Latest Stories

-

NPA raises fuel price floor for March 1 window; petrol now GH¢10.46, diesel GH¢11.42

16 minutes -

UCC to honour Veep Prof. Jane Opoku-Agyemang with Distinguished Fellow Award

22 minutes -

Rugby Africa enters a new chapter as national unions approve structural reforms at 17th AGM in Kampala

34 minutes -

Ghana falls 7 places in Global Mining Investment Attractiveness report

37 minutes -

MoFA lauds AGRA Ghana’s agriculture mechanisation interventions in Sekyere Central District

46 minutes -

MTN Ghana elevated to major subsidiary status within MTN Group

51 minutes -

Annoh-Dompreh inspects new Adoagyiri Health Centre Project, pledges full equipment support

1 hour -

Beyond Personal Choice: Understanding the Social and Environmental Drivers of Overweight and Obesity in Ghana

1 hour -

Political influence turned galamsey into a monster – Former CJ Sophia Akuffo

1 hour -

ECOWAS urges restraint amid escalating tensions in Gulf region

1 hour -

Liberia Embassy engages Ghana authorities over death of citizen in Accra

1 hour -

Pedestrian struck by vehicle at Pokuase Interchange amid streetlight concerns

1 hour -

Fact Check: Mahama’s claim that over one million people found employment from 2025 Q1 to Q3 is false

1 hour -

Health Directorate cracks down on staff absenteeism to boost performance

1 hour -

Ghana honours 3 ex-servicemen whose death peaked anti-colonial campaign

2 hours